Overview

Gold is a well-respected hedge in opposition to inflation and world financial uncertainty. The spot value of gold lately hit a 19-month excessive in March 2022 of US$2,058 per ounce and has since dipped to ~US$1,700. This fluctuation has prompted market analysts to say that “gold is completely on sale proper now,” as the present USD index is impacting its spot value.

There are a number of methods to spend money on gold, together with commodities and shares in mining corporations. When investing in a mining firm, it’s important to contemplate the situation of their initiatives. Secure jurisdiction with mining-friendly laws is right. Fraser Institute’s 2021 Annual Survey of Mining Corporations named Ontario the twelfth most tasty jurisdiction for funding attractiveness and thirteenth for mineral potential. Moreover, Ontario is the largest producer in Canada of gold, PGEs and nickel. These information supply a degree of confidence in Ontario-based mining operations.

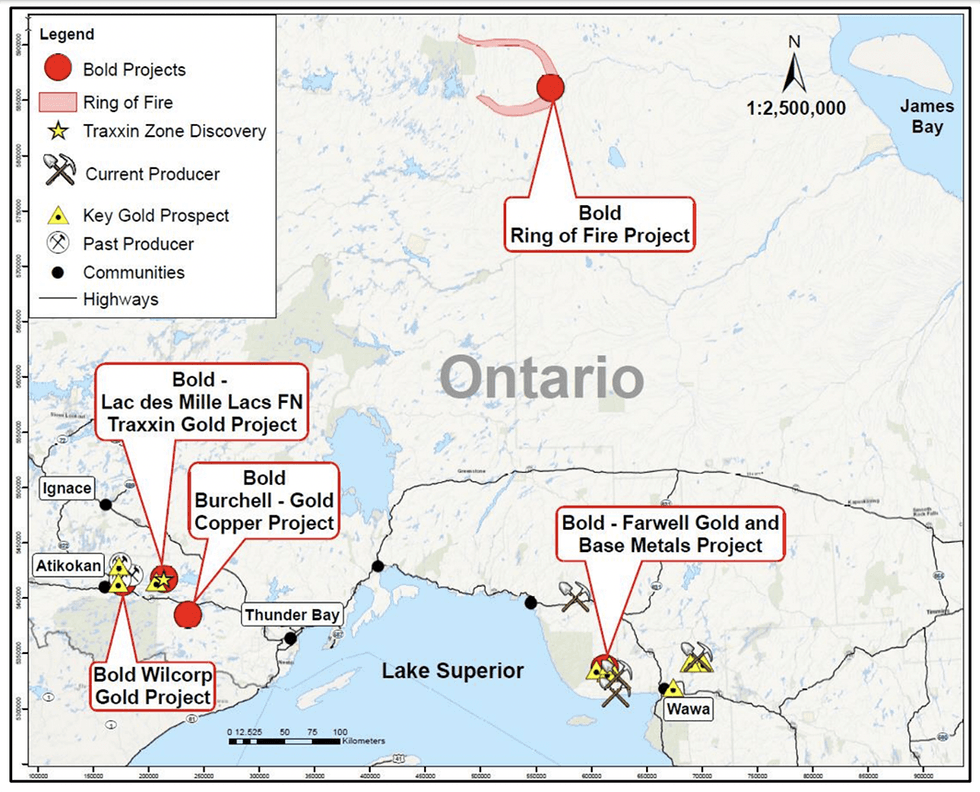

Daring Ventures (TSX.V:BOL) is a Canadian mineral exploration firm specializing in valuable and significant mineral belongings in Northwestern Ontario. The corporate’s asset portfolio demonstrates its twin deal with valuable metals and significant minerals, to create constant worth with gold and meet the rising demand for battery and significant metals. Daring Ventures’ initiatives are situated inside three lively areas all through Ontario: Thunder Bay West, Wawa West and the Ring of Hearth camp situated within the James Bay Lowlands. The Thunder Bay West initiatives comprise gold and copper mineralization, whereas Wawa West and James Bay have belongings with copper, nickel, zinc, silver and PGE mineralization.

The Traxxin gold challenge, west of Thunder Bay, has hosted quite a few high-grade gold intersections in drilling. The latest of which intersected 3.6 g/t gold over 12.3 meters. The challenge is a three way partnership between Daring Ventures, because the operator, and Lac des Milles First Nation, the place the three way partnership can earn as much as one hundred pc of the property. The corporate’s extra belongings embrace initiatives identified for gold and for base metals wanted for the rising clear power market.

An skilled staff of explorers and challenge managers leads the corporate towards totally realizing the potential of its portfolio. The corporate’s management staff has participated in three important world-class discoveries, together with:

- Eagle River Mine: Found in 1987 and has procured over 1 million ounces (Moz) of gold.

- Windfall Lake: Found in 2006 and at the moment has an indicated 4.1 Moz of gold at 11.4 g/t.

- Ring of Hearth Deposits: Found in 2017 and accommodates a number of important deposits of nickel, cobalt and chromite.

The Daring Ventures groups’ wealth of expertise permits them to amass undervalued belongings and apply refined exploration methods to establish important mineral deposits. Management continues to discover its current belongings because it strikes towards growth.

Firm Highlights

- Daring Ventures is a Canadian mineral exploration firm centered on exploring and creating its valuable and significant mineral initiatives in Northern Ontario.

- The corporate owns and operates a number of initiatives all through three key areas of Ontario: Thunder Bay West, James Bay Lowlands-Ring of Hearth and Wawa West.

- The Traxxin gold challenge is a notable three way partnership partnership between Lac des Milles First Nation and Daring Ventures, with the companions incomes as much as a one hundred pc possession of the property. Daring Ventures is the operator of the settlement.

- The Koper Lake Challenge is situated 300 meters from the Ring of Hearth Metals’ (previously Noront after which Wyloo) flagship Eagle’s Nest Nickel-Copper deposit. It hosts a massive chromite useful resource and enticing nickel potential.

- Daring Ventures’ administration staff has many years of expertise inside the mining sector. The administration and technical staff have participated in three world-class discoveries and have the correct expertise to information the corporate towards its targets.

Key Tasks

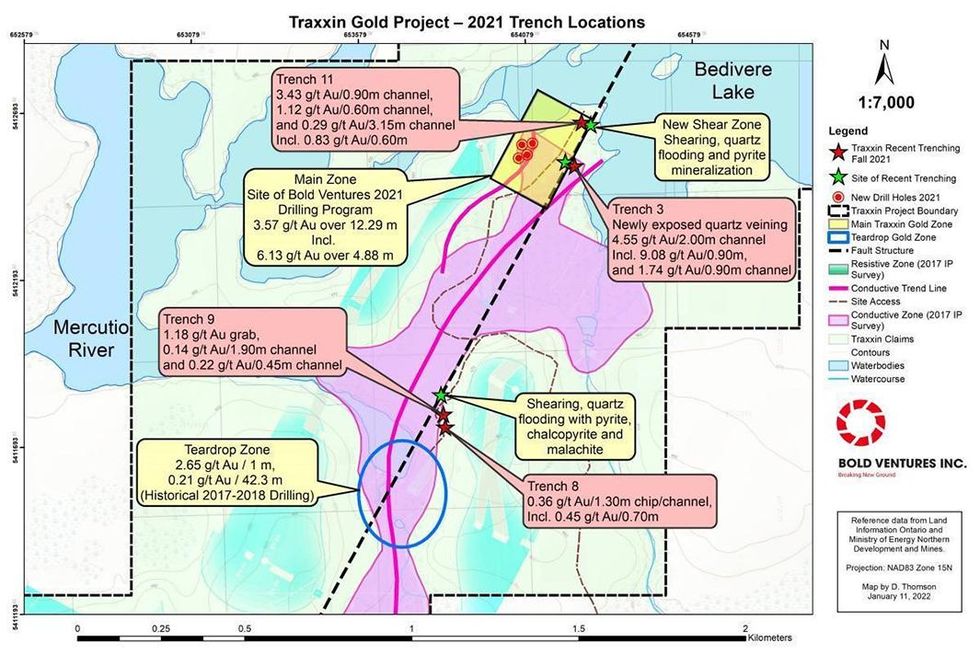

Traxxin Gold Challenge

The Traxxin gold challenge is 130 kilometers west of Thunder Bay and has 154 claims protecting 2,417 hectares. The challenge has glorious current infrastructure and is road-accessible, reducing down on future growth prices.

Challenge Highlights:

- Shut Proximity to Vital Gold Deposit: The challenge is 20 kilometers east of Agnico Eagle’s Hammond Reef deposit, which accommodates 5.6 Moz of gold at 0.71 g/t, together with reserves, measured and indicated.

- Promising New and Historic Exploration Outcomes: Daring Ventures lately accomplished its 2021 drill gap marketing campaign, which indicated 3.6 g/t gold over 12.3 meters. Further historic outcomes embrace:

- Seize samples 1281, 152, 116, 21.1 and three.73 g/t gold

- 5 historic drill holes with higher than 5 g/t gold over numerous intervals

- One historic drill gap higher than 37 g/t gold over 1 meter

- Further Exploration Campaigns Deliberate: The corporate will quickly observe up on its latest drill marketing campaign by additional exploring north, south, east and west to increase identified deposits.

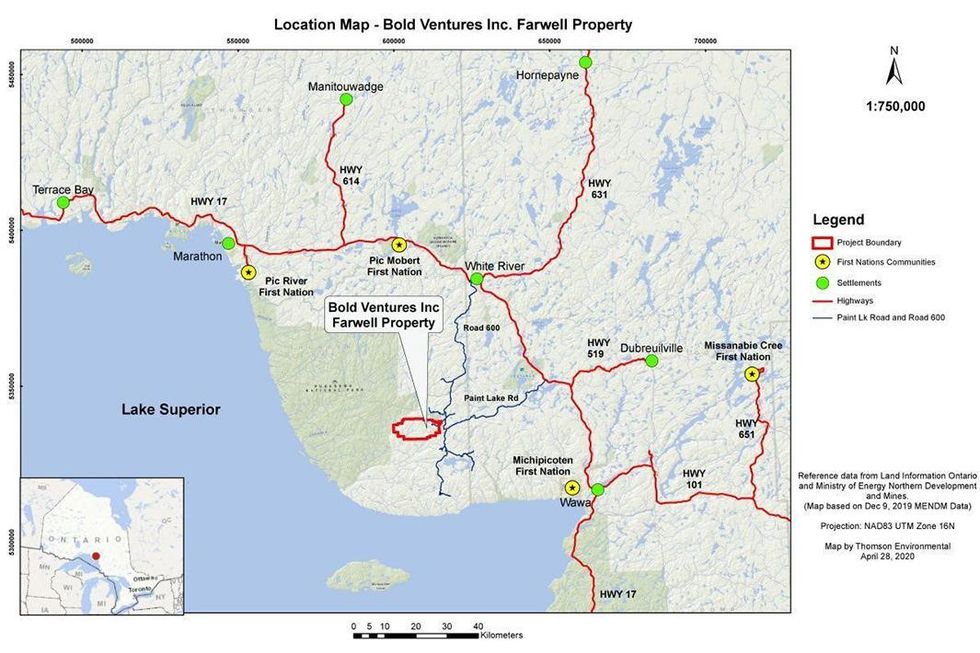

Farwell Copper-Gold Challenge

The Farwell challenge covers 19,200 acres of 113 cells, 18 multi-cells and 6 boundary claims. The asset is situated within the east Lake Superior area of Northeastern Ontario, roughly 55 kilometers northwest of Wawa, and in a confirmed gold camp.

Challenge Highlights:

- Promising Geological Formations: The asset accommodates gold-bearing quartz veins situated inside an iron formation that stretches alongside the western extensions of a significant deformation zone. Moreover, there may be potential for base metallic volcanogenic huge sulphide (VMS) mineralization identified for holding copper, zinc, lead and silver.

- Accomplished Exploration Highlights Future Drill Targets: A lately accomplished versatile time area electromagnetic (VTEM) survey has recognized a number of anomalous areas for future exploratory drilling.

- Highway-accessible: The asset is accessible by highway and connects to highways for future materials transportation.

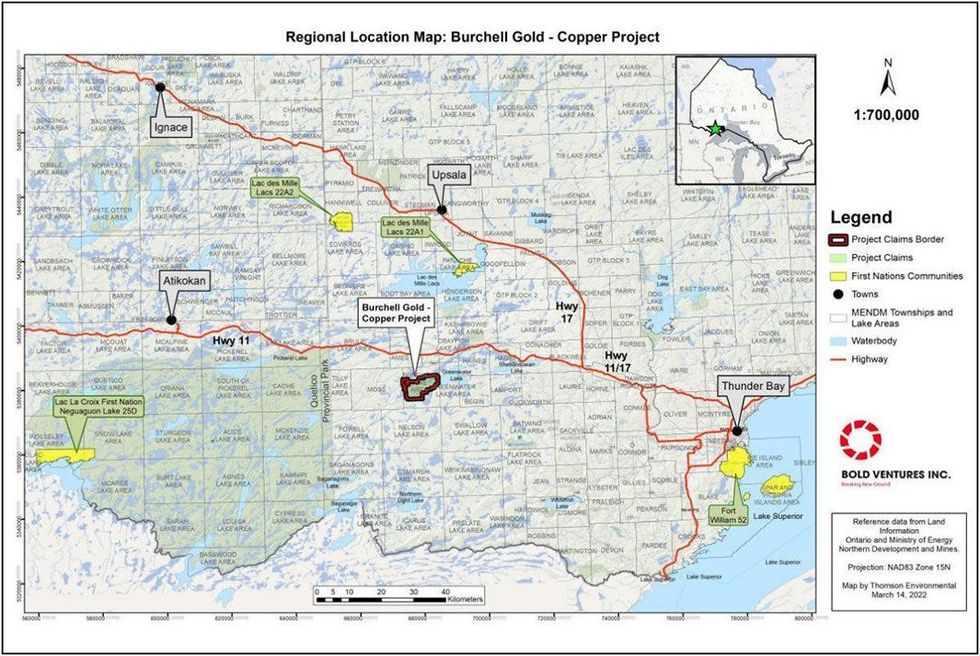

Burchell Gold and Battery Metals Challenge

The Burchell asset contains 188 cells protecting 4,512 hectares and is situated 105 kilometers west of the port metropolis of Thunder Bay within the south-central portion of Northwestern Ontario. The challenge is road-accessible by means of Trans-Canada Freeway 11.

Challenge Highlights:

- Positioned within the Western Shebandowan Greenstone Belt: The Burchell challenge is situated on the distinguished greenstone belt and accommodates copper, gold, silver and molybdenum mineralization.

- Vital Identified Deposits: One of many asset prospects, Hermia-Lake, extends for two.8 kilometers and accommodates 0.31 p.c to 1.1 p.c copper over 1.30 meters to six.7 meters, primarily based on historic information.

- Shut Proximity to Prolific Gold Property: The Burchell asset is close by Goldshore Sources Inc.’s Moss Lake property, which is at the moment conducting a 100,000-meter diamond drill marketing campaign.

Wilcorp Gold Challenge

The Wilcorp gold asset covers 266 hectares and consists of two contiguous properties within the McCaul township, together with 4 patent claims and one mineral declare. The asset is 14 kilometers east of the city of Atikokan, Ontario, and inside the Thunder Bay Mining Division. New drill targets have been recognized for follow-up exploration.

Challenge Highlights:

- Close to the Traxxin Challenge: The Wilcorp asset is near the corporate’s Traxxin challenge, which suggests it is usually close to Agnico Eagle’s promising Hammond Reef asset.

- Induced Polarization (IP) Surveys and Prospecting: An IP survey outlined a complete of 14 anomalies. Moreover, 62 seize samples had been taken all through the property with values starting from lower than 5 elements per billion (ppb) gold as much as 14,403 ppb gold, which is roughly 14.4 g/t gold. General, 16 samples returned values over 100 ppb gold, with six samples returning over 1,000 ppb gold.

- Vital Historic Work: The asset has pre-existing historic work, together with stripping, trenching and diamond drilling.

Koper Lake Challenge (Ring of Hearth)

Challenge Highlights:

- A number of Commodity Streams: The Koper Lake challenge has important potential for essential minerals. The property has the potential to develop battery metals, chromite and valuable metals for a number of income streams.

- Inside the Koper Lake Challenge, the Black Horse Chromite Deposit accommodates a NI 43-101 inferred useful resource of 85.9 MT at a grade of 34.5 p.c Cr2O3 utilizing a cutoff grade of 20 p.c Cr2O3.

- Black Horse Chromite Possession Pursuits:

- Daring 10 p.c carried curiosity, KWG 90 p.c working curiosity.

- Choice to earn as much as: Daring 20 p.c carried curiosity and KWG 80 p.c working curiosity.

- Black Horse Chromite Possession Pursuits:

Daring owns a 40 p.c working curiosity in all metals aside from chromite and has the choice to amass as much as an 80 p.c working curiosity in all different metals discovered inside the claims. The asset contains 1,024 hectares, and is lower than 400 meters from Noront’s Eagle’s Nest nickel- copper huge sulphide deposit.

Ring of Hearth Polymetallic Challenge

The Ring of Hearth asset is a future key challenge that shall be given additional consideration because the Ring of Hearth regional infrastructure and First Nation agreements are developed.

Challenge Highlights:

- The Ring of Hearth challenge is a grassroots challenge that has important potential concentrating on essential minerals for exploration.

- Daring carried out a VTEM airborne survey in 2013 that situated quite a few geophysical anomalies which are potential for essential minerals.

Administration Group

David Graham – CEO and Director

David Graham has been lively within the mineral exploration business for over 40 years. Between 1997 and 2004 he was co-founder, president and CEO of Normiska Company, an industrial minerals and supplies firm with 4 manufacturing amenities in Canada and the US. Between 2006 and 2010 he was a director and vice-president of Noront Sources Ltd. Throughout this time the corporate made main discoveries at Windfall Lake in City Twp., Quebec and the Ring of Hearth within the James Bay Lowlands of Ontario. From 2010 till 2017 he was government vice-president of Daring Ventures Inc. at which period, he was appointed president and CEO. Since 1986, Graham has been president of R. Bruce Graham and Associates Ltd., a mineral exploration and pure useful resource consulting agency based in 1956.

Graham has labored extensively in Canada in addition to in the US, Scandinavia and Africa. His expertise has steadily included working with First Nations and regulatory companies on initiatives that ranged from a grassroots stage to superior growth.

Robert Suttie – CFO

Robert Suttie has greater than 25 years of expertise, 10 of which had been in public accounting previous to his tenure with the monetary reporting group, Marrelli Assist Companies Inc., the place he at the moment serves as president. Suttie focuses on administration advisory providers, accounting and the monetary disclosure wants of the group’s publicly traded shopper base. He’s repeatedly concerned in preliminary public choices, enterprise mixtures and asset carve-out and spin-out transactions. Suttie additionally serves as chief monetary officer to a variety of junior mining corporations listed on the TSX, TSX Enterprise exchanges, CSE, in addition to non-listed corporations. Suttie leverages his expertise and expertise to turn out to be integral to the reporting issuers.

William Johnstone – Company Secretary

William R. Johnstone is the corporate’s company counsel and is the corporate’s company secretary. Johnstone has been a associate at Gardiner Roberts LLP since February 2005, training within the areas of company and securities regulation. Johnstone is the follow chief of the agency’s securities regulation group. Previous to that, Johnstone was the proprietor of Johnstone & Firm, a boutique company and securities regulation agency, for 12 years. Johnstone has been training regulation for over 28 years. He’s additionally a director and/or officer of six different TSX Enterprise Change listed corporations.

Ian Brodie-Brown – Director & Marketing consultant

Ian Brodie-Brown is an business marketing consultant and entrepreneur. Brodi-Brown is a graduate of the College of Toronto and has a few years of expertise arranging enterprise capital for rising corporations, specializing within the mining business. Brodie-Brown is the previous president and chief government officer of AurCrest Gold Inc., a TSX Enterprise listed junior useful resource exploration firm. Brodie-Brown can be a co-founder and president of Cathay Oil & Gasoline, a non-public firm with overseas useful resource belongings. He has a powerful understanding of Aboriginal points surrounding immediately’s mineral business in Canada, and has efficiently negotiated MOUs and exploration agreements with First Nation teams.

Steve Brunelle – Director

Steve Brunelle is a graduate in geology from Queen’s College with over 35 years’ expertise within the useful resource business. He’s the chairman and a director of Rio Silver Inc. listed on the TSX Ventures Change. Brunelle was a founder and officer/director of Nook Bay Silver, which found the Alamo Dorado Silver deposit in Mexico and was acquired by Pan American Silver. He was a founder and officer/director of Stingray Copper, which was acquired by Mercator Minerals for the El Pilar Copper deposit in Mexico. He presently sits on the board of a number of useful resource corporations which are lively in Canada and Peru.

Jeff Wareham – Director

Jeff Wareham has over 30 years within the monetary providers business. He’s a former vice-president of two main Canadian brokerage corporations. On this function, he was actively concerned within the IPO of the 2012 TSX Enterprise inventory of the 12 months, and the IPO of the biggest income inventory on the TSX-V. He was immediately concerned in elevating over $200 million for Canadian corporations. He’s at the moment CEO of Catch Capital Companions Inc., a non-public fairness agency. He’s a previous director of Marquest Asset Administration, an funding fund firm centered on Canadian useful resource investments. He’s additionally a director of Certive Options, a publicly listed US healthcare income cycle firm. He hosted a weekly radio present for a number of years, and performed many small cap funding interviews. Wareham graduated from Western College in 1990, with a level in economics and English. He has earned a number of monetary business designations. He has been a professor of economics and a visitor speaker on economics and political science at Canadian post-secondary establishments.