by Boo_Randy

Aka stagflation & not simply Sweden, however most european economies wanting fragile, with excessive non-public debt to GDP ( 140% in sweden), with most mortgages in floating charges (82% in Sweden), retail gross sales fairing terribly ( 5% down YoY), I would be stunned if their CB retains on climbing IR pic.twitter.com/3RggXv9KkH

— Cagatay Koc (@Cagatykc) November 22, 2022

New Zealand delivers its greatest charge hike ever

When is the implosion of Housing Bubble 2.0 going to crash the Fed’s Ponzi markets?

HOUSING COLLAPSE: Pending House Gross sales Publish Largest Drop Ever in October (-40%) as Deal Cancellations, Worth Cuts Hit File Excessive – Redfin

— Don Johnson (@DonMiami3) November 21, 2022

The Federal Reserve may very well be compelled to sluggish the reversal of its asset buy programme as deteriorating bond market liquidity might turn into worse than through the COVID-19 pandemic, MSCI has warned.

Liquidity within the bond market has worsened because the Fed introduced its intention to sluggish its bond purchases final autumn and have become worse nonetheless when it introduced it could be lowering its bond portfolio from January this 12 months.

“In the course of the early days of the COVID-19 disaster, Fed chair Jerome Powell partly justified the Fed’s asset buy program as crucial to revive market liquidity,” Greg Recine, vice chairman of MSCI Analysis, mentioned.

“At the moment, it appears fairly believable that treasury market liquidity might quickly be worse than what was skilled throughout COVID-19.”

The Fed introduced a large asset buying programme on the onset of the coronavirus disaster in March 2020 in a bid to revive the sleek functioning of the markets, together with $8.56bn of fastened earnings ETFs, leading to a large enchancment in liquidity circumstances.

With markets returned to normality, the Fed introduced plans to unload its total ETF holdings in June 2021.

From September this 12 months, the Fed will look to speed up its wider bond portfolio discount, doubling the quantity it sells to $60bn a month.

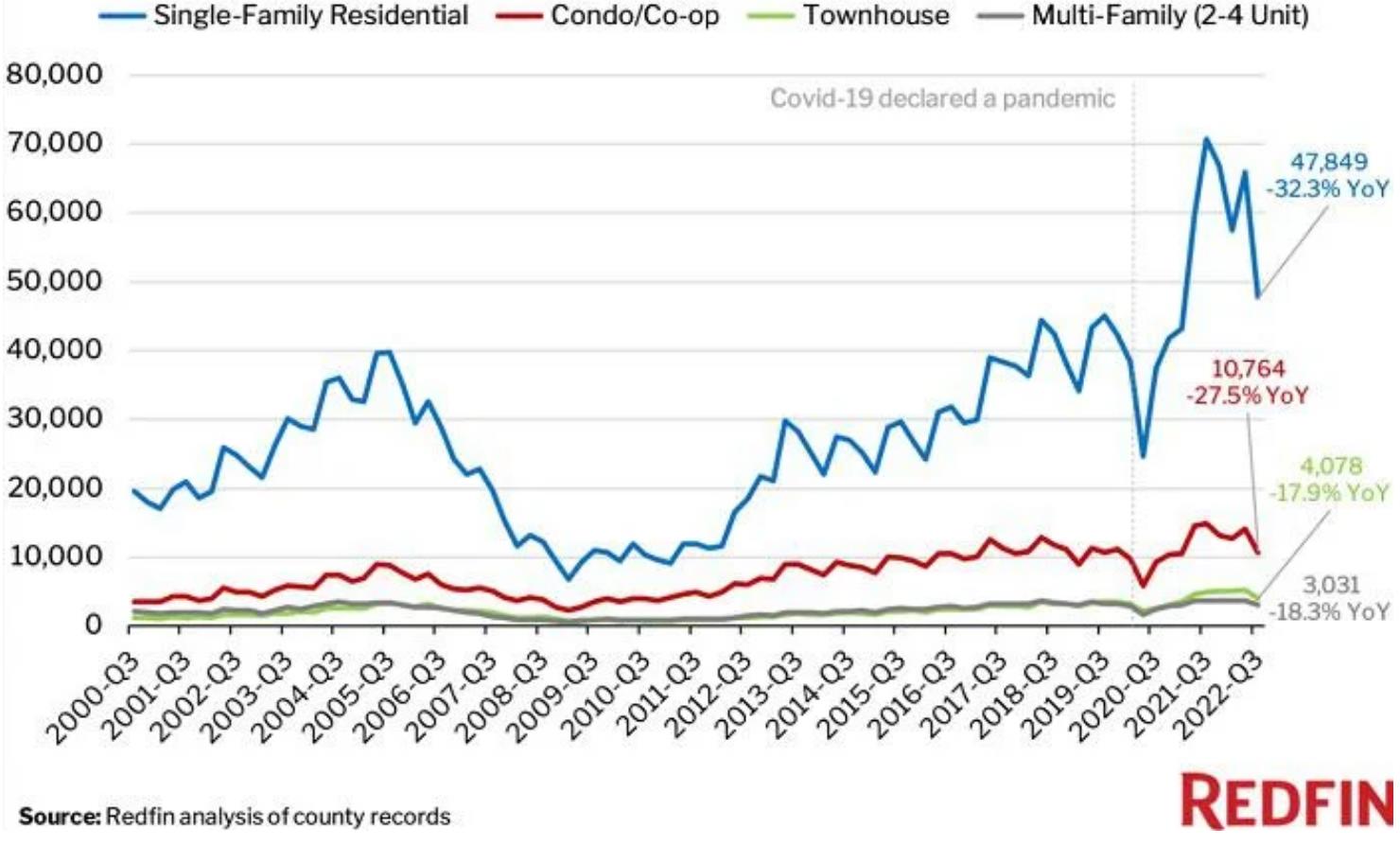

Investor Purchases of Single-Household Homes Plunged 32% in Q3, Plummeting

FED- Family financial savings are elevated! Family financial savings:

S&P Sees US Company Default Fee Extra Than Doubling in Shallow Recession

The default charge for US corporations will soar to three.75% if the Federal Reserve’s struggle in opposition to inflation solely suggestions the financial system right into a shallow recession, based on S&P International Rankings. A extra critical downturn would ship the speed to six%.

Larger rates of interest and client costs are anticipated to push 69 speculative-grade corporations to fall behind on debt servicing by September 2023 in S&P’s baseline situation, greater than doubling the default charge from 1.6% a 12 months earlier. That might be the best since June 2021, surpassing the 10-year common of three.1%, analysts led by Nick Kraemer wrote in a notice on Monday.

The 10y treasury yield is now decrease than the in a single day charge (SOFR). Final time this occurred the entire world went to shit just a few weeks later.