That is the second publication of the Market’s Compass Developed Markets ETF Research to be revealed in our Substack Weblog that may spotlight the technical adjustments of the 22 DM ETFs that we observe on a weekly foundation. Previous publications could be accessed by way of our Substack Weblog https://themarketscompass.substack.com/, The Market’s Compass web site https://themarketscompass.com/ or by contacting me straight at https://tbrackett@themarketscompass.com.

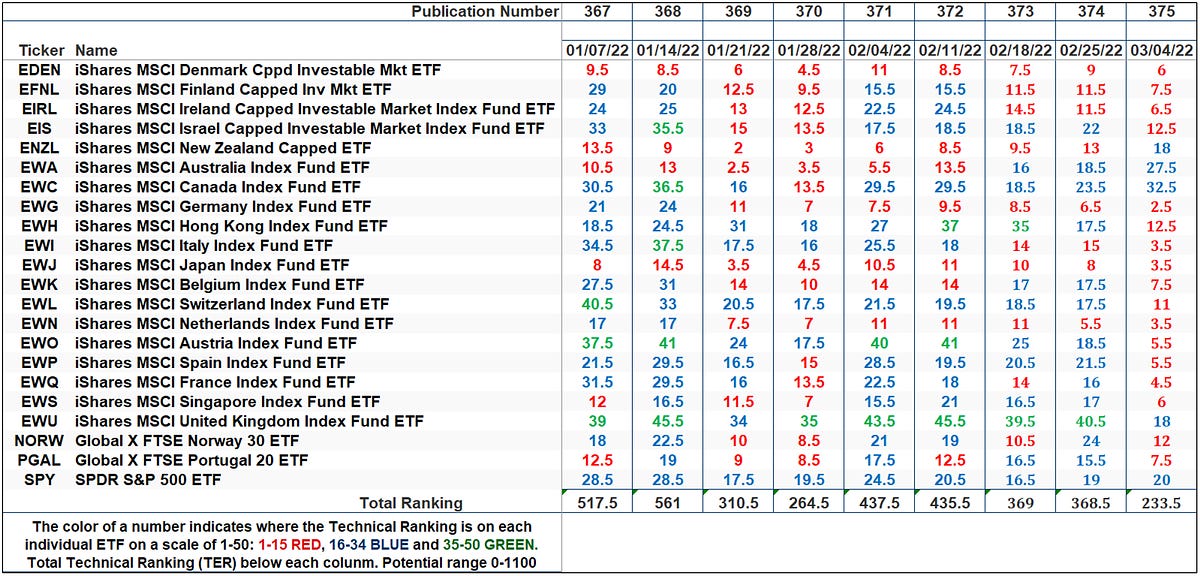

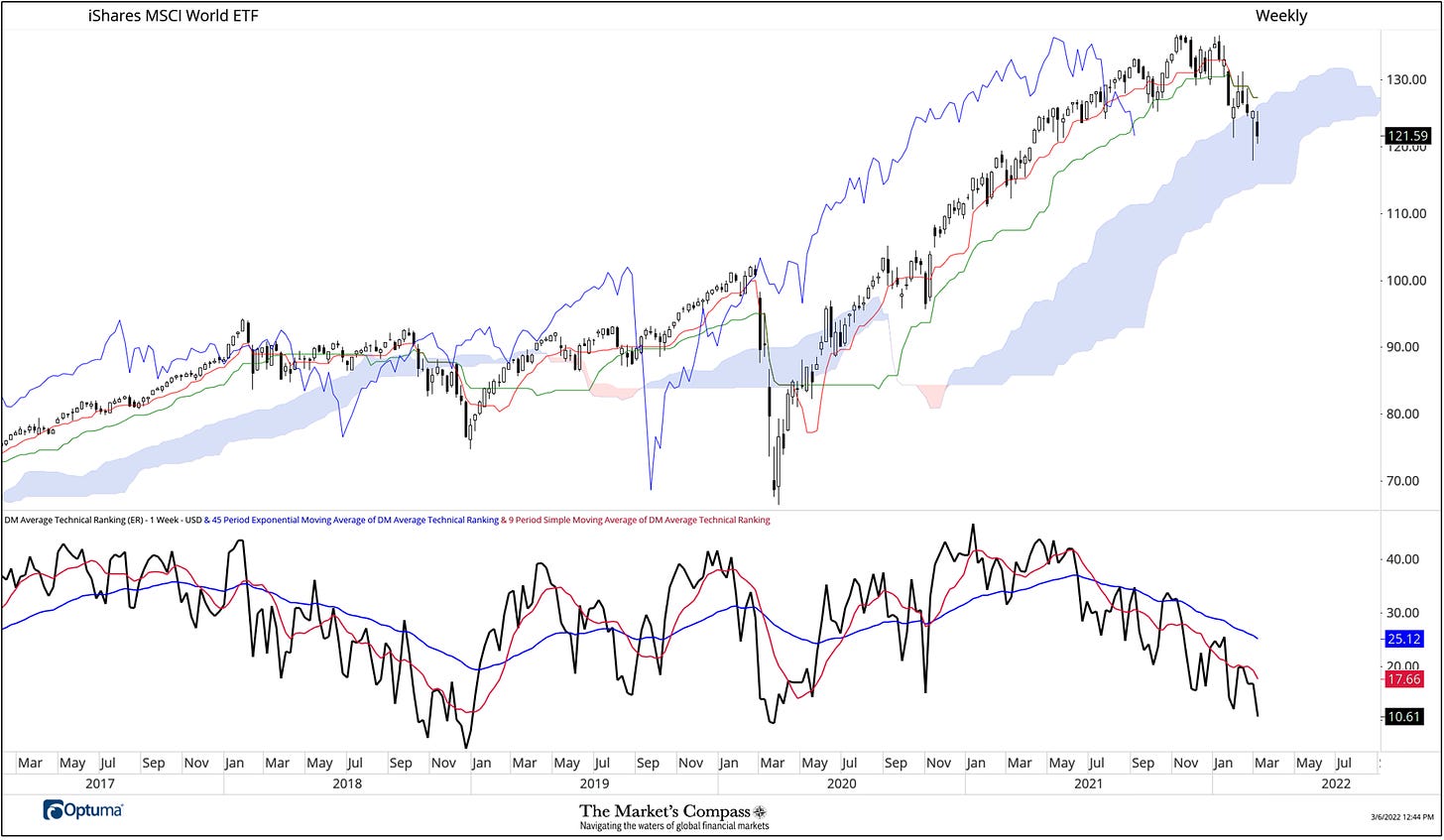

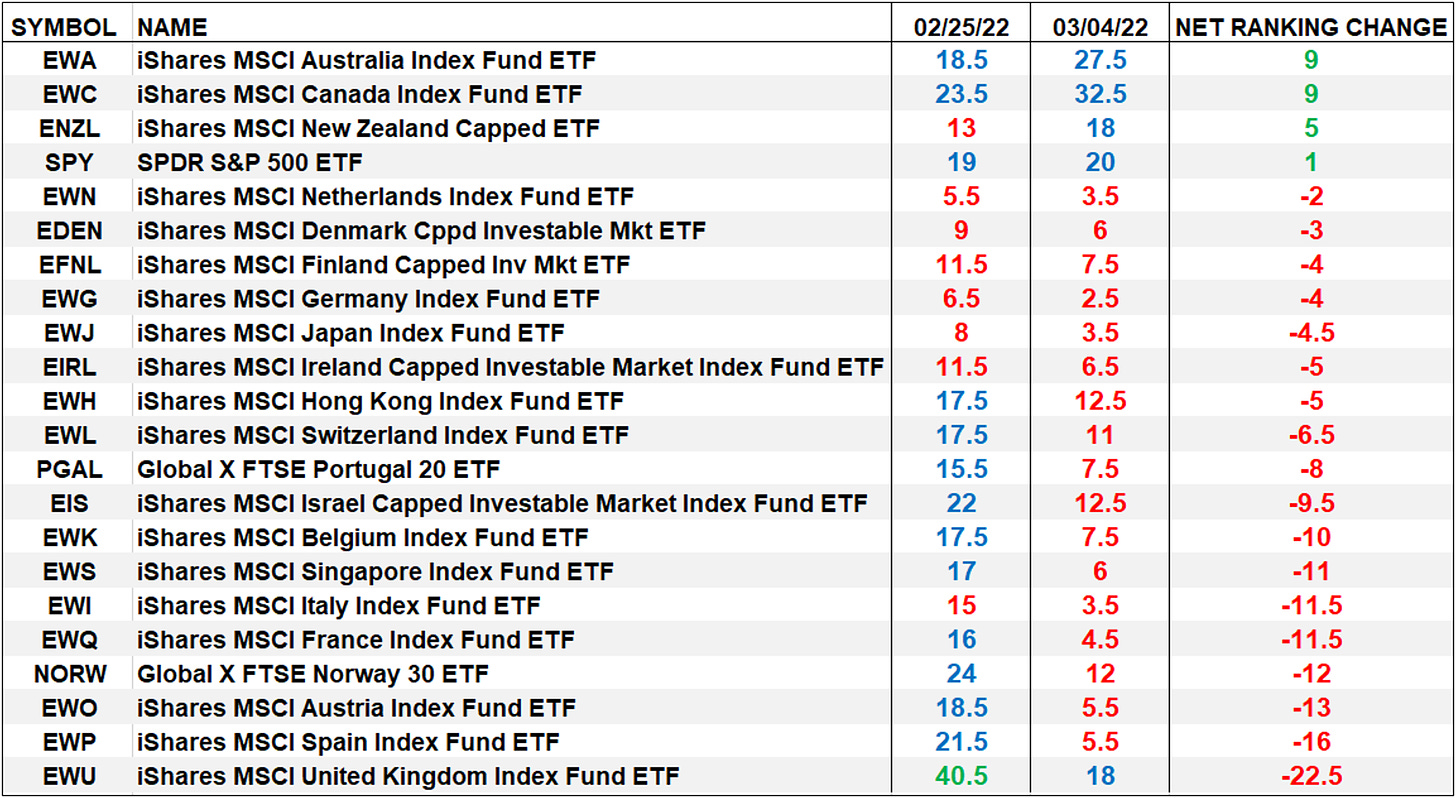

This Week’s and eight Week Trailing Technical Rankings of Particular person ETFs

The Excel spreadsheet under signifies the weekly change within the Technical Rating (“TR”) of every particular person ETF. The technical rating or scoring system is a completely quantitative method that makes use of a number of technical issues that embrace however aren’t restricted to development, momentum, measurements of accumulation/distribution and relative power. If a person ETFs technical situation improves the Technical Rating TR rises and conversely if the technical situation continues to deteriorate the TR falls. The TR of every particular person ETF ranges from 0 to 50. The first take away from this unfold sheet ought to be the development of the person TRs both the continued enchancment or deterioration, in addition to a change in route. Secondarily a really low rating can sign an oversold situation and conversely a continued very excessive quantity could be considered as an overbought situation however with due warning over bought situations can proceed at apace and overbought securities which have exhibited extraordinary momentum can simply change into extra overbought. A sustained development change must unfold within the TR for it to be actionable.

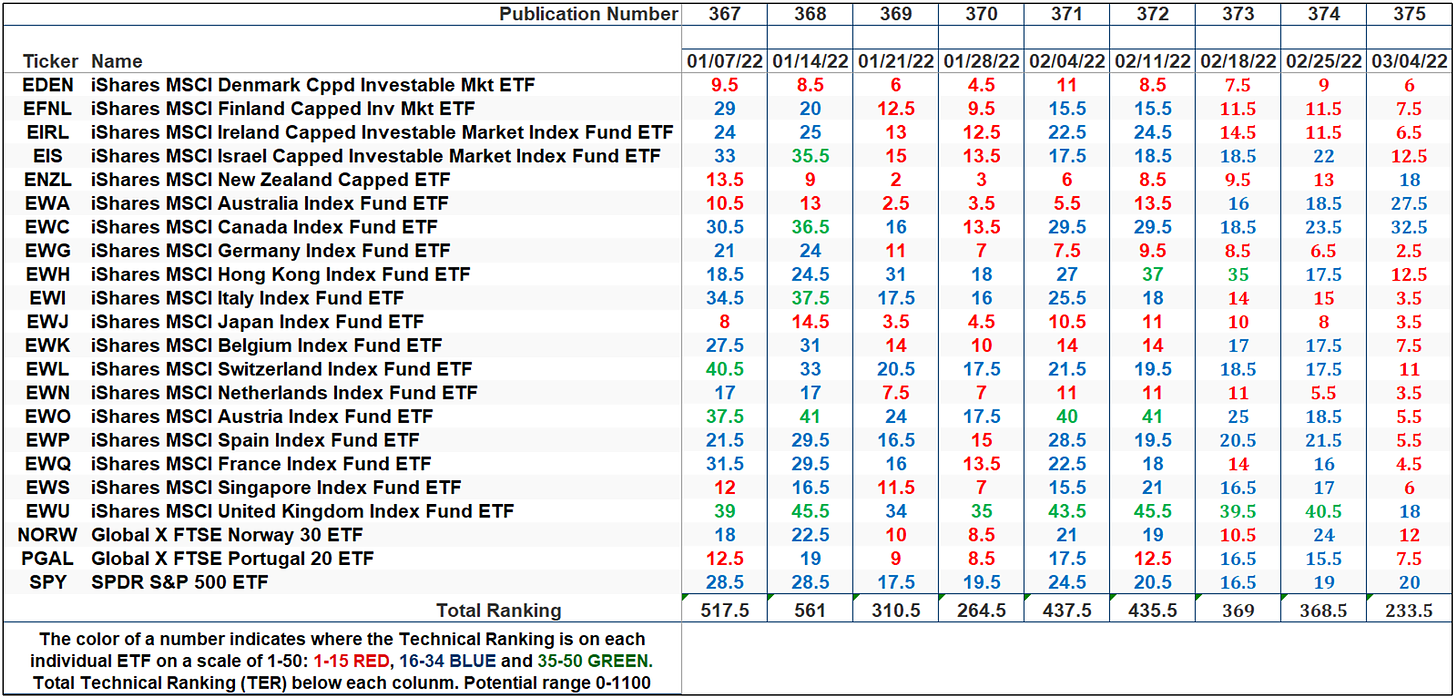

The URTH with This Week’s Complete ETF Rating “TER” Overlayed

The Complete ETF Rating (“TER”) Indicator is a complete of all 22 ETF rankings and could be checked out as a affirmation/divergence indicator in addition to an overbought oversold indicator. As a affirmation/divergence instrument: If the broader market as measured by the iShares MSCI World ETF (URTH) continues to rally and not using a commensurate transfer or larger transfer within the TER the continued rally within the URTH Index turns into more and more in jeopardy. Conversely, if the URTH continues to print decrease lows and there may be little change or a constructing enchancment within the TER a constructive divergence is registered. That is, in a style, is sort of a conventional A/D Line. As an overbought/oversold indicator: The nearer the TER will get to the 1100 degree (all 22 ETFs having a person Technical Rating “TR” of fifty) “issues can’t get a lot better technically” and a rising quantity particular person ETFs have change into “stretched” the extra of an opportunity of a pullback within the URTH. On the flip aspect the nearer to an excessive low “issues can’t get a lot worse technically” and a rising variety of ETFs are “washed out technically” an oversold rally or measurable low is near be in place. The 13-week exponential transferring common in crimson, smooths the risky TER readings and analytically is a greater indicator of development.

The Complete Technical Rating (“TER”) of the iShares MSCI World Index ETF, (URTH) fell to it lowest degree in virtually two years final week and has fallen from the week earlier than studying of 368.5 to 233.50 and from the February eleventh studying of 435.5 (the date of our final DM Markets Nation ETF Research) publication. Contemplating the tragic escalating conflict within the Ukraine and the potential that it could develop geographically and the financial knock-on results by way of out all of Europe the present technical situation of the Developed Markets Nation ETFs and their particular person TRs and in flip the TER is hardly a shock. What we will say is that the TER is close to a degree that means a deep over bought situation however there may be nary a sign that it has reached its terminus.

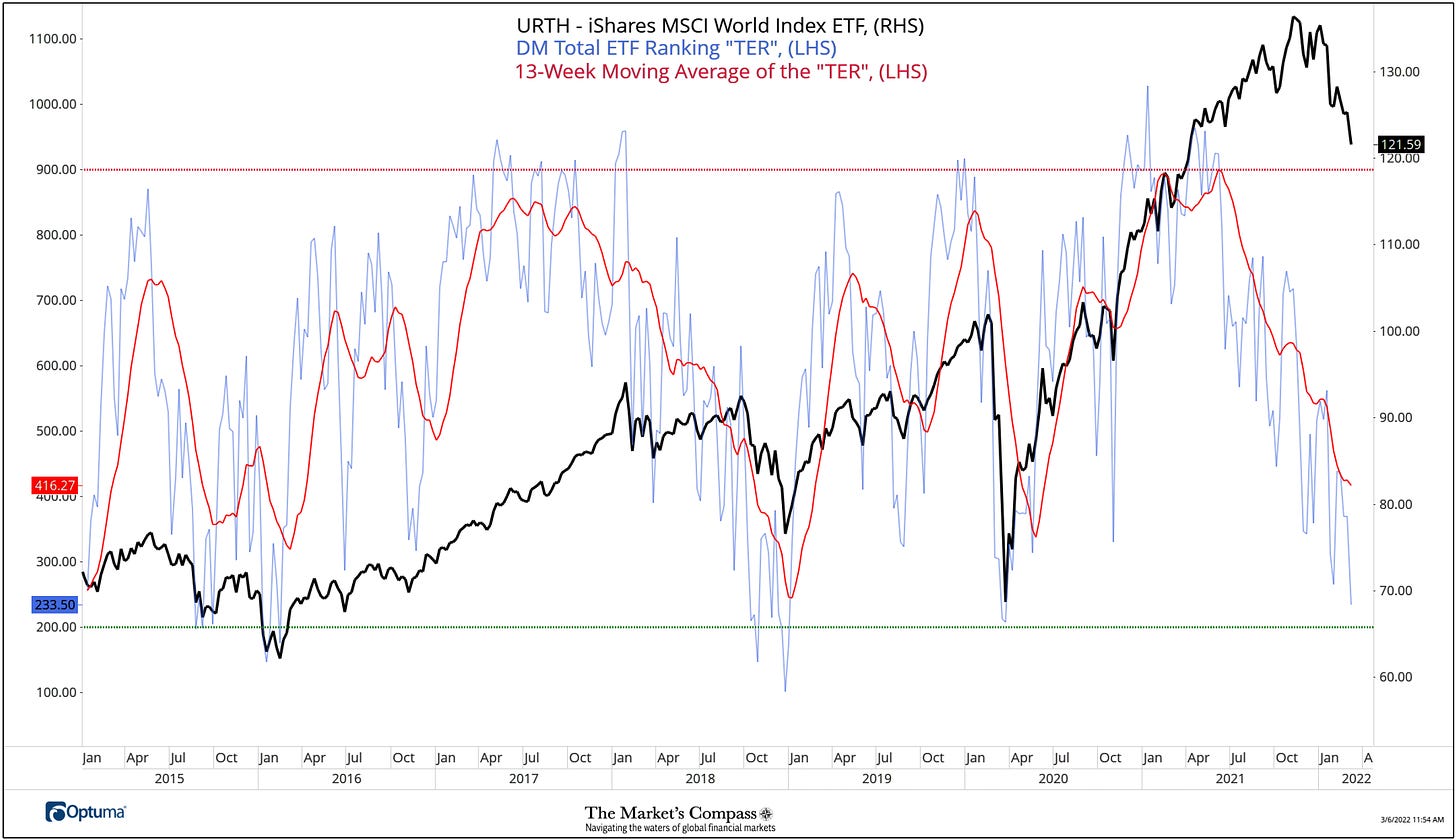

The Common “TR” Rating of the 22 DM Markets Nation ETFs

The Common Weekly Technical Rating (“ATR”) is the common technical rating of the 22 Developed Markets ETFs we observe weekly and is plotted within the decrease panel on the Weekly Candle Chart of the iShares MSCI World Index (URTH) offered under. Just like the “TER”, it’s a affirmation/divergence or overbought/oversold indicator.

The “ATR” of the 22 Developed Markets Nation ETFs has continued to trace decrease over the previous 4 weeks the ATR has fallen from 19.80 on February eleventh to 16.77, 16.75 to 10.61 respectively, extending its downtrend. As could be seen above, each the shorter-term transferring common (crimson line) and longer-term transferring common (blue line) of the ATR are nonetheless retreating. That stated the “ATR” has not reached an oversold excessive that we witnessed in December 2018 and has solely simply dropped under the March 2020 low. We would want to see a sustained reversal within the ATR and a rally in worth again above the Cloud to recommend a restoration was unfolding.

The Week Over Week Change within the DM Markets Nations Technical Rankings

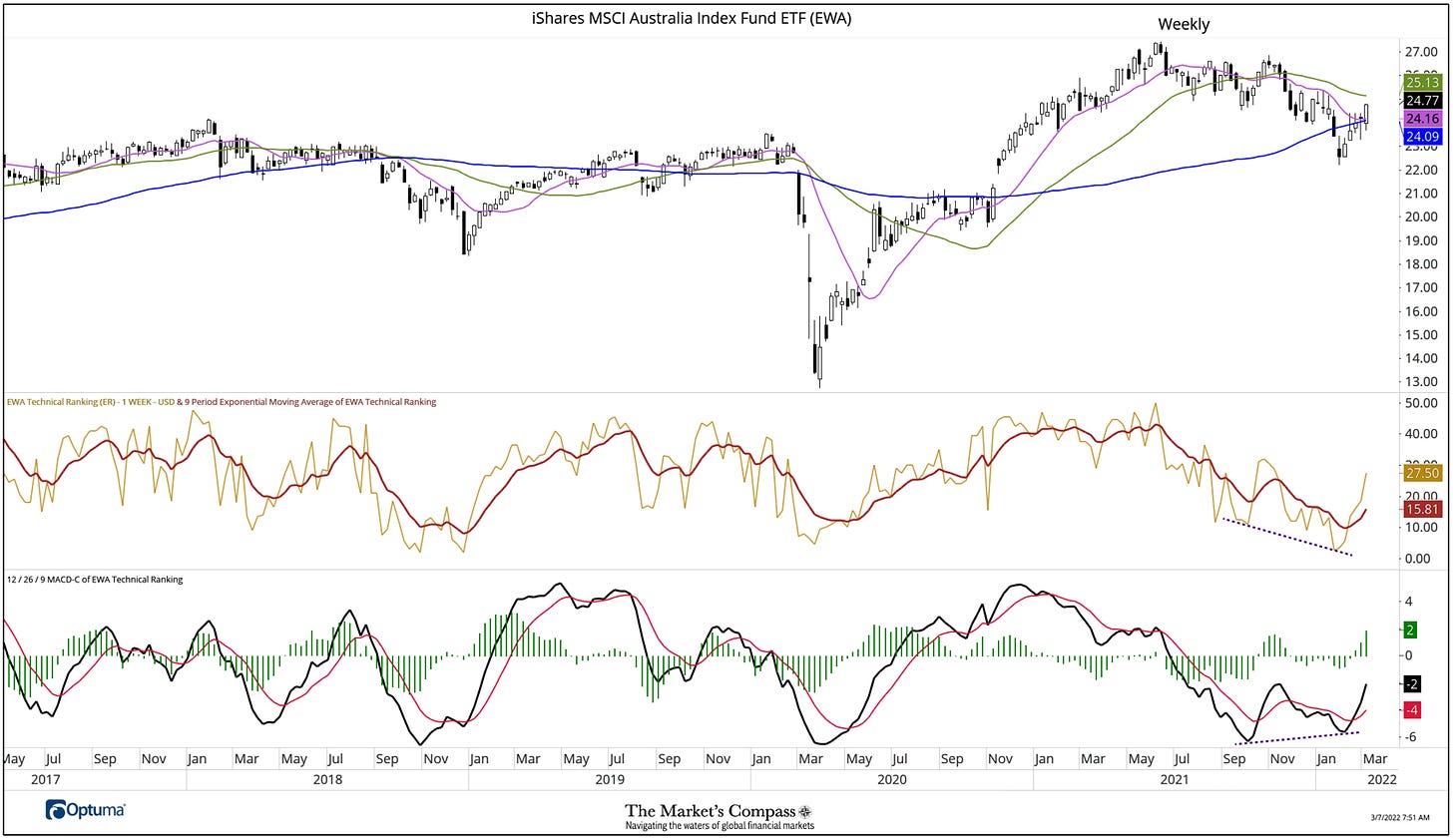

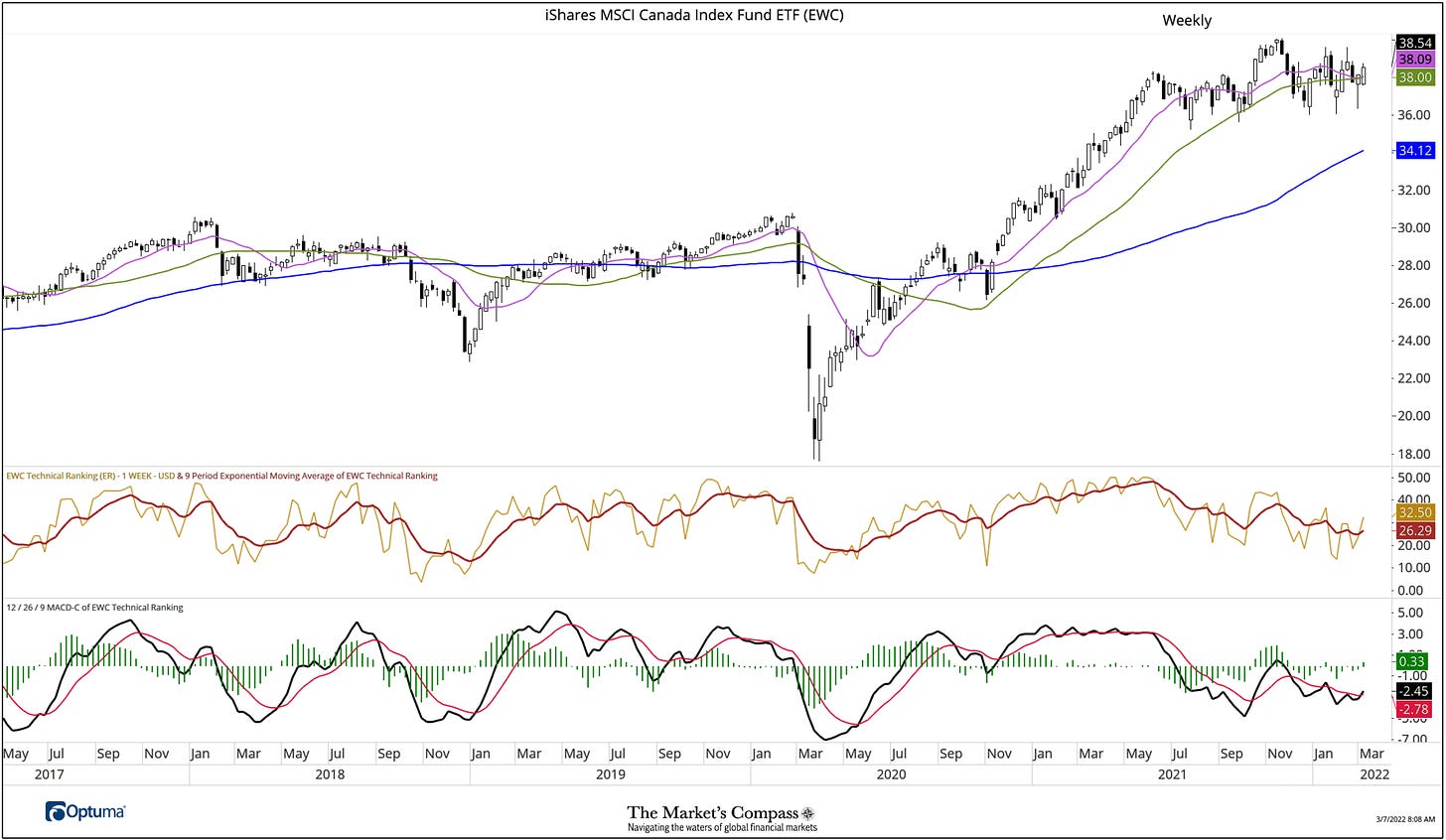

4 out of twenty-two Developed Markets Nation ETFs we observe registered improved TRs over the week and 18 declined with the common TR lack of -6.14. The 2 main the ETFs in enchancment had been the iShares MSCI Australia Index Fund ETF (EWA) rising 9 to 27.5 from 18.5. The iShares MSCI Canada Index Fund ETF (EWC) additionally rose 9 to 32.5 from 23.5 marking the very best TR of the 22 ETFs (weekly charts and holdings are posted under). Observe that the EWA registered a brand new TR low in January and MACD of the TR within the decrease panel of the chart didn’t, marking a bullish divergence (purple dashed strains).

ETF Holdings knowledge is courtesy of Bloomberg

EWA Holdings

EWC Holdings

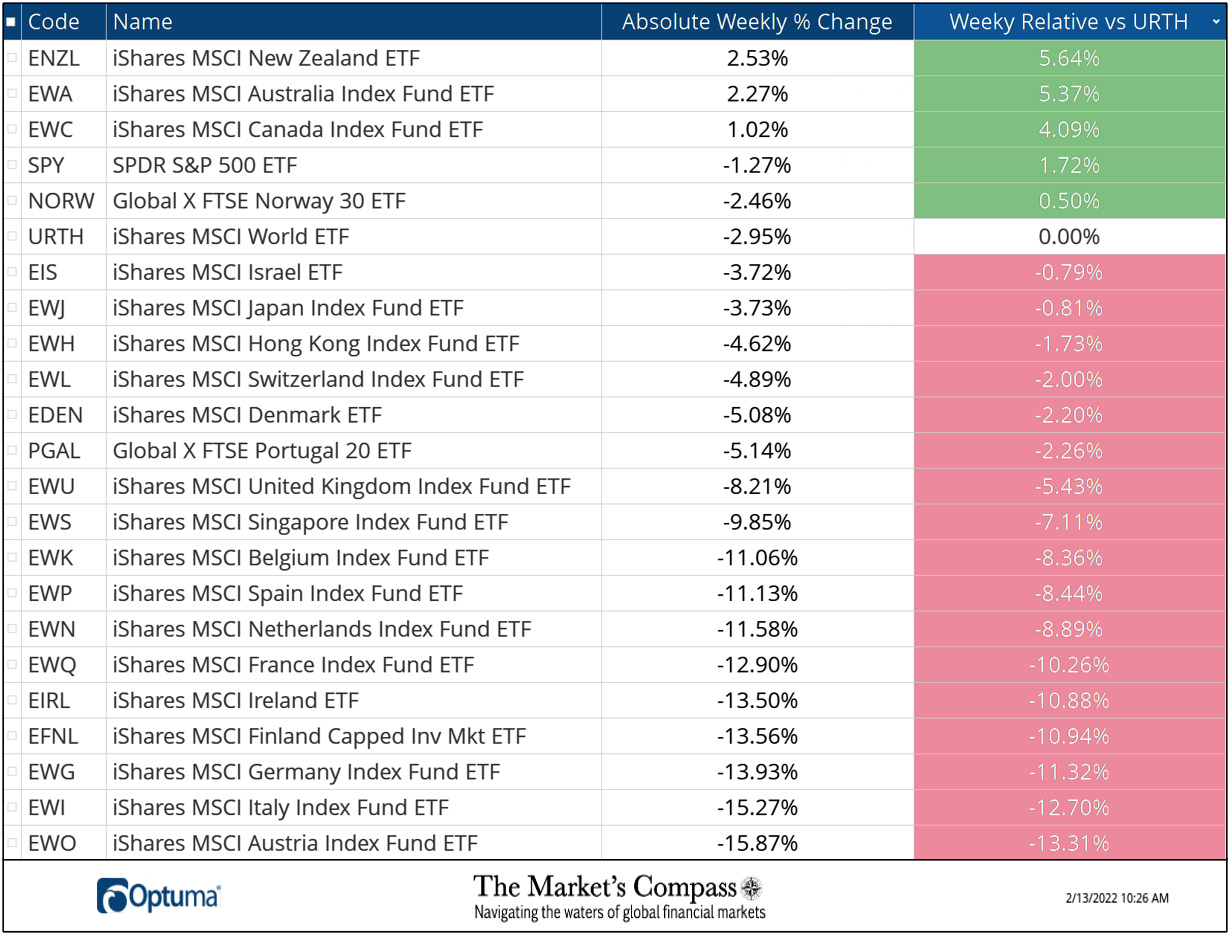

The DM Nation ETFs Weekly Absolute and Relative Value % Change*

*Doesn’t together with dividends

Solely three of the 22 Developed Markets Nation ETFs we observe improved on an absolute foundation final week led by the iShares MSCI New Zealand ETF (ENZL) up +2.53% adopted by the aforementioned iShares Australia Index Fund ETF (EWA) up +2.27% and the iShares MSCI Canada Index Fund ETF (EWC) which rose +1.02%. 5 DM Nation ETFs outperformed the iShares MSCI World ETF (URTH) on a relative foundation and 17 underperformed.

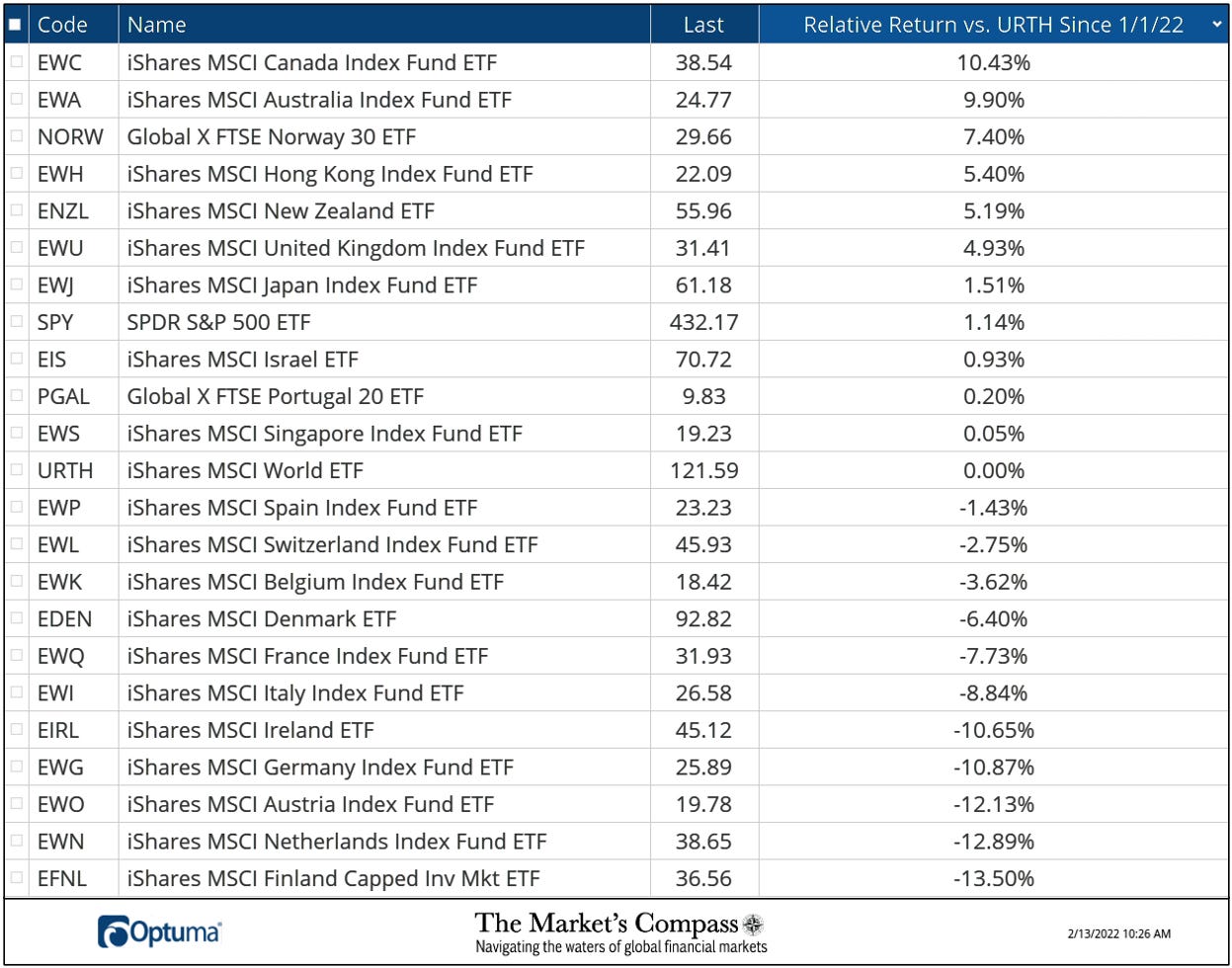

The Relative Return of the 22 DM Nation ETFs vs. the URTH Index Yr to Date*

*Doesn’t together with dividends

I invite our readers to contact me with any questions or feedback at…tbrackett@themarketscompass.com