Overview

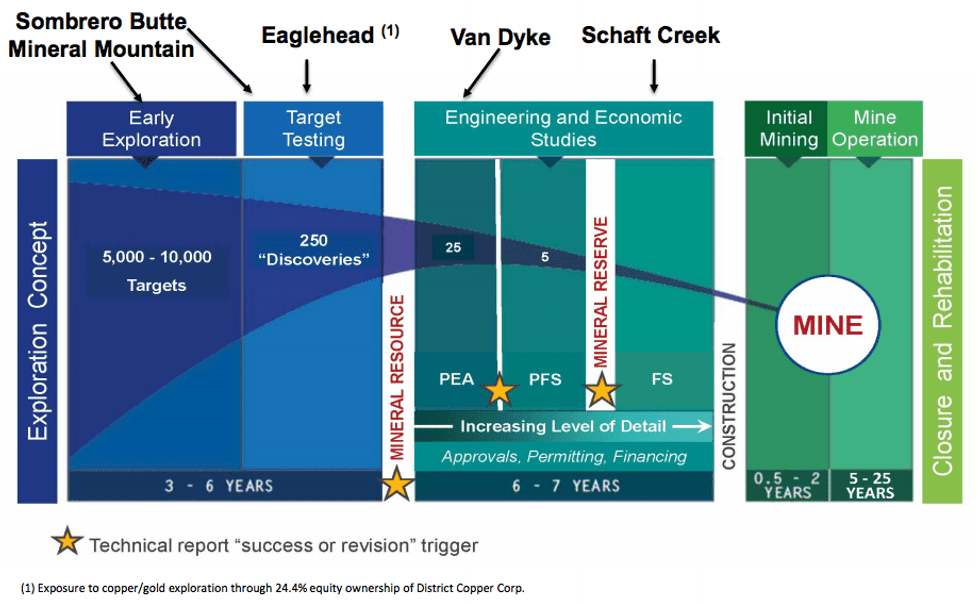

Copper Fox Metals Inc. (TSXV:CUU,OTC Pink:CPFXF) is a Canadian useful resource improvement firm centered on worth creation via the acquisition, exploration and improvement of probably low-cost, giant polymetallic porphyry copper tasks in North America. The corporate holds a 25 p.c carried curiosity within the Schaft Creek three way partnership undertaking with Teck Assets Restricted (TSX:B) in British Columbia and a 100% curiosity in three further tasks within the US.

In keeping with the US Geological Society, copper is the third most consumed industrial metallic on the planet. The crimson metallic is well-known for its excessive ductility and electrical conductivity, making it an necessary a part of the renewable power and electrical car (EV) revolutions. World copper demand reached 23.6 million tons in 2018 and is anticipated to achieve 30 million tons by 2027, in line with an article by Forbes. Nevertheless, analysts are predicting that provide just isn’t going to have the ability to sustain with demand, making it important for brand new tasks to be put into manufacturing.

With this in thoughts, Copper Fox is focusing its efforts on its advanced-stage copper undertaking, extra particularly, the Schaft Creek copper undertaking in British Columbia. The undertaking has a 2013 feasibility examine that outlines a confirmed and possible mineral reserve of 940.8 million tonnes grading 0.27 p.c copper, 0.19 g/t gold, 0.18 p.c molybdenum and 1.72 g/t silver. The feasibility examine forecasts annual manufacturing of 105,000 tonnes of copper, 201,000 ounces of gold, 1.2 million ounces of silver and 10.2 million kilos of molybdenum as soon as the property is put into manufacturing.

The Schaft Creek three way partnership (SCJV) is investigating a 133,000 tonne per day mining state of affairs on the Schaft Creek undertaking. The SCJV has devoted C$2.1 million to trade-off research associated to that mining state of affairs together with a evaluation of the allowing and environmental necessities wanted for the 133,000 tonnes per day state of affairs in addition to new engineering enhancements and accumulating further baseline environmental information.

Subsequent within the firm’s undertaking pipeline is the event of the Van Dyke copper undertaking in Arizona. Copper Fox launched a preliminary financial evaluation (PEA) in November 2015 that returned a number of suggestions for optimizing the undertaking’s economics. In March 2020 the corporate introduced the outcomes of an up to date useful resource estimate for the undertaking that was ready by Moose Mountain Technical Providers. Highlights of the useful resource estimate embody 97.6 million tonnes, grading 0.33 p.c whole copper and 0.24 p.c whole recovered soluble copper containing 717 million kilos of whole copper and 517 million kilos of recoverable soluble copper within the indicated class.

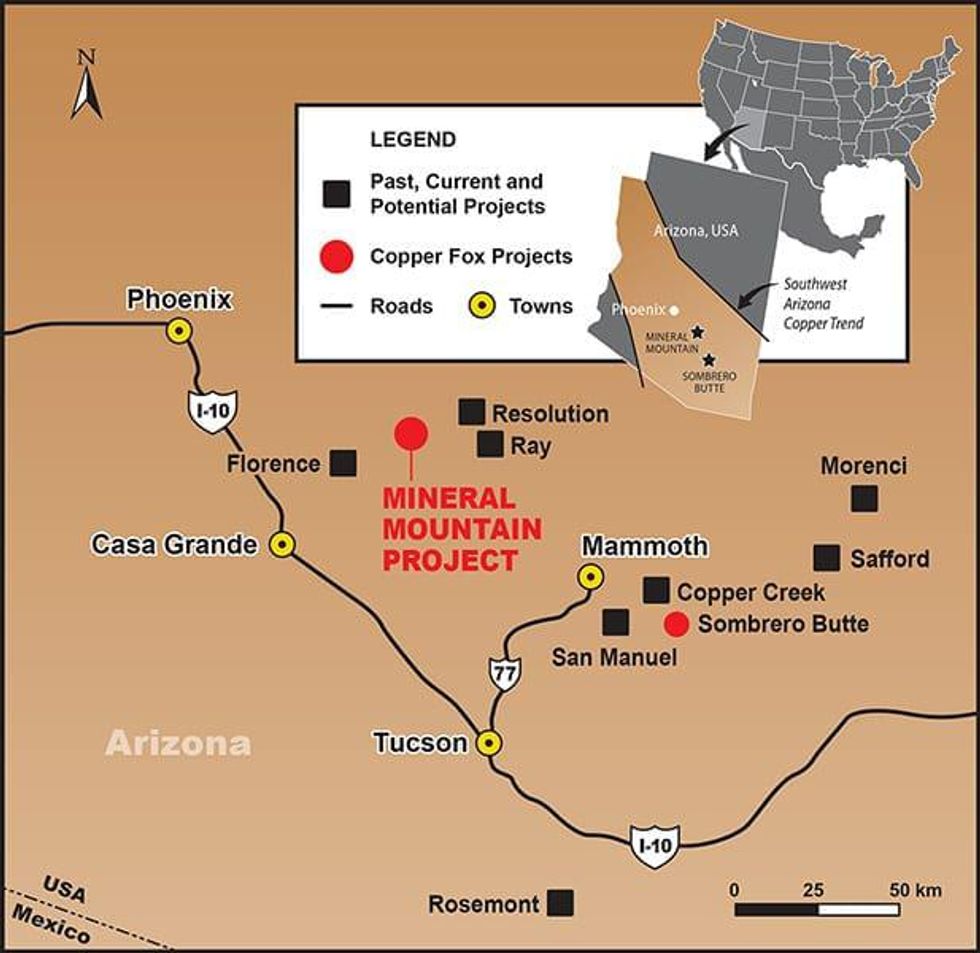

Copper Fox can also be advancing its exploration-stage Mineral Mountain and Sombrero Butte copper tasks in Arizona. Each tasks reside in well-defined main porphyry copper belts in Arizona that host giant porphyry copper deposits, such because the Decision, Ray, San Manuel and Kalamazoo deposits.

Copper Fox additionally owns 24.4 p.c of the issued and excellent shares of District Copper Corp. (TSXV:DCOP), offering its shareholders with publicity to a gold undertaking in Newfoundland. In early 2019, District Copper diversified its undertaking portfolio by buying the Stony Lake gold undertaking in Newfoundland. The corporate additionally owns the Eaglehead copper-molybdenum-gold undertaking in British Columbia, which has just lately been positioned on care and upkeep.

Firm Highlights

- Copper Fox’s focus is on tasks that maximize asset worth per greenback spent.

- Balanced property portfolio starting from exploration to advanced-stage improvement tasks.

- The corporate is targeted on giant, low-cost copper tasks in confirmed copper districts in North America.

- 25 p.c carried curiosity within the advanced-stage improvement undertaking, Schaft Creek. Teck Assets Restricted holds the remaining 75 p.c curiosity within the undertaking and is the undertaking operator.

- Copper Fox has a 100% curiosity within the Van Dyke undertaking, an advanced-stage in-situ leach (“ISL”) copper undertaking.

- The 2020 useful resource estimate at Van Dyke consists of 97.6 million tonnes, grading 0.33 p.c whole copper and 0.24 p.c whole recovered soluble copper containing 717 million kilos of whole copper and 517 million kilos of recoverable soluble copper within the indicated class

- A pre-tax internet asset worth of roughly C$423 million primarily based on NI 43-101 technical stories for the Schaft Creek and Van Dyke deposits.

- Copper Fox owns a 24.4 p.c curiosity in District Copper, offering its shareholders with publicity to an extra copper undertaking in British Columbia and a gold undertaking in Newfoundland.

- Confirmed administration group with the flexibility to develop tasks.

Key Initiatives

Schaft Creek Joint Enterprise Undertaking — British Columbia

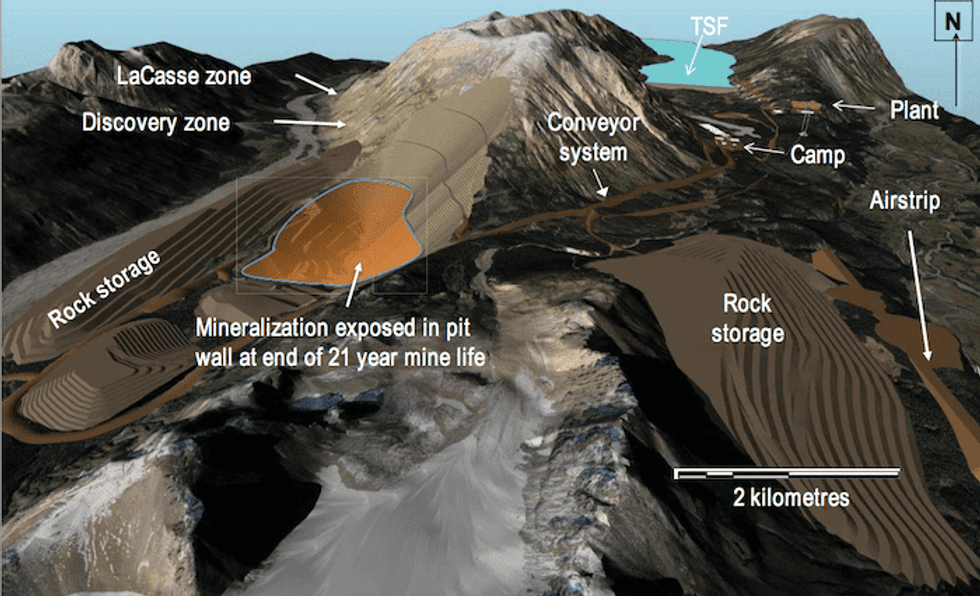

The Schaft Creek undertaking is a complicated stage porphyry copper-gold-molybdenum-silver undertaking in northwest British Columbia. The undertaking contains roughly 55,779.56 hectares within the Cassiar-Liard mining division positioned 278 kilometers from the Port of Stewart, North America’s closest deep-water seaport to China.

In July 2013, Copper Fox and Teck executed a three way partnership settlement whereby Copper Fox holds a 25-percent carried curiosity within the Schaft Creek Joint Enterprise (SCJV) and Teck holds 75 p.c together with operatorship. Since 2013, the SCJV accomplished further geotechnical research, diamond drilling, collected environmental baseline information and an up to date geological mannequin for the undertaking.

First found within the late Nineteen Fifties, Schaft Creek has an intensive exploration historical past together with the completion of 444 drill holes totaling 108,459 meters. The deposit incorporates three mineralized zones: the Liard zone (additionally known as the Principal zone), the West Breccia zone and the Paramount zone.

2013 Feasibility Examine

Copper Fox accomplished a feasibility examine on the property in January 2013. Highlights of the examine embody:

- Preliminary mine lifetime of 21 years at a milling charge of 130,000 tonnes per day – open pit mine at 2:1 strip ratio;

- Preliminary capital price of $3.26 billion, which incorporates contingencies of $374 million;

- Confirmed and possible mineral reserves whole 940.8 million tonnes grading 0.27 p.c copper, 0.19 g/t gold, 0.018 p.c molybdenum and 1.72 g/t silver containing 5.6 billion kilos of copper, 5.8 million ounces of gold, 363.5 million kilos of molybdenum and 51.7 million ounces of silver;

- The NPV and IRR of the undertaking are most delicate to the international change (FOREX) adopted by the worth of copper. A FOREX of C$0.97 and US$1 was used within the feasibility examine;

- One share level change within the FOREX will increase the undertaking NPV by US$75 million (discounted at eight p.c) over the lifetime of mine;

- The undertaking has constructive NPV and IRR;

- 5-year, pre-production interval (consists of allowing, highway, energy line and services development);

- The feasibility examine additionally recognized quite a lot of enhancements that would enhance the economics of the undertaking.

The feasibility examine was primarily based on a confirmed and possible reserve of 940.8 million tonnes grading 0.27 p.c copper, 0.19 g/t gold, 0.18 p.c molybdenum and 1.72 g/t silver, containing 5.6 billion kilos of copper, 5.7 million ounces of gold, 363.5 million kilos of molybdenum and 51.7 million ounces of silver. From this, Copper Fox expects annual manufacturing of 105,000 tonnes (232 million kilos) of copper, 201,000 ounces of gold, 1.2 million ounces of silver and 10.2 million kilos of molybdenum over the lifetime of mine.

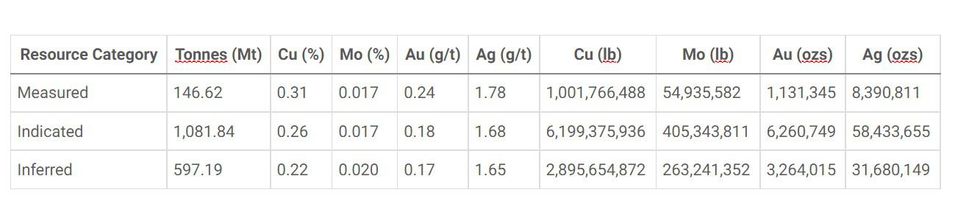

The feasibility examine additionally included a measured and indicated useful resource of 1.2 billion tonnes grading 0.26 p.c copper, 0.017 p.c molybdenum, 0.19 g/t gold and 1.69 g/t silver and an inferred useful resource grading 0.22 p.c copper, 0.016 p.c molybdenum, 0.17 g/t gold and 1.65 g/t silver. The confirmed and possible reserves are included within the measured and indicated assets.

Technical Research

In 2014, the SCJV commenced a sequence of optimization research to advance the undertaking, together with metallurgical, pit slope design, geological modeling and environmental monitoring. Fieldwork performed right now led to the invention of the copper-gold mineralization within the LaCasse zone.

In 2015, the SCJV accomplished research that have been centered on each day throughput charges, mine and infrastructure planning, water administration, updating the useful resource mannequin and tailings storage. Optimization research additionally included a comminution examine to find out energy necessities, milling capability and circuit design, Geomet Unit definition, era of latest Whittle pits and preparation of mine schedules.

The SCJV additionally accomplished re-logging roughly 43,000 meters of drill core from the Schaft Creek deposit. The corporate additionally accomplished floor mapping and geochemical and geophysical surveys on the property that recognized a number of new exploration targets to the north and south of the deposit.

The Conceptual infrastructure of Schaft Creek deposit primarily based on 2013 feasibility examine

The next 12 months, the SCJV used drilling outcomes from 2013 and re-logged drill core data to replace that useful resource mannequin for the Schaft Creek deposit with an emphasis positioned on higher understanding the controls on the copper and treasured metals. In 2017, the SCJV accomplished useful resource transforming, desktop engineering and trade-off research, assortment of environmental baseline information, utilized for a multi-year area-based allow and engaged in social actions with the Tahltan Nation.

The constructive end result of the 2017 work program shaped the premise of the 2018 sizing and infrastructure different examine. The examine investigated 4 sizing situations focusing on capital, working and sustaining price reductions, a higher-grade preliminary starter pit and different methods to enhance undertaking economics. The ultimate report advised {that a} 133,000 tonnes per day state of affairs must be chosen for in-depth examine in 2019.

In 2019, the SCJV devoted C$2.1 million to judge the recognized engineering enchancment choices additional to scale back capital and working prices assuming the 133,000 tonnes per day throughput case. The 2019 program additionally features a evaluation of the location traits of potential revisions to key infrastructure components, equivalent to tailing storage, conveyance methods, ore and waste transport choices and mill location primarily based on a 133,000 tonnes per day throughput case.

Van Dyke Copper Undertaking – Arizona

Copper Fox holds a 100-percent curiosity within the 1,312.8-acre Van Dyke in-situ leach (ISL) copper undertaking. The property is positioned within the Globe-Miami mining district, 90 miles east of Phoenix, Arizona. The district is positioned alongside the Globe-Miami and Casa Grande structural pattern, which hosts the Casa Grande, Florence, Ray, Decision and Globe-Miami copper deposits.

The Van Dyke copper deposit is positioned inside the Globe-Miami mining district, which hosted 4 precept orebodies: Dwell Oak, Thornton, Miami Caved and Miami East. The property was first explored and developed within the early 1900s. Between 1929 and 1945, the Van Dyke property was in manufacturing and reportedly produced 11.8 million kilos of copper with a grade of 5 p.c copper.

2015 PEA and Useful resource Estimate

In January 2015, Copper Fox accomplished a NI 43-101 useful resource estimate for the undertaking reporting an inferred useful resource estimate of 261.7 million tonnes grading 0.25 p.c copper at a 0.05 p.c copper cut-off (estimated 1.44 billion kilos of copper) and accomplished a PEA for the Van Dyke deposit in December 2015.

The 2015 PEA is the primary NI 43-101 engineering technical examine accomplished on the undertaking and means that Van Dyke is a technically sound ISL copper undertaking, utilizing underground entry, typical solvent extraction and electrowinning (SX-EW) restoration strategies with low money prices, robust money flows and an after-tax inner charge of return (IRR) of 27.9 p.c.

2015 PEA Highlights (primarily based on US$3 per pound copper):

- Gross income of US$1.37 billion over 11-year lifetime of mine;

- Cumulative internet free money move after restoration of preliminary capital prices of US$453.1 million earlier than tax and US$342.2 million after-tax;

- Web free money move inside the first six years is roughly US$72 million per 12 months earlier than tax, declining after that;

- LOM direct working price of US$0.60 per pound copper;

- Manufacturing plan of 60 million kilos of copper inside the first six years, declining thereafter;

- Preliminary capital price (together with pre-production prices) totals US$204.4 million, together with contingencies of US$42.4 million;

- LOM soluble copper restoration estimated at 68 p.c with acid consumption of 1.5 kilos of acid per kilos of copper produced;

- After-tax payback of preliminary capital in 3.9 years.

“The PEA has fulfilled its objective and signifies that the undertaking warrants extra detailed testing and engineering,” stated Stewart. “The PEA has recognized a number of facets that, with constructive outcomes from the up to date useful resource estimate together with further testing and engineering, may lengthen the mine life and considerably enhance undertaking economics, indicating that Van Dyke may turn out to be a robust undertaking within the mid-size copper improvement house.”

The 2015 PEA recognized a number of facets of the undertaking that would have a constructive affect on the undertaking’s economics. The report additionally really helpful {that a} pre-feasibility examine must be accomplished to maneuver the undertaking ahead.

Exploration

Between 1968 and 1980, Occidental Minerals Company drilled 70 exploration holes (62 of which encountered measurable copper mineralization) on the Van Dyke property. Forty-six of those have been used to estimate a historic useful resource of 112 million tons at a grade of 0.52 p.c copper. Occidental additionally performed two ISL checks on the Van Dyke oxide copper deposit. Outcomes of Occidental’s ISL checks have been constructive.

In July 2014, Copper Fox accomplished a six-hole (3,211.7-meter) verification diamond drill program on the Van Dyke oxide copper deposit. All six drill holes intersected oxide copper mineralization over broad intervals with the soluble copper concentrations to whole copper focus ratio starting from 73 p.c to 97 p.c. Based mostly on modeling accomplished after the 2014 drilling program, the deposit is interpreted to be open to the west.

In late 2014, Copper Fox introduced the outcomes of in-situ stress leaching checks on samples of the oxide copper mineralization from the Van Dyke deposit. The targets of the take a look at work have been to judge copper dissolution kinetics, whole soluble copper extraction (restoration), acid consumption and to simulate the underground hydraulic stress in an in-situ leaching course of. The take a look at work indicated that roughly 89 p.c of the copper contained within the samples stories as soluble copper with copper extractions averaging 63 p.c over a 120 day leach interval.

In 2019, Copper Fox commenced a program to re-analyze all historic pulp samples and chosen core intervals. The targets of this system have been to outline the complete extent of the soluble copper envelope for the Van Dyke deposit and to replace the geological mannequin for the undertaking. Preliminary outcomes present a 29 p.c enhance in acid-soluble copper focus and thicker mineralized intervals when in comparison with the undertaking’s authentic database.

The outcomes from the analytical program and an up to date geological mannequin type the premise for the up to date useful resource estimate for the Van Dyke deposit. Copper Fox retained Moose Mountain Technical Providers to finish the up to date useful resource estimate, which was launched in March 2020. Highlights from the useful resource estimate embody:

- An indicated useful resource of 97.6 million tonnes, grading 0.33 p.c whole copper and 0.24 p.c whole recovered soluble copper containing 717 million kilos of whole copper and 517 million kilos of recoverable soluble copper

- An inferred useful resource of 168.0 million tonnes, grading 0.27 p.c whole copper and 0.19 p.c whole recovered soluble copper containing 1.0 billion kilos of whole copper and 699 million kilos of recoverable soluble copper

The 2019 re-assay program performed by Copper Fox and up to date geologic interpretation resulted in a major enhance in contained soluble copper inside the Van Dyke copper deposit when in comparison with the earlier 2015 estimate. The mineralized envelope of the Van Dyke copper deposit is open to the south and southwest. Transferring ahead, the corporate intends to proceed to discover the property with a purpose to outline unknown zones of mineralization.

“The 2019 work program has elevated the boldness degree within the undertaking assets and considerably elevated the recoverable soluble copper content material of the Van Dyke deposit. The 2019 evaluation of historic exploration information mixed with the present useful resource estimation, signifies the deposit could possibly be open to the south and southwest with a attainable strike extension of between 1 and a couple of kms. Further drilling might be required to appreciate this potential and to outline the un-explored parts of the Van Dyke deposit,” stated Stewart.

Mineral Mountain Copper Undertaking – Arizona

Copper Fox has 100-percent possession of the 4,905-acre Mineral Mountain copper undertaking positioned east of Florence, Arizona. The Laramide porphyry copper province in Arizona is among the most prolific copper mineralized districts on the planet. The Globe-Miami, Decision, Florence and Casa Grande copper districts are positioned in central Arizona and happen alongside a northeast pattern. The Mineral Mountain copper undertaking is positioned on this pattern between the Florence and Decision copper deposits.

“The invention of latest porphyry copper districts in geopolitically steady areas is key to the way forward for the copper trade,” defined Stewart. “The Mineral Mountain undertaking reveals the floor traits of a buried porphyry copper deposit and supplies Copper Fox appreciable publicity to copper exploration within the Laramide porphyry copper province of Arizona in an simply accessible location.”

Historic Exploration

Historic exploration for the undertaking consists of bulldozed trenching and an Induced potential geophysical survey (1971) accomplished inside a 3,000-foot by 2,000-foot space of copper +/- molybdenite mineralization hosted in a Laramide age quartz monzonite intrusion.

“The evaluation of quite a lot of historic exploration stories has considerably superior our understanding of the property and focussed the 2018 exploration program,” stated Stewart. “The porphyry copper goal is hosted in a Laramide age quartz monzonite, the principle host rock for porphyry copper deposits in Arizona. The valuable metallic targets have been beforehand mined for higher-grade gold-silver-base metallic mineralization. Based mostly on our evaluation, the realm doesn’t seem to have been explored for lower-grade treasured metallic mineralization.”

Ongoing Exploration

Between 2015 and 2018, Copper Fox recognized two giant areas of porphyry-style copper-molybdenum-gold mineralization on the property. The primary goal referred to as Space 1, hosts roughly 600 copper showings in outcrops over a 4,500-meter-long by as much as 2,000-meter-wide space in that portion of the quartz monzonite inventory alongside the contact with the Precambrian Pinal schist. The first copper minerals are malachite, chrysocolla, chalcocite in addition to uncommon covellite and chalcopyrite happen as disseminations, in quartz veinlets and alongside fractures primarily hosted in potassic and phyllic-altered Laramide age quartz monzonite. Inside the space of copper mineralization, three zones of disseminated copper-molybdenum mineralization happen; the biggest of which measures roughly 1,000 meters lengthy by 350meters to 450 meters large with concentrations of as much as 0.2 p.c molybdenum. The copper mineralization correlates with a constructive chargeability and resistivity anomaly (1,800 meters by 900 meters) outlined in 1971. The molybdenite mineralization (“B” veins – porphyry terminology) and spatial distribution of the totally different types of copper mineralization counsel an outward development from the core of a porphyry system.

The copper mineralization in Space 2 happens over an space that measures 2,800 meters lengthy, averages 400 meters large and is characterised by quartz vein and fracture-controlled copper mineralization in Laramide age dikes and Precambrian age Pinal schist, diabase and granite. The copper mineralization in Space 2 incorporates considerably decrease concentrations of molybdenum than Space 1. The decrease molybdenum concentrations and totally different types of copper mineralization are interpreted to mirror the depth to the potential porphyry inventory.

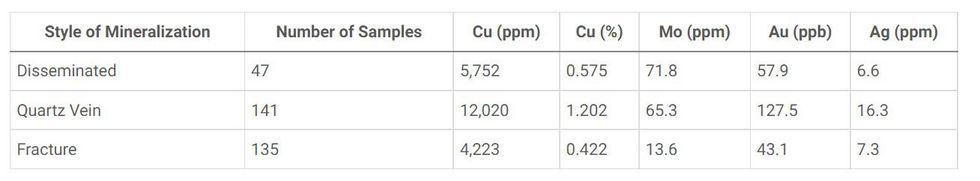

The common metallic concentrations of the three types of copper mineralization in Space 1 and Space 2 are proven beneath.

Common Focus

The 2018 rock chip sampling program was accomplished over the 2 goal areas to characterize the mineralized buildings uncovered in outcrops. The sampling program returned values of as much as 10.38 p.c copper and 0.208 p.c molybdenum in Space 1.

Sombrero Butte Undertaking – Arizona

The two,913-acre Sombrero Butte undertaking is positioned within the Bunker Hill mining district within the Laramide porphyry copper province in Arizona; one of the prolific copper mineralized districts on the planet. The undertaking is positioned on a pattern that hosts giant porphyry copper deposits such because the San Manuel-Kalamazoo, Ray and Copper Creek deposits. The area is a well known mining jurisdiction with wonderful and available infrastructure. The property is 100-percent owned by Copper Fox. Through the early 1900s, copper mining actions have been performed inside the property with Magma Chief being the biggest mine within the district.

Exploration Actions:

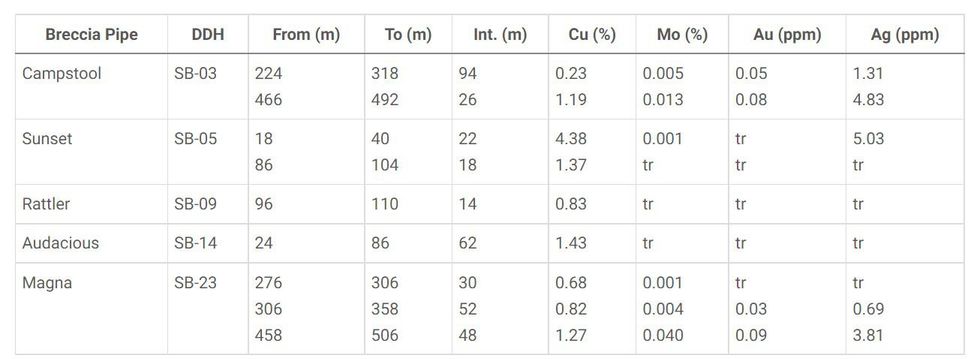

Mineralized breccia pipes generally characterize the floor expression of buried porphyry copper deposits in Arizona. Between 2006 and 2008, Bell Copper Corp. (TSXV:BCU) accomplished 34 diamond drill holes testing seven mineralized breccia pipes positioned on the north finish of the property. This program yielded vital copper mineralization. Chosen mineralized intervals from the Bell Copper drilling are listed beneath:

The mineralized intervals listed within the above desk don’t characterize true widths.

Copper Fox bought the undertaking in 2012 and accomplished floor exploration which recognized two floor exploration targets.

Copper Fox commissioned a Titan-24 DCIP survey in July 2015, and the outcomes of the IP survey assist the interpretation of the presence of a buried porphyry copper system. The chargeability signature reveals a robust constructive correlation with the alternation, mineralization and copper-molybdenite geochemical anomalies outlined in 2013 in addition to the mineralized breccia pipes and historic drill outcomes.

Two giant porphyry copper targets have been recognized on the property. On the south finish of the property a 2,000-meter-long porphyry copper goal consisting of copper-molybdenum geochemical anomalies, copper-molybdenite veins, related potassic and argillic alteration, pyrite veining (now limonite) and 40 mineralized breccia pipes, of which solely six have been drill examined. Inside this goal, no less than 12 breccia pipes present intense dickite alteration—an indicator mineral of superior argillic alteration, an alteration that happens in lots of the area’s porphyry copper deposits, together with BHP Group PLC’s (LSE:BHP) San Manuel-Kalamazoo deposit.

Copper Fox launched the outcomes of a examine accomplished in October 2016 on the chemistry of six hydrothermal breccia pipes inside an space that measures 300 meters by 400 meters on the north finish of the Sombrero Butte undertaking. The remaining 18 hydrothermal breccia pipes on the north finish of the property and hydrothermal breccia pipes positioned within the heart of the property weren’t included within the examine because of the lack of geochemical information.

“This examine helps the presence of a buried porphyry system and exhibits that the breccia pipes acted as a pathway for a posh multi-phase introduction of metals,” stated Stewart. “Along with the pipes that comprise vital concentrations of copper-molybdenum-gold-silver mineralization, the underside 500-meter interval of diamond drill gap SB-23 is interpreted to have intersected the outer portion of a porphyry system generally known as a ‘pyrite shell.’ The truth that the 2015 Titan-24 DCIP survey mapped the mineralized breccia pipes has superior our interpretation of different chargeability anomalies inside the property.”

The 2016 examine centered on hint components, equivalent to molybdenum, gold, silver, arsenic, antimony and tungsten, components which might be generally related to a porphyry copper system. Whereas analytical outcomes for copper have been beforehand introduced by Bell Copper, the outcomes for molybdenum-gold-silver and related components had not been beforehand introduced.

A mapping and sampling program is deliberate to begin within the close to time period on the Sombrero Butte property. This system is anticipated to concentrate on the floor expression of the big chargeability and resistivity anomaly positioned within the south-central portion of the property. Copper Fox is searching for vein sorts, alteration and distribution of copper-molybdenite mineralization on this space.

District Copper Funding

Copper Fox owns 24.4 p.c of the issued and excellent shares of District Copper (previously Carmax Mining Corp.). Trying to capitalize on the rising gold costs, District Copper picked up belongings within the gold exploration house in 2018. District Copper now has two properties in its portfolio: the Stony Lake gold undertaking and the Eaglehead copper-molybdenum-gold-silver undertaking.

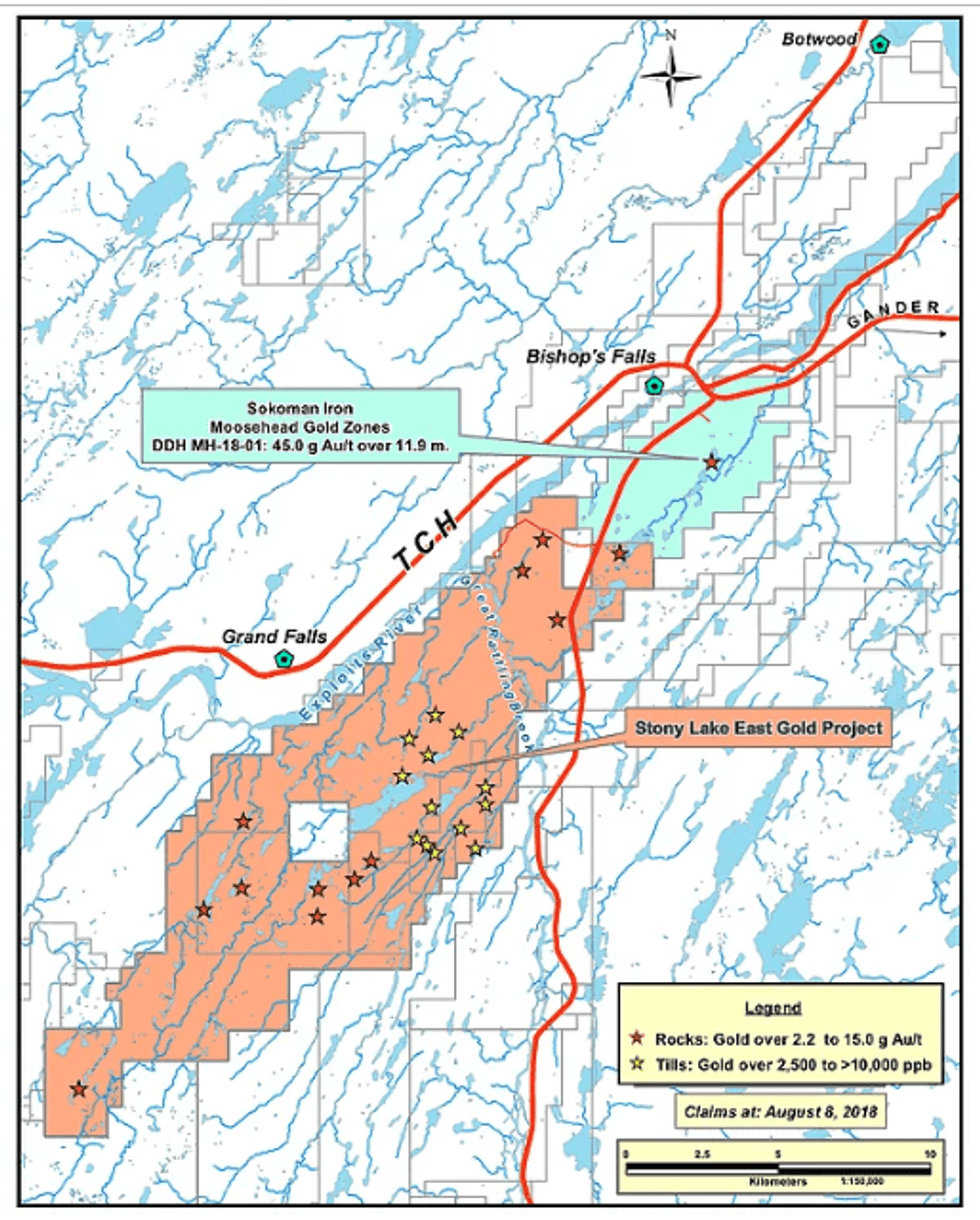

Stony Lake Undertaking – Newfoundland

The 13,025-hectare Stony Lake gold undertaking covers a 27-kilometer portion of the Cape Ray-Valentine Lake Structural pattern in central Newfoundland. This space is a part of Canada’s latest rising orogenic gold district. The area hosts a number of latest high-grade gold discoveries together with Sokoman Iron Company’s Moosehead discovery, Antler Gold Inc.’s (TSXV:ANTL) Twilight zone and Marathon Gold Corp.’s (TSX:MOZ) Valentine Lake gold deposit. The Stony Lake property is positioned between the Twilight and Moosehead discoveries.

Following the acquisition of the Stony Lake undertaking, District Copper expanded the scale of the Stony Lake undertaking by buying the Duffitt and Island Pond gold tasks that are contiguous with or adjoining to the Stony Lake undertaking.

Exploration

In 2019, prospecting and sampling (286 samples) and mapping of lithologies, alterations, and types of mineralization was accomplished. Chosen samples have been collected from outcrop, sub crop and enormous angular boulders (near bedrock) to characterize the valuable and base metals and hint ingredient geochemistry current in veins, different mineralized buildings and outcrops.

An airborne geophysical survey was accomplished in August 2019. The compilation and interpretation of the geophysical outcomes are in progress.

The 2019 program outlined eight areas of anomalous to low-grade gold mineralization (larger than 50 to 4,026 ppb). The gold mineralization is hosted in pyrite and arsenopyrite bearing quartz-feldspar porphyry, decreased sandstone, quartz stockwork and quartz veins, characterised by various intensities of sericite, silica, ankerite, carbonate and chlorite alteration usually as pervasive alteration and envelopes round quartz stockwork, quartz veins. The mineralization reveals arsenic-antimony-molybdenum geochemical associations.

The parameters that characterize the anomalous to low-grade gold mineralization positioned on the Stony Lake property counsel the potential for a sediment-hosted intrusion-related gold atmosphere. Sediment-hosted intrusion-related gold mineralization is characterised by faulted and folded siliciclastic rocks, granitic intrusions, regional-scale faults, sericite with late carbonate alteration, mineralization hosted in sheeted veinlets, stockwork, disseminated and vein swarms with gold, silver, bismuth, tungsten and molybdenum geochemical associations.

The zones of anomalous to low-grade gold mineralization are positioned alongside an interpreted northeast-southwest trending hall positioned within the western facet of the property. Sampling to the west and east of the interpreted hall returned low (lower than 20 ppb gold) concentrations of gold. It’s anticipated that the outcomes of the airborne survey ought to present perception into the structural management if any of those areas of anomalous to low-grade gold mineralization.

Eaglehead Undertaking—British Columbia

The 15,956-hectare Eaglehead copper-molybdenum-gold-silver undertaking is positioned within the Laird mining district in northern British Columbia. The undertaking is at the moment on care and upkeep.

Exploration

Between 2014 and 2018, District Copper re-logged 94 historic diamond drill holes, accomplished airborne and floor geophysical surveys, preliminary rock characterization take a look at work and drilled six holes to check the continuity of the East, Bornite and Cross zones. The corporate additionally sampled, re-sampled and re-analyzed 22,697 meters of drill core from 99 historic drill holes. In 2018, District Copper accomplished the re-logging, sampling and resampling work required to get rid of “legacy information” points regarding the Eaglehead undertaking.

In 2017, Copper Fox launched a NI 43-101 technical report on the Eaglehead undertaking. The report really helpful that C$4.95 million is warranted to judge the potential of the undertaking.

Preliminary Metallurgical Testing

Preliminary flotation take a look at work on mineralization from the Eaglehead deposit signifies about 88 p.c copper, 74 p.c gold, 72 p.c silver and a minimal of 55 p.c molybdenum recoveries right into a clear 28-36 p.c copper focus.

Administration Group

Elmer B. Stewart, P.Geol, MSc. – Chairperson of the Board, President and CEO

Elmer Stewart has over 42 years of home and worldwide expertise in mining and exploration for gold, uranium, base metals and copper. Throughout his profession, he has been concerned within the financing and acquisition of quite a lot of base metallic and gold tasks as properly the event and development of two underground mines and the development and operation of three open pit gold mines. With roughly 30 years of expertise on the senior administration degree for numerous firms listed on the TSX and TSXV, he’s at the moment the Chairman, CEO and President of Copper Fox Metals Inc., Chairman of District Copper Corp. and is a Director of Liard Copper Mines Ltd. Stewart is Copper Fox’s consultant on the Administration Committee for the Schaft Creek Joint Enterprise

Braden Jensen, CA, B.Comm. – Chief Monetary Officer

Braden Jensen is a chartered accountant with a bachelor of commerce diploma from the College of Victoria. Jensen started his profession and coaching with KPMG LLP. He was within the public follow sector for six years, concentrating in commodities-based accounting and tax previous to coming into the useful resource sector the place he has been answerable for reporting on exploration and operations.

Hector MacKay-Dunn, Q.C. – Director

Hector MacKay-Dunn is a Senior Associate at Farris, Vaughan, Wills & Murphy LLP the place he advises non-public and public high-growth firms in a broad vary of industries on home and cross-border non-public and public securities choices, mergers and acquisitions, tender gives and worldwide partnering transactions. MacKay-Dunn is acknowledged by Lexpert, a revered Canadian authorized publication, as being among the many high 100 Canada/US cross-border company attorneys in Canada and amongst Canada’s main attorneys in mergers in acquisitions, know-how and biotechnology. Appointed Queen’s Counsel in 2003, he holds the best (AV Pre-eminent) authorized capability ranking from Martindale-Hubbell, an authoritative and world supply for figuring out main attorneys and regulation companies, and the Greatest Attorneys in Canada ranks him as a nationwide chief in know-how and biotechnology.

Michael Smith – Director

Michael Smith has been a director of Copper Fox Metals since September 2004 and was Govt Vice-President till his retirement in September 2013. Smith had a 38-year banking profession with RBC Royal Financial institution, holding senior administration positions in Calgary, Edmonton, Montreal and New York. Mr. Smith is at the moment a Director and a member of the Audit Committee for Copper Fox, a Director and Chairman of the Audit Committee for District Copper in addition to a Director and Treasurer of a registered public charity.

Ernesto Echavarria, CPA – Director

Ernesto Echavarria is a Licensed Public Accountant and has in depth expertise each on the government and board ranges of enormous firms. He’s a major investor with quite a lot of main firms in Mexico together with MegaCable Holding Sab, a controlling shareholder, and is an government and Director of Franks Distributing, a significant worldwide distributor of vegetables and fruit. Echavarria can also be an investor and Director of quite a few different entities, together with mining firms.

Erik Koudstaal, CA – Director

Erik Koudstaal is a Canadian Chartered Accountant and a retired companion of Ernst and Younger. His accounting profession spans 40 plus years in The Netherlands, Canada, Africa (Nigeria), Asia (Singapore), Europe (Spain) and america. Koudstaal retired from Ernst and Younger’s New York Worldwide workplace in 2001. His multinational purchasers have been in pure assets, banking, manufacturing and know-how. Since retiring, he has been a monetary marketing consultant and a Board Member (Treasurer) of two organizations. In January 2008, Koudstaal accomplished the Governance Necessities Program for Administrators (not-for-profit) on the Institute of Company Administrators and the Rotman Faculty of Administration, College of Toronto.