January has now been and gone and turned out to be a pleasant present for buyers. Battered by 2022’s bear, the tech-heavy Nasdaq, specifically, put in a wonderful exhibiting, seeing out the month ~11% into the inexperienced, in what amounted to its finest begin to a yr since 2001.

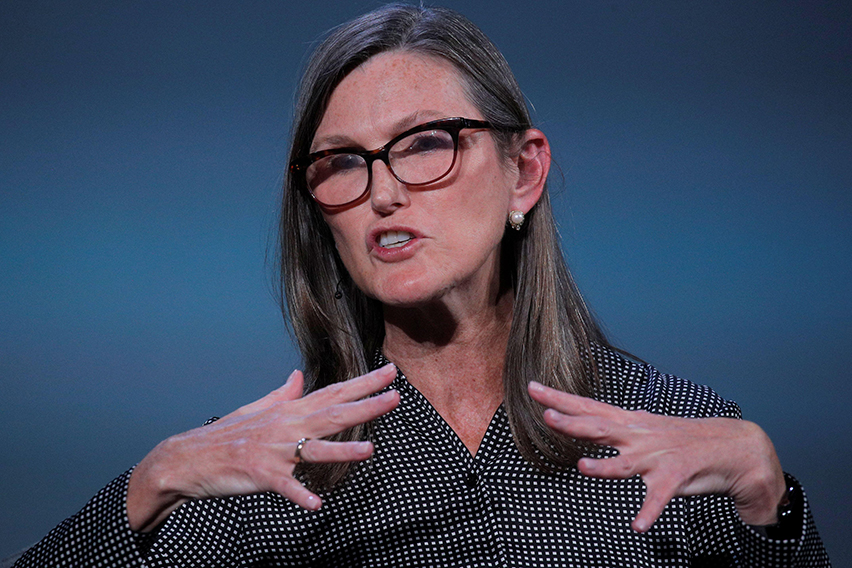

That indicators the urge for food for danger is on once more and that shall be excellent news for Cathie Wooden, the ARK Funding CEO, whose investing model closely favors disruptors – equities which are naturally positioned on the dangerous finish of the dimensions.

Wooden has proven a choice for names she considers game-changers, resembling those that make up her ARK Genomic Revolution ETF, a fund that focuses on offering publicity to the developments made in genomics – DNA sequencing tech, gene modifying, CRISPR, and molecular diagnostics, are all represented right here.

Wooden has not been shy loading up the truck with names she believes in, each in tough and higher instances, and through January she purchased extra shares of two shares that make up an excellent chunk of the ARKG fund. We ran them via the TipRanks database to see what makes them interesting funding selections proper now.

Beam Therapeutics Inc. (BEAM)

The primary Wooden-backed inventory we’ll take a look at is Beam Therapeutics, a pioneer within the software of base modifying. This can be a doubtlessly new class of precision genetic medicines, with the intention of offering life-long remedies to these affected by crippling ailments. Base modifying is cutting-edge tech that’s supposed to right errors or mutations in intact cells’ DNA, permitting for “gene knockouts” and genetic modifications.

It’s comparatively early days for a lot of Beam’s pipeline, though some candidates have superior to medical trials. Main the hematology portfolio, in November, Beam enrolled the primary affected person in its BEACON medical examine assessing BEAM-101, indicated to deal with sickle cell illness (SCD). The corporate anticipates concluding enrollment within the sentinel cohort and kicking off enrollment within the enlargement group of BEACON this yr. The plan is to have an information readout from a number of sufferers from one or each teams in 2024.

Within the immunology-oncology portfolio, the corporate has initiated a first-in-human Section 1/2 medical examine to evaluate BEAM-201 in sufferers with relapsed/refractory T-cell acute lymphoblastic leukemia (T-ALL)/T-cell lymphoblastic lymphoma (T-LL) with the primary affected person anticipated to be dosed by mid-year.

In the meantime, Cathie Wooden has been including extra BEAM shares to the ARKG ETF. Throughout January, she bought 163,838 shares. The ETF now maintain 2,126,439 shares in whole, at the moment price ~$92.4 million.

Of additional curiosity to buyers, Beam additionally has a strategic partnership with Verve Therapeutics, which dictates that the latter has unique entry to Beam’s base modifying, gene modifying, and supply tech. And it’s from this partnership that BMO analyst Kostas Biliouris sees upcoming catalysts for Beam.

“In 2023, we anticipate two key updates from Beam’s associate Verve to drive upside in BEAM. Beam’s associate Verve is using Beam’s base modifying know-how in its lead program (VERVE-101) for in vivo gene modifying. In 2023, we anticipate Verve to supply updates on: (1) Administration’s response to FDA on VERVE-101 medical maintain (doubtlessly in ~mid-2023); and (2) The primary medical knowledge from VERVE-101 that derisk base modifying (in 2H23). We consider these catalysts can have a direct readthrough on BEAM, every driving a ~10%+ upside,” Biliouris opined.

To this finish, Biliouris charges BEAM an Outperform (i.e. Purchase), whereas his $66 worth goal gives room for 12-month positive aspects of ~50%. (To observe Biliouris’ monitor report, click on right here)

So, that’s BMO’s view, how does the remainder of the Avenue see the following 12 months panning out for BEAM? Primarily based on 5 Buys and 4 Holds, the analyst consensus charges the inventory a Average Purchase. Going by the $70.89 common goal, the shares will climb ~62% greater within the yr forward. (See BEAM inventory forecast)

CareDx, Inc (CDNA)

The subsequent Wooden-endorsed inventory additionally belongs within the healthcare sector, though it provides a special worth proposition. CareDx is a commercial-stage diagnostics firm that gives take care of transplant sufferers, from discovering the fitting match to follow-on surveillance post-transplant.

Its preliminary providing, the AlloMap coronary heart transplant molecular take a look at, is a non-invasive blood take a look at that helps in figuring out sufferers with steady graft operate. Nowadays, the corporate has a number of services and products for transplanted hearts, lungs and kidneys with its AlloSure product being the primary and sole non-invasive blood take a look at that assesses allograft harm instantly and determines the probability of energetic rejection in kidney transplant sufferers.

The corporate will report fourth-quarter and full yr 2022 monetary outcomes later this month, however already offered a preliminary income replace. For 4Q22, CareDx anticipates report revenues between $81.9 million to $82.2 million, amounting to a year-over-year improve of roughly 4%. Analysts had been on the lookout for This fall income of $81.69 million. For the full-year, income is predicted to develop by ~8% to the vary between $321.3 million and $321.6 million (consensus has $321.09 million). The corporate additionally stated it notched its highest ever money collections at 110% of income for testing providers, amounting to roughly a ten% year-over-year uptick.

With shares down 64% over the previous 12 months, Wooden should assume they signify good worth. Wooden purchased 241,234 shares in January by way of the ARK Genomic Revolution ETF. The fund now holds 6,404,090 shares general, at the moment price greater than $96.4 million.

Wooden is evidently a fan and so is Raymond James analyst Andrew Cooper. Assessing the trail forward, Cooper lately wrote: “CareDx stays effectively positioned because the chief in a pretty market and a number of other catalysts are nonetheless on the desk for 2023 (however not in our mannequin) together with AlloSure Lung, AlloMap Kidney, and UroMap protection on high of the flip to EBITDA positivity and eventual combine and collections stabilization (notably after amassing 110% of revenues in 4Q). We consider adjusting our 2023 mannequin akin to how we suspect the corporate will information (which we predict probably proves conservative because the yr performs out) is suitable, and stay snug with our Sturdy Purchase ranking…”

The Sturdy Purchase ranking is accompanied by a $24 worth goal, which is predicted to generate returns of ~60% over the one-year timeframe. (To observe Cooper’s monitor report, click on right here)

Wanting on the consensus breakdown, primarily based on 4 Buys vs. a solitary Maintain, the inventory claims a Sturdy Purchase consensus ranking. Shares are anticipated to vary palms for a hefty 106% premium a yr from now, contemplating the typical goal at the moment stands at $31. (See CareDx inventory forecast)

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is vitally essential to do your individual evaluation earlier than making any funding.