Pull quotes had been offered by Investing Information Community purchasers Vitality Fuels, Discussion board Vitality Metals and Purepoint Uranium Group. This text shouldn’t be paid-for content material.

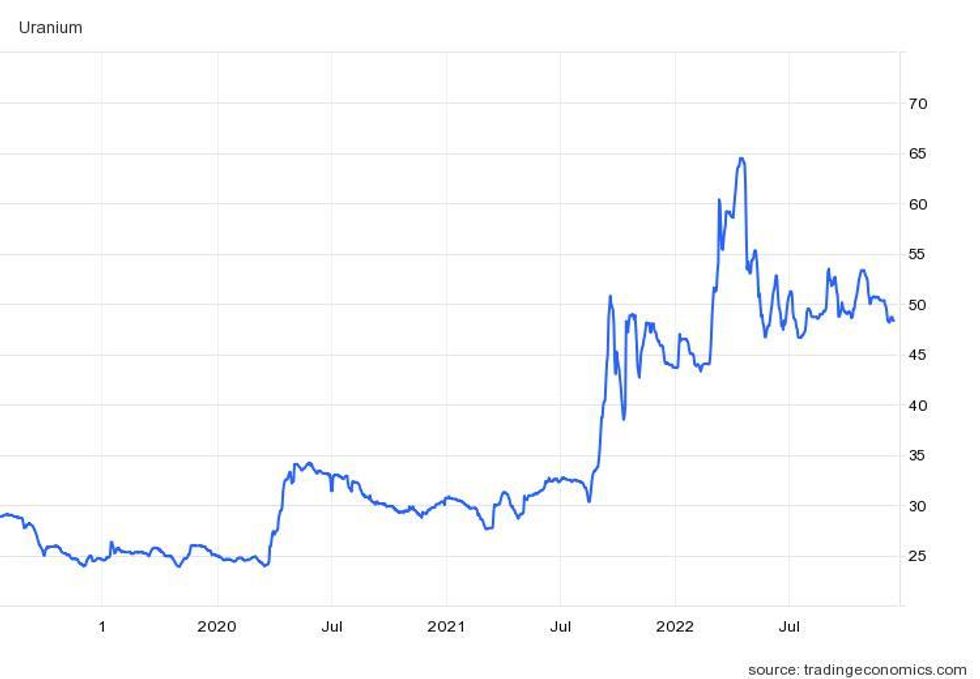

After years of worth stagnation, uranium has grow to be a breakout performer, climbing 164 % from January 2020 to an 11 yr excessive in April 2022 on the again of the inexperienced transition and considerations about vitality safety.

These components allowed uranium to carry firmly above US$48 per pound for almost all of 2022, however like most commodities it is nonetheless going through challenges. Sky-high inflation and steadily rising rates of interest shaved off a few of uranium’s upside potential in 2022; nevertheless, the market has seen help from provide considerations and different components.

With 2023 shortly approaching, the Investing Information Community (INN) requested specialists about their expectations for uranium within the subsequent 12 months. Learn on to study what they needed to say concerning the business.

2022 units stage for bullish 2023 for uranium

Wanting first at 2022, the market contributors INN spoke to emphasised uranium’s constructive worth motion.

“Uranium — like lithium — has probably the most bullish fundamentals, coupled with bipartisan help globally,” mentioned Gerardo Del Actual, founding father of Junior Useful resource Month-to-month and Junior Useful resource Dealer. “Each suffered from years of underinvestment and each now get pleasure from surging demand that received’t have the ability to be introduced on-line quick sufficient at present costs.”

Uranium and lithium are among the many only a few commodities which have posted annual positive factors this yr, attaining upward momentum regardless of the financial upheaval that has weighed on markets for almost all of the calendar yr.

U3O8 spot worth efficiency, 2019 to 2022.

Chart by way of TradingEconomics.

For Lobo Tiggre, founding father of IndependentSpeculator.com, uranium’s transfer was solely a matter of time. “I believe this was going to occur anyway, as a result of the world’s largest producers reduce their output and BRICS international locations (Brazil, Russia, India, China and South Africa) are constructing nuclear energy crops as quick as they’ll — however the battle has accelerated the pattern,” he instructed INN.

Russia’s late February invasion of Ukraine despatched the nuclear gasoline market into overdrive as all three key segments — U3O8 provide, together with conversion and enrichment companies — noticed worth development. “With the New Iron Curtain slicing off Russian vitality, the writing is on the wall, and it’s very bullish for uranium costs,” Tiggre commented.

Ukraine homes 15 operational nuclear reactors and 4 energy crops that generate half the nation’s electrical energy, and Russia’s takeover of the Zaporizhzhia plant created some considerations about potential injury. Nonetheless, each Tiggre and Del Actual emphasised that the plant’s resilience is a constructive signal.

“The actual story is that regardless of the shelling of the Ukrainian energy plant it has held up remarkably properly and carried out higher than anticipated,” Del Actual mentioned. “The uranium fundamentals are as bullish as I’ve ever seen them.”

Provide safety will proceed to take middle stage

Procurement is a vital factor of vitality safety, and uranium provide is anticipated to remain in focus in 2023.

For the time being, nuclear energy generated on the 438 reactors globally produces 10 % of the world’s electrical energy, and that quantity is forecast to rise considerably over the following decade as about 60 new reactors come on-line.

There are one other 96 reactors presently within the planning section.

Securing regular provide of uranium that may be processed into nuclear gasoline is particularly important to the vitality transition, based on John Ciampaglia, CEO of Sprott Asset Administration.

“The 434 odd reactors require about 180 million kilos of uranium every yr for his or her gasoline inventory,” he mentioned in November. “Main manufacturing is about 130 million kilos, and subsequent yr it is going to most likely go to 140 million to 145 million kilos.”

He went on to clarify that the deficit can solely be shored up with extra mined provide. Nonetheless, with inflation driving prices up in all places, uranium’s worth positivity could solely be sufficient to restart shuttered tasks — not construct new mines.

“The prices have gone up considerably,” he mentioned. “We predict the associated fee — or the value that you’d must see in uranium to incent improvement of any new greenfield venture — is someplace between US$75 and US$100.”

Over the last uranium bull market greater than a decade in the past, traders watched the spot worth climb greater than 1,800 %, rising from US$7 in December 2000 to an all-time excessive of US$140 June 2007. This time round, the market has extra fundamentals in its favor which are encouraging sustained worth development.

One of the promising is the necessity for clear, uninterrupted vitality. Whereas photo voltaic and wind vitality are thought of inexperienced, they’re prone to precarious climate conditions, which have gotten extra frequent.

“If you concentrate on how dependable every of those totally different types of vitality is, nuclear is the best at 92 %,” the CEO mentioned. “That signifies that 92 % of the time, in case you’re operating a nuclear energy plant, it’s producing electrical energy.”

Then again, that quantity drops to 42 % when speaking about hydroelectric energy, and falls to 35 % for wind and solely 25 % for photo voltaic. “Low greenhouse fuel emissions are essential, however reliability is equally essential,” Ciampaglia mentioned.

Extra uranium M&A exercise doubtless within the yr forward

Uranium specialists can even be watching M&A exercise in 2023 within the wake of a number of essential 2022 offers.

One of the memorable bulletins this previous yr was the October information that Cameco (TSX:CCO,NYSE:CCJ) and Brookfield Renewable Companions (TSX:BEP.UN,NYSE:BEP) will purchase Westinghouse Electrical Firm.

The large US$7.8 billion association will see Cameco, one of many largest uranium producers globally, take a 49 % controlling curiosity in “one of many world’s largest nuclear companies companies.”

Earlier within the yr, Uranium Vitality (NYSEAMERICAN:UEC) acquired Canada-listed UEX in a bid to “create the biggest diversified North American targeted uranium firm.” The acquisition marked the second main transfer from Uranium Vitality in below 12 months — in December 2021, the corporate acquired Uranium One Americas.

“There’s an rising pattern by Western utilities to safe provides from uranium tasks in politically secure and confirmed jurisdictions. It is a sturdy match with UEC’s permitted, and production-ready US ISR tasks and intensive development pipeline in Canada,” mentioned Amir Adnani, president and CEO of Uranium Vitality.

Optimistic demand fundamentals, together with uranium’s worth stability within the face of sturdy headwinds, are prone to end in extra sector offers, defined Junior Useful resource Month-to-month’s Del Actual. “I count on extra M&A as firms with higher property merge to place themselves to maximise positive factors from the approaching uranium mania I see creating,” he mentioned.

Whereas these offers could also be excellent news for the North American uranium sector, Tiggre inspired warning.

“The consolidation provides speculators fewer firms to trace — however every firm that’s grown by way of acquisitions has grow to be extra difficult to investigate,” he mentioned. “I’m particularly cautious of firms that may now boast very massive uranium assets within the floor, however don’t current a compelling worth proposition because of the high quality of the property they purchased. Purchaser beware.”

Because the uranium market fees forward, he anticipates extra offers down the street.

“There may simply be extra consolidation among the many juniors, however that doesn’t essentially create worth,” Tiggre mentioned. “The builders that ship worthwhile new mines, nevertheless, are clear takeover targets that would ship outsized capital positive factors.”

How excessive can uranium costs go in 2023?

Simply how excessive uranium costs will go through the present bull market stays to be seen.

As talked about, over the past bull section, costs went up over 1,800 %, rising from US$7 in December 2000 to an all-time excessive of US$140 June 2007. The earlier cycle, which ran from 1973 to 1978, noticed values rise 629 % over 5 years.

“I count on the uranium worth to overshoot to the US$200 degree earlier than settling again to decrease triple digits,” Del Actual mentioned.

Though the demand outlook is vivid, Tiggre sees the value making a extra staggered advance. “I count on a unstable however persistent climb greater, with smaller spikes attainable alongside the way in which. Then, the market ought to settle at a worth that incentivizes sufficient mine provide,” he mentioned. “That is likely to be round US$60 to US$70 at present, however would should be adjusted for inflation going ahead.”

By way of what the Impartial Speculator will probably be anticipating within the sector within the yr forward, he pointed to long-term contracting from utilities firms.

“Costs for these contracts are sometimes not disclosed at signing, however we should always have the ability to work them out, in mixture, from producers’ monetary studies sooner or later,” Tiggre defined. “This has already began. Until I’m very a lot mistaken, 2023 ought to be a fair higher yr for uranium than 2022 has been.”

Extra broadly, Del Actual sees 2023 as a breakout yr for various commodities.

“The lithium and uranium areas stay the 2 commodities I see having the very best 2023 — however don’t underestimate a speedy rerating of high quality gold firms because the gold worth regains its standing as not only a wealth preserver, however a solution to develop wealth,” he mentioned, whereas additionally mentioning copper. “2023 ought to be one for the books for many commodities,” Del Actual concluded.

Don’t overlook to observe us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the knowledge reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

From Your Web site Articles

Associated Articles Across the Net