A Sneak Peek At What The Insiders Are Saying

“I’ve mentioned for years … that a rise within the uranium worth was inevitable, however perhaps not imminent. I feel now with the tempo of Japanese restarts it is imminent and inevitable.”

— Rick Rule, Rule Funding Media

“Until I’m very a lot mistaken, 2023 needs to be an excellent higher 12 months for uranium than 2022 has been.”

— Lobo Tiggre, founder and CEO of IndependentSpeculator.com

“The (uranium) thesis I feel has grow to be way more understood on a world foundation, and likewise amongst many extra establishments and even particular person buyers.”

— John Ciampaglia, Sprott Asset Administration

Who We Are

The Investing Information Community is a rising community of authoritative publications delivering impartial, unbiased information and schooling for buyers. We ship educated, fastidiously curated protection of a wide range of markets together with gold, hashish, biotech and plenty of others. This implies you learn nothing however the perfect from your complete world of investing recommendation, and by no means need to waste your worthwhile time doing hours, days or even weeks of analysis your self.

On the identical time, not a single phrase of the content material we select for you is paid for by any firm or funding advisor: We select our content material primarily based solely on its informational and academic worth to you, the investor.

So if you’re on the lookout for a option to diversify your portfolio amidst political and monetary instability, that is the place to begin. Proper now.

Uranium Outlook 2023

Uranium Worth Forecasts 2023 and High Uranium Shares to Watch

Uranium Worth 2022 12 months-Finish Assessment

Uranium confronted some worth constraints in 2022, but it surely stays in bull market territory. Discover out what elements impacted the vitality gas this 12 months.

Pull quotes had been offered by Investing Information Community purchasers CanAlaska Uranium and Skyharbour Sources. This text shouldn’t be paid-for content material.

After climbing 41 % in 2021, uranium’s rise was extra muted this 12 months. The vitality gas is about to finish the 12 months simply 9.94 % increased than its January begin, however has nonetheless performed properly amid world financial turmoil and geopolitical strife.

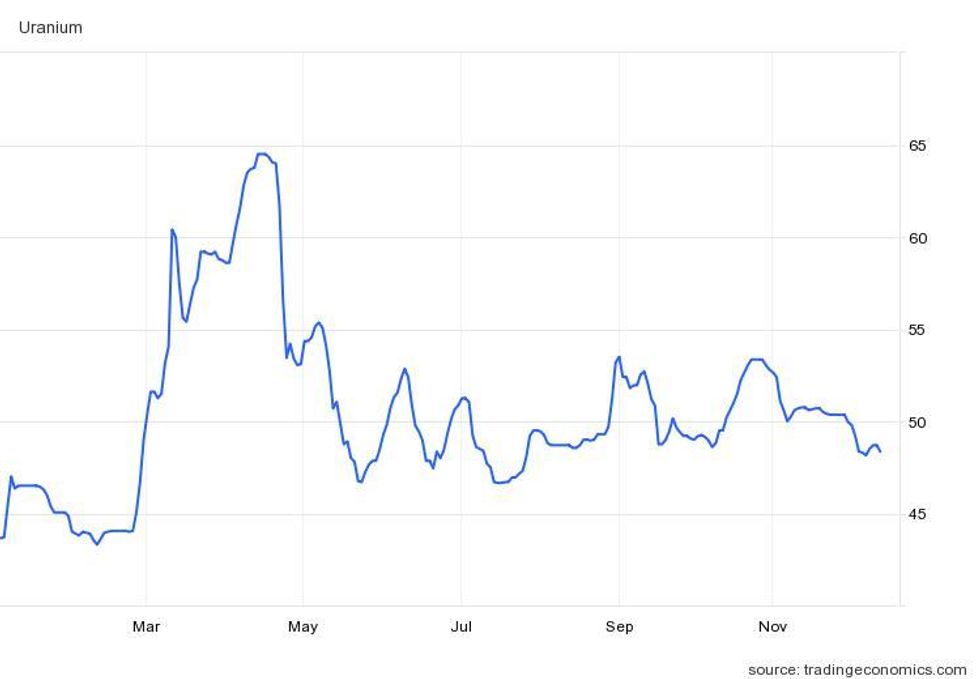

Potential provide challenges associated to conversion and enrichment added tailwinds to the market early within the 12 months, propeling uranium costs to an 11 12 months excessive of US$64.47 per pound in April. Efforts to tame inflation eroded a few of uranium’s worth as the primary half of the 12 months neared its finish, and costs slipped to US$46.92 on the finish of Could.

Constructive fundamentals across the want for nuclear vitality prevented uranium from falling under US$48 from June by December. Learn on for extra particulars on the commodity’s quarter-by-quarter efficiency in 2022.

Uranium worth in Q1: Geopolitical instability a key driver

The 12 months began with U3O8 buying and selling for US$43.66 as main uranium producer Kazakhstan confronted civil unrest — protesters within the nation took to the streets to voice their displeasure about points corresponding to vitality prices.

By February 9, costs had fallen to US$43.15, their lowest level in 2022. Nonetheless, Russia’s late February invasion of Ukraine served as a development catalyst, sending uranium values above US$50 by the start of March.

As tensions continued to accentuate between Russia and Ukraine, issues over the way forward for Russia’s function within the conversion and enrichment section of the nuclear gas cycle elevated.

In accordance with UxC, costs for conversion jumped from US$15 per kilogram of uranium to US$40, the place they proceed to carry.

“Conversion provide has grow to be extraordinarily tight and is anticipated to stay weak to provide shocks over the subsequent decade as manufacturing capability has been decreased whereas demand is rising because of shifts in enricher tails assays,” UxC explains in a observe.

The overview additionally factors to a number of elements that would drive the market to unprecedented ranges.

“A number of points have affected the provision aspect of the equation in recent times, together with Honeywell’s determination in 2017 to shutter its Metropolis conversion plant till 2023, Orano’s delayed transition to its new COMURHEX II services, in addition to impacts from Russia’s invasion of Ukraine,” it reads. “Consequently, costs for conversion providers have risen to historic highs as of 2022.”

Earlier than Q1 ended, U3O8 had damaged previous the US$60 mark for the primary time since 2011.

Uranium worth in Q2: Vitality safety comes into focus

The second quarter of the 12 months noticed uranium make its most pronounced worth soar, including 49 % from its February low to an 11 12 months excessive of US$64.50 in April. The market continued to search out assist from the battle in Ukraine, together with world efforts to fight rising greenhouse gasoline emissions.

U3O8’s worth efficiency year-to-date.

Chart through TradingEconomics.

Russia is accountable for 43 % of world uranium enrichment capability, and enrichment is a important step in producing the fabric wanted to feed nuclear reactors and generate electrical energy.

“Basically, because the world is making an attempt to pivot away and punish Russia for its invasion of Ukraine, western utilities try to determine the best way to safe different provide, and that is inflicting an actual pinch level,” John Ciampaglia, CEO of Sprott Asset Administration, mentioned throughout his keynote deal with at a summer time uranium convention held by Purple Cloud Monetary Providers.

The transition away from Russian enrichment could also be simpler mentioned than performed as Russia additionally possesses the most important share — roughly 40 % — of the world’s conversion infrastructure.

The US, the world’s largest purchaser of uranium for nuclear reactors, depends on Russia for 20 % of its transformed uranium. Eradicating Russian provide from America has an estimated value of over US$1 billion and would take time to return to fruition.

Domestically, the nation has one conversion facility, Honeywell’s Metropolis plant in Illinois, which was shuttered in 2017. In early 2021, Honeywell introduced plans to restart the plant amid rising conversion costs.

Metropolis is scheduled to start conversion in 2023.

Uranium costs ended the primary half of 2022 within the US$50 vary, a 13 % uptick from January.

Uranium worth in Q3: Sprott belief continues shopping for

Q3 noticed the Sprott Bodily Uranium Belief (SPUT) (TSX:U.UN,TSX:U.U) proceed to amass kilos of U3O8.

“SPUT bought greater than 24 million kilos U3O8 in 2021, or about 25 % of all spot purchases,” a UxC report states. “By means of August 2022, the Belief has bought an extra 16 million kilos U3O8 out there.”

At present, SPUT holds 59,269,000 kilos of U3O8 valued at US$2.84 billion.

By early September, the uranium costs had been as excessive as US$53.63, their prime H2 stage. Strain from the US Federal Reserve’s response to skyrocketing inflation saved most markets from making any significant good points within the fall.

A powerful US greenback additionally impeded development throughout all markets.

“For uranium, the U3O8 spot worth fell 8.66 % in September, bodily uranium’s largest month-to-month decline since March 2019,” wrote Jacob White, senior analyst at Sprott Asset Administration. “Uranium miners adopted go well with, shedding 16.17 %, posting their worst month-to-month efficiency for the reason that inception of the North Shore World Uranium Mining Index in June 2017.”

Regardless of the poor September efficiency, the worth of U3O8 remained above US$48 by October earlier than rallying again to the US$53 threshold on the finish of the month. The vitality gas’s resilience amid broad headwinds “belies the robust fundamentals of uranium markets,” based on White.

“12 months-to-date as of September 30, U3O8 conversion and enriched uranium costs have all considerably appreciated for each short- and long-term buy contracts,” White wrote. In his opinion, the market is at a flux level.

“We imagine that the present demand for uranium conversion and enrichment, coupled with a shift away from Russian suppliers, helps increased U3O8 uranium spot costs, finally benefiting uranium miners,” he mentioned.

Though the present macroeconomic setting is opposed, Sprott Asset Administration believes the “uranium bull market stays intact” and on monitor for continued development. Future catalysts embody the change to inexperienced vitality, the necessity for vitality safety and the proliferation of latest nuclear reactor builds.

“Over the long run, elevated demand within the face of an unsure uranium provide will possible assist a sustained bull market,” added White. “For buyers, uranium miners have traditionally exhibited low/average correlation to many main asset courses, probably offering portfolio diversification.”

Uranium worth in This fall: Attitudes towards nuclear enhance

The final quarter of 2022 started with U3O8 sustaining its US$48 worth level. This stage additionally appears to suggest the brand new backside for the market as values have remained at or above the edge since July.

The spot worth endured some volatility as a result of Fed’s rate of interest mountain climbing regime, in addition to power within the US greenback, which hit a 20 12 months excessive and held in that territory by the penultimate month of the 12 months.

On the flip aspect, costs benefited from optimistic attitudes towards nuclear vitality on the United Nations’ COP27 convention. Whereas nuclear vitality was previously excluded from discourse round clear and inexperienced vitality, this 12 months’s convention included the significance of nuclear for attaining world emissions-reduction objectives.

The occasion culminated within the world nuclear business releasing a joint assertion urging “determination makers to acknowledge and assist the necessity for elevated nuclear vitality era.” The group additionally known as for extra funding throughout the sector for brand spanking new nuclear builds and the development of nuclear innovation.

“Nuclear vitality has the very best capability issue versus conventional and different vitality sources and may complement renewable vitality sources’ intermittency with dependable baseload energy,” Sprott Asset Administration’s White wrote in a December observe.

As of December 19, U3O8 was priced at US$48.10.

Don’t neglect to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the data reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

Uranium Worth Forecast: High Developments That Will Have an effect on Uranium in 2023

Because the vitality disaster in Europe intensifies, market individuals are honing in on uranium’s function in vitality safety. Discover out what consultants suppose is coming for the market in 2023.

Pull quotes had been offered by Investing Information Community purchasers Vitality Fuels, Discussion board Vitality Metals and Purepoint Uranium Group. This text shouldn’t be paid-for content material.

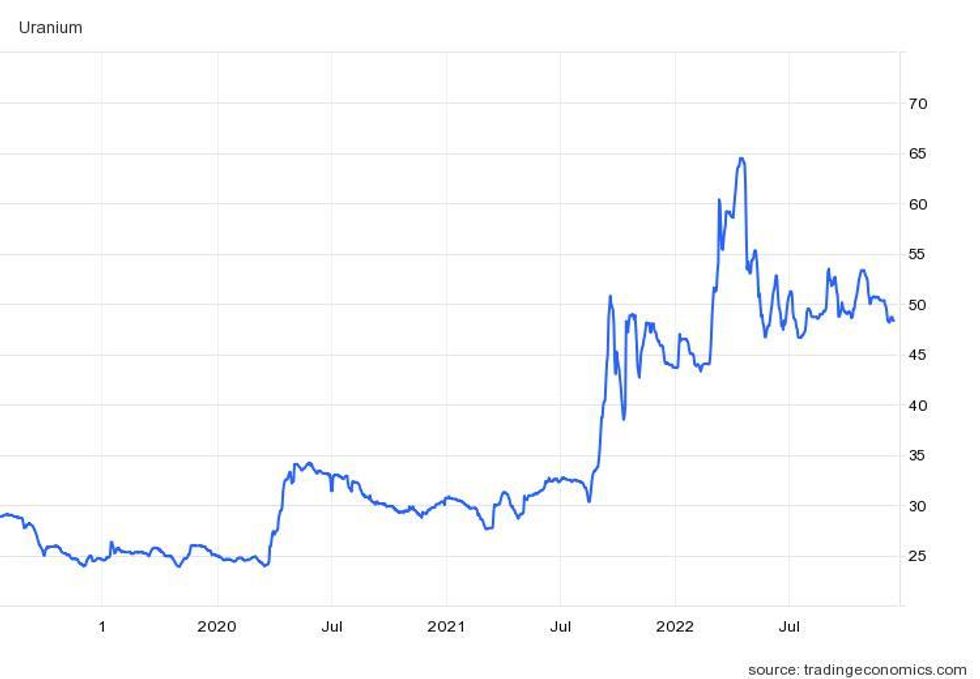

After years of worth stagnation, uranium has grow to be a breakout performer, climbing 164 % from January 2020 to an 11 12 months excessive in April 2022 on the again of the inexperienced transition and issues about vitality safety.

These elements allowed uranium to carry firmly above US$48 per pound for almost all of 2022, however like most commodities it is nonetheless dealing with challenges. Sky-high inflation and steadily rising rates of interest shaved off a few of uranium’s upside potential in 2022; nonetheless, the market has seen assist from provide issues and different elements.

With 2023 shortly approaching, the Investing Information Community (INN) requested consultants about their expectations for uranium within the subsequent 12 months. Learn on to study what they needed to say in regards to the business.

2022 units stage for bullish 2023 for uranium

Wanting first at 2022, the market individuals INN spoke to emphasised uranium’s optimistic worth motion.

“Uranium — like lithium — has essentially the most bullish fundamentals, coupled with bipartisan assist globally,” mentioned Gerardo Del Actual, founding father of Junior Useful resource Month-to-month and Junior Useful resource Dealer. “Each suffered from years of underinvestment and each now take pleasure in surging demand that gained’t be capable of be introduced on-line quick sufficient at present costs.”

Uranium and lithium are among the many only a few commodities which have posted annual good points this 12 months, reaching upward momentum regardless of the financial upheaval that has weighed on markets for almost all of the calendar 12 months.

U3O8 spot worth efficiency, 2019 to 2022.

Chart through TradingEconomics.

For Lobo Tiggre, founding father of IndependentSpeculator.com, uranium’s transfer was solely a matter of time. “I feel this was going to occur anyway, as a result of the world’s largest producers in the reduction of their output and BRICS nations (Brazil, Russia, India, China and South Africa) are constructing nuclear energy crops as quick as they will — however the battle has accelerated the pattern,” he instructed INN.

Russia’s late February invasion of Ukraine despatched the nuclear gas market into overdrive as all three key segments — U3O8 provide, together with conversion and enrichment providers — noticed worth development. “With the New Iron Curtain slicing off Russian vitality, the writing is on the wall, and it’s very bullish for uranium costs,” Tiggre commented.

Ukraine homes 15 operational nuclear reactors and 4 energy crops that generate half the nation’s electrical energy, and Russia’s takeover of the Zaporizhzhia plant created some issues about potential harm. Nonetheless, each Tiggre and Del Actual emphasised that the plant’s resilience is a optimistic signal.

“The actual story is that regardless of the shelling of the Ukrainian energy plant it has held up remarkably properly and carried out higher than anticipated,” Del Actual mentioned. “The uranium fundamentals are as bullish as I’ve ever seen them.”

Provide safety will proceed to take heart stage

Procurement is a vital ingredient of vitality safety, and uranium provide is anticipated to remain in focus in 2023.

In the intervening time, nuclear energy generated on the 438 reactors globally produces 10 % of the world’s electrical energy, and that quantity is forecast to rise considerably over the subsequent decade as about 60 new reactors come on-line.

There are one other 96 reactors presently within the planning section.

Securing regular provide of uranium that may be processed into nuclear gas is very important to the vitality transition, based on John Ciampaglia, CEO of Sprott Asset Administration.

“The 434 odd reactors require about 180 million kilos of uranium every 12 months for his or her gas inventory,” he mentioned in November. “Main manufacturing is about 130 million kilos, and subsequent 12 months it is going to in all probability go to 140 million to 145 million kilos.”

He went on to clarify that the deficit can solely be shored up with extra mined provide. Nonetheless, with inflation driving prices up in every single place, uranium’s worth positivity might solely be sufficient to restart shuttered initiatives — not construct new mines.

“The prices have gone up considerably,” he mentioned. “We predict the price — or the value that you’d must see in uranium to incent growth of any new greenfield venture — is someplace between US$75 and US$100.”

Over the past uranium bull market greater than a decade in the past, buyers watched the spot worth climb greater than 1,800 %, rising from US$7 in December 2000 to an all-time excessive of US$140 June 2007. This time round, the market has extra fundamentals in its favor which might be encouraging sustained worth development.

One of the vital promising is the necessity for clear, uninterrupted vitality. Whereas photo voltaic and wind vitality are thought of inexperienced, they’re inclined to precarious climate conditions, which have gotten extra widespread.

“If you consider how dependable every of those completely different types of vitality is, nuclear is the very best at 92 %,” the CEO mentioned. “That signifies that 92 % of the time, for those who’re working a nuclear energy plant, it’s producing electrical energy.”

However, that quantity drops to 42 % when speaking about hydroelectric energy, and falls to 35 % for wind and solely 25 % for photo voltaic. “Low greenhouse gasoline emissions are necessary, however reliability is equally necessary,” Ciampaglia mentioned.

Extra uranium M&A exercise possible within the 12 months forward

Uranium consultants can even be watching M&A exercise in 2023 within the wake of a number of necessary 2022 offers.

One of the vital memorable bulletins this previous 12 months was the October information that Cameco (TSX:CCO,NYSE:CCJ) and Brookfield Renewable Companions (TSX:BEP.UN,NYSE:BEP) will purchase Westinghouse Electrical Firm.

The huge US$7.8 billion association will see Cameco, one of many largest uranium producers globally, take a 49 % controlling curiosity in “one of many world’s largest nuclear providers companies.”

Earlier within the 12 months, Uranium Vitality (NYSEAMERICAN:UEC) acquired Canada-listed UEX in a bid to “create the most important diversified North American centered uranium firm.” The acquisition marked the second main transfer from Uranium Vitality in underneath 12 months — in December 2021, the corporate acquired Uranium One Americas.

“There’s an rising pattern by Western utilities to safe provides from uranium initiatives in politically steady and confirmed jurisdictions. It is a robust match with UEC’s permitted, and production-ready US ISR initiatives and intensive development pipeline in Canada,” mentioned Amir Adnani, president and CEO of Uranium Vitality.

Constructive demand fundamentals, together with uranium’s worth stability within the face of robust headwinds, are more likely to end in extra sector offers, defined Junior Useful resource Month-to-month’s Del Actual. “I count on extra M&A as firms with higher property merge to place themselves to maximise good points from the approaching uranium mania I see growing,” he mentioned.

Whereas these offers could also be excellent news for the North American uranium sector, Tiggre inspired warning.

“The consolidation provides speculators fewer firms to trace — however every firm that’s grown by acquisitions has grow to be extra difficult to research,” he mentioned. “I’m particularly cautious of firms that may now boast very massive uranium assets within the floor, however don’t current a compelling worth proposition as a result of high quality of the property they purchased. Purchaser beware.”

Because the uranium market expenses forward, he anticipates extra offers down the highway.

“There may simply be extra consolidation among the many juniors, however that doesn’t essentially create worth,” Tiggre mentioned. “The builders that ship worthwhile new mines, nonetheless, are clear takeover targets that would ship outsized capital good points.”

How excessive can uranium costs go in 2023?

Simply how excessive uranium costs will go in the course of the present bull market stays to be seen.

As talked about, over the last bull section, costs went up over 1,800 %, rising from US$7 in December 2000 to an all-time excessive of US$140 June 2007. The earlier cycle, which ran from 1973 to 1978, noticed values rise 629 % over 5 years.

“I count on the uranium worth to overshoot to the US$200 stage earlier than settling again to decrease triple digits,” Del Actual mentioned.

Though the demand outlook is brilliant, Tiggre sees the value making a extra staggered advance. “I count on a unstable however persistent climb increased, with smaller spikes doable alongside the best way. Then, the market ought to settle at a worth that incentivizes sufficient mine provide,” he mentioned. “That could be round US$60 to US$70 in the present day, however would must be adjusted for inflation going ahead.”

When it comes to what the Unbiased Speculator shall be expecting within the sector within the 12 months forward, he pointed to long-term contracting from utilities firms.

“Costs for these contracts are sometimes not disclosed at signing, however we should always be capable of work them out, in combination, from producers’ monetary experiences sooner or later,” Tiggre defined. “This has already began. Until I’m very a lot mistaken, 2023 needs to be an excellent higher 12 months for uranium than 2022 has been.”

Extra broadly, Del Actual sees 2023 as a breakout 12 months for a variety of commodities.

“The lithium and uranium areas stay the 2 commodities I see having the perfect 2023 — however don’t underestimate a fast rerating of high quality gold firms because the gold worth regains its standing as not only a wealth preserver, however a option to develop wealth,” he mentioned, whereas additionally mentioning copper. “2023 needs to be one for the books for many commodities,” Del Actual concluded.

Don’t neglect to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the data reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

John Ciampaglia: Uranium Thesis Gaining World Traction, Highly effective Catalysts at Work

“The thesis I feel has grow to be way more understood on a world foundation, and likewise amongst many extra establishments and even particular person buyers,” mentioned John Ciampaglia.

As vitality issues rise internationally, extra nations wish to uranium as an answer.

John Ciampaglia, CEO of Sprott Asset Administration, mentioned that whereas his agency was “very constructive and bullish” when it launched the favored Sprott Bodily Uranium Belief (TSX:U.UN,TSX:U.U) simply over a 12 months in the past, the provision/demand fundamentals for the commodity have solely improved since then.

“The thesis I feel has grow to be way more understood on a world foundation, and likewise amongst many extra establishments and even particular person buyers,” he instructed the Investing Information Community.

A slew of occasions have led to this awakening, and the bull case for uranium appears to be intensifying virtually each day — Ciampaglia pointed to latest occasions corresponding to Japan’s transfer to restart extra nuclear reactors and California’s determination to increase the lifetime of its Diablo Canyon nuclear energy plant.

“All of those catalysts I feel are very highly effective,” he mentioned.

Other than broad elements at play, Ciampaglia broke down a key ingredient of the nuclear gas cycle, explaining that somewhat than securing provide of uranium first, utilities go “in reverse order” after they resolve to purchase.

“(The utilities) truly begin by contracting out the fabrication of gas rods, after which they contract the enrichment providers; then they contract out the conversion a part of the step,” he defined in the course of the dialog. “Then they purchase the uranium that may begin the entire course of.”

Russia controls 25 % of world conversion capability and virtually 40 % in terms of enrichment; Ciampaglia mentioned this dominance has boosted costs about 50 % for the previous and 120 % for the latter.

“We predict ultimately what’s taking place to the costs of conversion and enrichment goes to sort of transfer backwards into the chain and finally carry the value of U3O8,” he mentioned.

Watch the interview above for extra from Ciampaglia on uranium.

Do not forget to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the data reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

Peter Grandich: There’s No Such Factor as a Certain Factor — however Uranium is Shut

“There is not any such factor as a certain factor … however the closest I’ve ever seen in all of the years I have been doing this — which is 38 — is the uranium market proper now,” he mentioned.

There is not any such factor as a certain factor. However for Peter Grandich of Peter Grandich & Co., uranium comes shut.

Chatting with the Investing Information Community, he defined that the outlook for uranium has performed a 180 within the final 5 years or so and is gaining momentum on what looks like a each day foundation.

Demand for clear vitality is strengthening, and years of low costs have weakened provide. Other than that, Grandich identified that it is turning into tougher to search out jurisdictions which might be hospitable to mining.

In his view, sector main Cameco (TSX:CCJ,NYSE:CCO) is the apparent place to look in terms of shares.

“To me, Cameco is like Apple (NASDAQ:AAPL) to the expertise business. If you are going to love uranium, Cameco is totally first,” Grandich mentioned, noting that the lengthy bear market has decreased the variety of gamers within the house.

Because the uranium story continues to realize traction, he emphasised the significance of not getting too caught up in day-to-day information, saying that typically seeing many optimistic bulletins could make buyers antsy.

“I feel we’re getting arrange for good actions in uranium, however endurance is a advantage,” Grandich defined.

“And keep in mind, up till now the negativity within the inventory market has been a damper. However ultimately they will separate — persons are going to appreciate how important uranium turns into by this subsequent winter … and it doesn’t matter what the final market is doing, I feel the uranium shares are going to have the ability to separate themselves.”

Watch the interview above for extra from Grandich on the uranium market, in addition to gold and copper, two different commodities he’s bullish on in the mean time.

Do not forget to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the data reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

High 3 Uranium Shares on the TSX and TSXV (Up to date November 2022)

What are the highest uranium shares? Right here’s a listing of the businesses on the TSX and TSXV with the largest year-to-date share worth good points.

Click on right here to learn the earlier prime uranium shares on the TSX and TSXV article.

As was anticipated by consultants, uranium has seen massive good points in 2022, reaching US$64.50 per pound on April 14 — a decade excessive — because of elements like Russia’s invasion of Ukraine and growing nuclear adoption.

Whereas costs have fallen since then, uranium continues to be performing properly, remaining within the vary of US$46 to US$54 all through Q3 and This fall. Nonetheless, many shares are nonetheless not seeing the efficiency one would possibly count on. What do consultants suppose?

The Investing Information Community spoke with many market watchers who’re bullish on uranium on the New Orleans Funding Convention in mid-October, together with Lobo Tiggre, Rick Rule, Nick Hodge and Gerardo Del Actual.

“We want uranium if we will be impartial of this fossil vitality that we have had for thus a few years, and there is truly a number of bipartisan assist for that,” Del Actual mentioned in his interview. “There’s actual capital, particularly right here within the US proper now, into growing impartial important metals provide chains, particularly with uranium.”

For his half, Hodge mentioned uranium’s fundamentals have by no means been higher.

“What we’re ready on now could be for the value of uranium to return up,” he mentioned. “You are going to see a time within the subsequent two to 3 years, I am fairly certain, of +US$100 uranium, if not +US$150 uranium, similar to you probably did in 2007.”

Under are the highest uranium shares on the TSX and TSXV by share worth efficiency to this point this 12 months. All knowledge was obtained on November 14, 2022, utilizing TradingView’s inventory screener, and all firms had market caps above C$10 million on the time.

1. Marvel Discovery (TSXV:MARV)

12 months-to-date acquire: 60 %; market cap: C$11.59 million; present share worth: C$0.12

Marvel Discovery is concentrated on initiatives for a lot of completely different metals all through Canada. Whereas uranium shouldn’t be one among its prime commodities, the corporate has been engaged on buying and exploring uranium properties within the Athabasca Basin in 2022. It now has the Freeway North claims, the KLR declare group and the Walker declare group within the basin; these are contiguous with Cameco’s (TSX:CCO,NYSE:CCJ) Key Lake property, which is past-producing and now hosts the Key Lake mill, in addition to Fission 3.0’s (TSXV:FUU,OTCQB:FISOF) Hobo Lake uranium properties. Marvel additionally has properties with uncommon earths, gold, platinum-group components, nickel and copper.

In late February, Marvel acquired approval from the TSXV to amass Freeway North, and accomplished a floor magnetic survey on the property in early March. Later that month, the corporate entered into an choice settlement to amass the KLR and Walker claims. Its share worth spent March trending upwards, opening the month at C$0.10 and shutting it at C$0.15.

“We’re extraordinarily lucky to have acquired the KLR and Walker declare teams being straight tied on to the north and south of our not too long ago acquired Freeway North Challenge,” Marvel President and CEO Karim Rayani mentioned. “This brings our new complete to over 16,000 hectares alongside a pattern that hosts a number of the highest-grade uranium mines on the planet.”

After Marvel Discovery accomplished an airborne survey at KLR and Walker, the corporate outlined the DD zone, which it calls an space of “excessive advantage and potential for fulfillment.” It plans to carry out diamond drilling on the zone to discover it additional. On October 5, Marvel signed a three way partnership settlement that may enable Carmanah Minerals (CSE:CARM) to earn a 50 % curiosity within the Walker claims. To take action, Carmanah might want to fund C$1.5 million in exploration, pay C$400,000 in money and challenge 3.5 million shares and warrants. Marvel Discovery mentioned within the launch that each firms share the objective of a tier one discovery on the web site

2. Cameco (TSX:CCO)

12 months-to-date acquire: 11.03 %; market cap: C$12.92 billion; present share worth: C$32.32

Cameco is a prime world uranium miner with lively operations in Canada and Kazakhstan and suspended mines within the US. Its Canadian mines are the Cigar Lake three way partnership, the world’s highest-grade uranium mine, and McArthur River/Key Lake, the world’s largest high-grade uranium mine and mill. Each are in Saskatchewan’s Athabasca Basin. Though McArthur River/Key Lake was beforehand on care and upkeep, it’s been slowly introduced again on-line in 2022 because of strengthening uranium market circumstances. Cameco’s Inkai mine in Kazakhstan is a 40/60 three way partnership between it and nationwide operator Kazatomprom (LSE:KAP).

The corporate’s H1 share worth excessive got here early in Q2, when it reached C$39.68 on April 13. In Could, Cameco and Orano Canada, the bulk house owners of the Cigar Lake three way partnership, purchased out Idemitsu Canada Sources’ 7.875 % taking part curiosity within the mine. Cameco’s possession stake is now 54.547 %. Though the corporate’s share worth traded decrease after April, a spike within the uranium worth in late August coincided with the same spike for Cameco, which hit a year-to-date excessive of C$40.10 on September 8.

This fall has introduced vital information for the corporate. On October 11, Cameco and Brookfield Renewable Companions introduced that they had been forming a strategic partnership to purchase Westinghouse Electrical Firm. Cameco will personal 49 % of the corporate, whereas Brookfield and its institutional companions will personal 51 %. In accordance with a press launch, “Westinghouse providers about half the nuclear energy era sector and is the unique gear producer to greater than half the worldwide nuclear reactor fleet.”

Per week later, Cameco shared that it had accomplished a C$747.6 million purchased deal providing. The corporate mentioned it intends to make use of nearly all of the funds for its roughly US$2.2 billion portion of the aforementioned acquisition.

On October 31, Cameco launched its Q3 outcomes, during which it shared updates on many components of its enterprise. In November, the corporate introduced it had signed a uranium provide settlement with China Nuclear Worldwide for an undisclosed quantity. Its most up-to-date information got here on November 9, when it introduced that the first kilos of uranium had been packaged from the McArthur River/Key Lake mine restart. In accordance with the corporate, it expects 2 million kilos of uranium to be produced there in 2022.

3. Ur-Vitality (TSX:URE)

12 months-to-date acquire: 1.14 %; market cap: C$408.32 million; present share worth: C$1.77

Ur-Vitality is a uranium miner with two major initiatives. Its Misplaced Creek in-situ uranium restoration facility has been in manufacturing since 2013 and has produced 2.7 million kilos of U3O8 in that point. It additionally has the Shirley Basin venture, which has acquired all crucial permits and is almost building prepared.

The corporate’s share worth additionally hit an early year-to-date excessive of C$2.37 on March 9, in sync with uranium’s spike. It reached these heights once more on April 13, though it has since fallen, staying decrease all year long.

Considerably, in early August, Ur-Vitality entered right into a multi-year gross sales settlement to provide uranium to a number one US nuclear utility firm. Ur-Vitality will ship 200,000 kilos yearly for a six 12 months interval to the utility firm. Ur-Vitality additionally shared in that launch that it has entered a bid with the US Division of Vitality to provide uranium in direction of the nationwide stockpile. The corporate’s share worth started transferring upwards once more within the weeks following this information.

Ur-Vitality launched its Q3 outcomes on November 1, with operational updates, in addition to the promotion of a brand new chief working officer.

“We proceed to steadily advance building and drilling at our Misplaced Creek Mine in preparation for a ramp up as we search to layer in extra gross sales contracts,” Ur-Vitality CEO John Money mentioned. “U.S. and worldwide assist for nuclear energy continues to strengthen as nations acknowledge the carbon-free attributes of dependable nuclear energy and more and more need to be vitality impartial.”

FAQs for investing in uranium

What’s uranium used for?

Uranium is primarily used for the manufacturing of nuclear vitality, a type of clear vitality created in nuclear energy crops. In actual fact, 99 % of uranium is used for this function. As of 2022, there have been 439 lively nuclear reactors, as per the Worldwide Atomic Vitality Company. Final 12 months, 8 % of US energy got here from nuclear vitality.

The commodity can be used within the protection business as a part of nuclear weaponry, amongst different makes use of. Nonetheless, there are safeguards in impact to maintain this to a minimal. To create weapons-grade uranium, the fabric must be enriched considerably — above 90 % — to the purpose that to attain simply 5.6 kilograms of weapons-grade uranium, it might require 1 metric ton of uranium pre-enrichment.

Due to this necessity, uranium enrichment services are carefully monitored underneath worldwide agreements. Uranium used for nuclear energy manufacturing solely must be enriched to five %; nuclear enrichment services want particular licenses to counterpoint above that time for makes use of corresponding to analysis at 20 % enrichment.

The metallic can be used within the medical subject for purposes corresponding to transmission electron microscopy. Earlier than uranium was found to be radioactive, it was used to impart a yellow colour to ceramic glazes and glass.

The place is uranium discovered?

The nation with the biggest uranium reserves by far is Australia — the island nation holds 28 % of the world’s uranium reserves. Rounding out the highest three are Kazakhstan with 15 % and Canada with 9 %.

Though Australia has the very best reserves, it holds uranium as a low precedence and is just fourth general for manufacturing. All its uranium output is exported, with none used for home nuclear vitality manufacturing.

Kazakhstan is the world’s largest producer of the metallic, with manufacturing of 21,819 metric tons in 2021. The nation’s nationwide uranium firm, Kazatomprom, is the world’s largest producer.

Canada’s uranium reserves are discovered primarily in its Athabasca Basin, and the area is a prime producer of the metallic as properly, though a number of the main mines have been underneath care and upkeep in recent times.

Why ought to I purchase uranium shares?

Buyers ought to at all times do their very own due diligence when any commodity in order that they will resolve whether or not it suits into their funding plans. With that being mentioned, many consultants are satisfied that uranium has entered right into a vital bull market, which means that uranium shares may very well be purchase.

A slew of things have led to this bull market. Whereas the uranium business spent the final decade or so in a downturn following the 2011 Fukushima nuclear catastrophe, discourse has been constructing across the metallic’s use as a supply of fresh vitality, which is necessary for nations seeking to attain local weather objectives. Nations at the moment are prioritizing a mixture of clear energies corresponding to photo voltaic and wind vitality alongside nuclear. Considerably, in August 2022, Japan introduced it’s trying into restarting its idled nuclear energy crops and commissioning new ones. Specialists think about this an necessary catalyst for uranium.

Uranium costs are essential to uranium miners, as in recent times ranges haven’t been excessive sufficient for manufacturing to be financial. Nonetheless, in 2021, costs spiked from the US$30 to US$45 vary, and moved even increased in 2022 on provide issues from the Russia/Ukraine battle, hitting US$64.50 earlier than transferring again to stabilize round US$50. This worth motion has resulted in some firms bringing their mines out of care and upkeep, together with Cameco’s McArthur River/Key Lake.

Don’t neglect to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Lauren Kelly, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: Marvel Discovery is a shopper of the Investing Information Community. This text shouldn’t be paid-for content material.