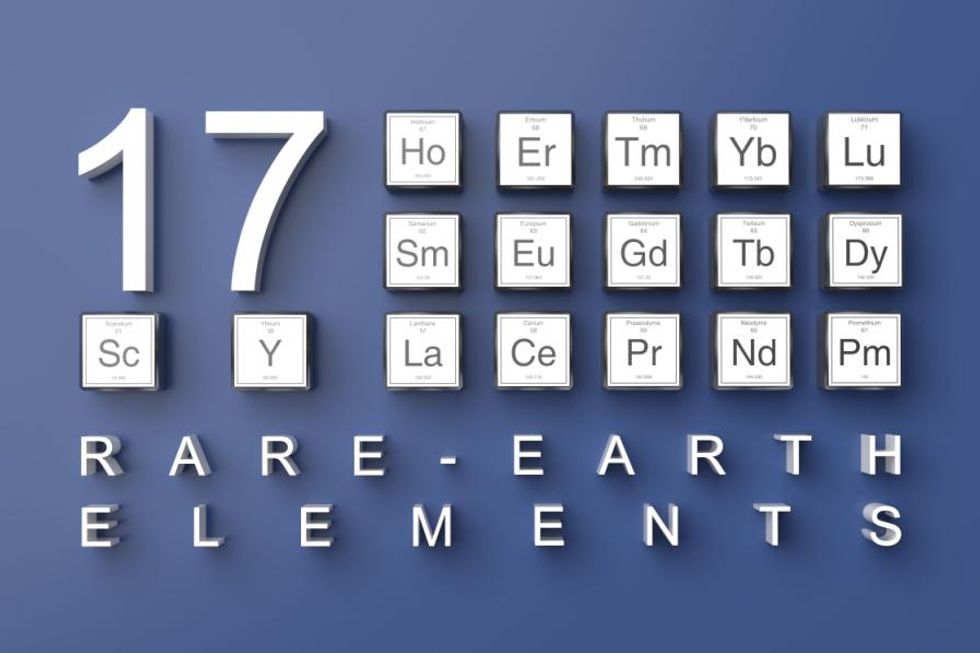

Uncommon earths are important in all kinds of right this moment’s applied sciences, from smartphone cameras to protection programs.

The group of important metals, which incorporates neodymium and praseodymium, has additionally seen growing demand from the electrical car business. “The only engineering answer for a drive practice on an electrical car is to make use of a everlasting magnet synchronous motor, and people everlasting magnets are made from uncommon earth parts (REEs),” Jon Hykawy of Stormcrow Capital defined to the Investing Information Community. “In order that pattern continues, I count on the costs to stay excessive.”

China is by far the world’s prime producer of uncommon earths and holds the biggest uncommon earths reserves. The nation’s monopoly on the uncommon earths market has led different nations such because the US, Canada and Australia to incentivize uncommon earths mining, processing and the manufacturing of value-added REE merchandise outdoors of China with a purpose to bolster their very own provide chains.

Beneath the Investing Information Community profiles the most important uncommon earths shares by market cap on US, Canadian and Australian inventory exchanges. Knowledge was gathered on January 3, 2022, utilizing TradingView’s inventory screener.

US uncommon earths shares

The US is on the forefront within the race to safe steady provides of uncommon earths outdoors of China. Whereas the nation has huge uncommon earths reserves and is the second largest international REE producer, the US is severely missing in processing amenities. The US uncommon earths shares seeking to change that imbalance supply buyers a chance to leverage the expansion potential of this market.

Market cap: US$4.25 billion; share worth: US$23.96

MP Supplies is the biggest producer of uncommon earths outdoors of China, with a deal with high-purity separated neodymium and praseodymium (NdPr) oxide, a heavy uncommon earths (HREE) focus and lanthanum and cerium oxides and carbonates.

The corporate went public in mid-2020 in a US$1.47 billion deal following the acquisition of Molycorp’s Mountain Go mine in California, the one working US-based uncommon earths mine and processing facility.

2. Power Fuels (NYSEAMERICAN:UUUU,TSX:EFR)

Market cap: US$975.7 million; share worth: US$6.19

Power Fuels is greatest often known as a number one US uranium firm that provides uranium merchandise to main nuclear utilities. The corporate holds three key US primarily based uranium manufacturing facilities: the White Mesa Mill in Utah (the one typical uranium mill working within the nation right this moment), the Nichols Ranch in-situ restoration (ISR) mission in Wyoming, and the Alta Mesa ISR mission in Texas.

Understanding the significance of REEs for a inexperienced vitality future, Power Fuels has been constructing out its REE manufacturing capabilities. In mid-November 2022, the corporate introduced plans to promote its Alta Mesa ISR mission to enCore Power (TSXV:EU,OTCQB:ENCUF) for US$120 million. The funds will probably be used to finance the Power Fuels’ uranium, REE, vanadium and medical isotope enterprise plans for the following few years.

This contains financing the development of its Part 1 REE separation infrastructure on the White Mesa Mill, which can give the corporate 2,500 to five,000 metric tons (MT) per 12 months complete uncommon earth oxides (TREO) capability, together with 500 to 1,000 MT per 12 months of NdPr oxide or oxalate; and advancing the design, engineering and allowing of a deliberate Part 2 crack-and-leach and REE separation facility with as much as 15,000 MT per 12 months TREO capability.

Canadian uncommon earths shares

In December 2022, the Canadian authorities launched its Vital Minerals Technique, which incorporates US$3.8 billion in federal funding and “focuses on alternatives at each stage alongside the worth chain for Canada’s 31 important minerals, from exploration to recycling.” Canada’s important metals checklist contains REEs, and the announcement follows the C$7.5 million in authorities funding earmarked for supporting the institution of a REE processing facility in Saskatchewan.

Beneath are the biggest Canadian uncommon earths shares by market cap.

1. NioCorp Developments (TSX:NB)

Market cap: C$279.45 million; share worth: C$1.04

NioCorp Developments is growing its Nebraska-based Elk Creek mission, a pure-play important minerals mission that the corporate claims hosts the highest-grade main niobium deposit underneath improvement in North America, large-scale manufacturing of scandium and the second largest indicated-or-better uncommon earths useful resource within the US.

In Could 2022, NioCorp launched an up to date feasibility research on Elk Creek. Whereas the brand new mineral reserve and financial mannequin doesn’t but embody any knowledge on uncommon earths manufacturing, the up to date feasibility research does function an extended anticipated mine life, greater anticipated ore grades and tonnages and improved anticipated mission economics for niobium, scandium and titanium manufacturing.

At its demonstration-scale processing plant, NioCorp is working to point out that it might probably extract and separate REEs from ore that NioCorp expects to mine from the Elk Creek mission website. The information is anticipated to assist inform an up to date Elk Creek mission feasibility research that includes an financial evaluation of separated uncommon earth oxide merchandise and the simplified course of movement sheet.

Market cap: C$53.8 million; share worth: C$0.25

Mkango Assets is growing new sources of REEs, comparable to neodymium, praseodymium, dysprosium and terbium, for cleantech markets, together with electrical automobiles and wind generators. Its most important asset is the Songwe Hill uncommon earths mission in East Africa’s Malawi.

In 2021, Mkango reported that its subsidiary Mkango Polska has joined with Grupa Azoty Pulawy (WSE:ZAP) to develop a uncommon earths separation plant in Poland concentrating on 2,000 MT per 12 months of separated neodymium/praseodymium oxides and 50 MT per 12 months of dysprosium and terbium oxides in a carbonate enriched with heavy uncommon earths.

Mkango Assets accomplished its definitive feasibility research for the Songwe Hill mission in July 2022. The outcomes spotlight a mine lifetime of 18 years with manufacturing anticipated to start in February 2025 and full manufacturing capability anticipated by July of that 12 months. For the primary 5 years of full manufacturing, output is predicted to common 5,954 MT per 12 months TREO.

The corporate’s subsidiary Maginito holds a 42 % curiosity in UK uncommon earths magnet recycler HyProMag, which is growing a recycling plant within the UK along with the College of Birmingham, with first manufacturing focused for 2023. HyProMag in flip owns 80 % of its subsidiary HyProMag Restricted, which was just lately awarded grants totaling 3.7 million euros from the European Regional Improvement Fund and the Ministry of Financial Affairs, Labour and Tourism Baden-Württemberg to assist fund its improvement of a uncommon earths recycling facility in Germany, with first manufacturing slated for 2024.

Market cap: C$52.03 million; share worth: C$0.31

Aclara Assets is growing its Chilean-based Penco Module mission, which hosts ionic clays wealthy in heavy REEs. The corporate’s objective is to supply a uncommon earth focus by means of a proposed processing plant utilizing an environmentally pleasant extraction course of that doesn’t require a tailings facility, makes use of minimal water consumption and comprises no radioactivity within the remaining product.

In December 2022, Aclara launched a mineral useful resource replace for the Penco Module REE mission. The mineral useful resource replace is predicated on drill campaigns Aclara carried out in 2021 and 2022 that totaled 5,298 meters and 175 new drill holes. The work additionally led to the definition of a brand new useful resource space on the mission in addition to a rise within the mineral sources throughout the mission space.

Aclara will incorporate these outcomes right into a deliberate feasibility research for the Penco Module mission anticipated to be developed throughout 2023. Additionally on the calendar for this 12 months, the corporate plans to submit an environmental allow utility for the mission in Q2 and produce its pilot plant on-line in Q3. Aclara is concentrating on Q1 2026 for the beginning of manufacturing at Penco Module.

Australian uncommon earths shares

Australia is likely one of the world’s largest uncommon earths producers and hosts the fifth largest uncommon earths reserves. The nation is house to the world’s largest non-Chinese language uncommon earths provider, which can also be the biggest Australian uncommon earths inventory by market cap.

1. Lynas Uncommon Earths (ASX:LYC)

Market cap: AU$7.1 billion; share worth: AU$7.69

Lynas Uncommon Earths is the main separated uncommon earths producer outdoors China. The corporate operates the Mount Weld mine and concentrator in Western Australia and sends mined materials for refining and processing at its separation facility in Malaysia.

In 2021, the corporate obtained US$30.4 million in funding from the Pentagon to construct a light-weight uncommon earths processing facility in Texas, and earned one other contract to construct a heavy uncommon earths separation facility within the state. The mission’s completion won’t solely profit Lynas, but additionally the uncommon earths business in each Australia and the US.

Extra just lately, Lynas introduced an funding of AU$500 million to fund its plans to spice up manufacturing to 10,500 MT per 12 months of neodymium-praseodymium merchandise by 2025.

Market cap: AU$4.04 billion; share worth: AU$9.42

Iluka Assets is working to develop its Eneabba uncommon earths refinery in Western Australia with a mortgage from the Australian authorities, which has made a major dedication to improve its international share of the uncommon earths market by means of the event of the nation’s largely untapped uncommon earths reserves.

The refinery will probably be absolutely built-in for the manufacturing of sunshine and heavy separated uncommon earth oxides and will probably be able to processing materials from Iluka’s feedstocks, in addition to from third get together suppliers. The corporate expects first manufacturing to start in 2025. In October 2022, Iluka introduced it has entered into an settlement with Northern Minerals (ASX:NTU) for the provision of uncommon earths focus from Northern’s Browns Vary mission.

The corporate’s Wimmera mission in Victoria includes the mining and beneficiation of a fine-grained heavy-mineral-sands ore physique within the Victorian Murray Basin for the potential long run provide of zircon and uncommon earths.

Market cap: AU$923.795 million; share worth: AU$0.45

Arafura Assets is one other Australian uncommon earths firm that has secured authorities funding to help mission improvement. Arafura is growing its Nolans uncommon earths mission within the Northern Territory.

The Nolans mission is within the improvement section with a definitive feasibility research, and comprises the entire completely different uncommon earths; nonetheless, is very enriched with neodymium and praseodymium, the magnet feed uncommon earths. Arafura has secured a binding offtake settlement with Hyundai (KRX:005380) and Kia (KRX:000270), along with a non-binding memorandum of understanding with GE’s (NASDAQ:GE) GE Renewable Power, to collaborate in institution of sustainable uncommon earths provide chain.

Arafura has plans for Nolans to be a vertically built-in operation with processing amenities on-site. An up to date mine report from 2022 states that Nolans has a 38 12 months mine life at a capability of 340,000 MT of focus manufacturing per 12 months.

Don’t neglect to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Melissa Pistilli, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: Aclara Assets and Power Fuels are shoppers of the Investing Information Community. This text is just not paid-for content material.

From Your Web site Articles

Associated Articles Across the Net