I am happy with how the portfolio has formed up over the past couple weeks. Of our 8 present positions, 6 are winners, one is breaking even, and one is a small loser. A number of of the shares have been in an uptrend as nicely. In the interim, we’ll (possible) concentrate on smaller adjustments akin to trimming or including to positions. We’re at about 70% allocation of our money, which I feel is cheap on this atmosphere. Issues can change in a rush in fact, however I am content material with the combo of shares we’ve within the portfolio right now. Let’s check out what is going on on within the S&P 500 (SPY) week. Learn on for extra….

(Please take pleasure in this up to date model of my weekly commentary initially printed June 8th within the POWR Shares Below $10 e-newsletter).

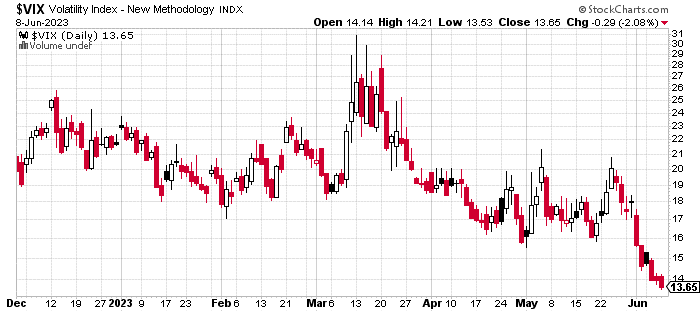

Market volatility has actually come crashing down for the reason that debt ceiling scare ended with hardly a whimper. We’re seemingly experiencing the summer season buying and selling doldrums, the place not a lot occurs within the inventory market from a macro perspective.

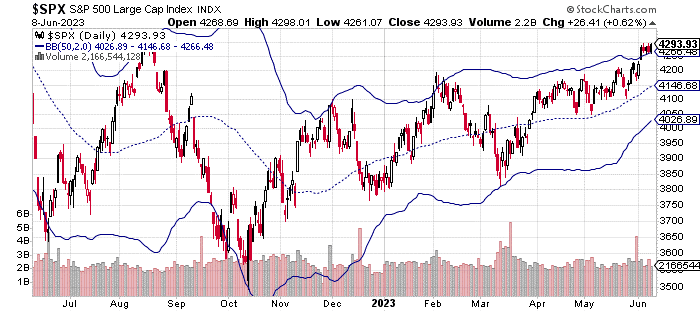

You may see within the chart above, the SPX (S&P 500 index) has breached the two-standard deviation higher barrier.

That does not essentially imply shares are going to unload because the bands are fairly slim as a result of a decrease volatility atmosphere. Nevertheless, imply reversion is a positively risk within the coming days (simply as a result of regulation of averages).

Whether or not the market stays on this low volatility atmosphere will largely be decided by what the Fed says and does on the June and July FOMC conferences.

We’ve the June assembly coming subsequent week after which it will not be a shock to see a complete lot of nothing within the markets till after Independence Day.

The market continues to foretell a pause in charge hikes for June. The futures market exhibits a 72.5% probability of the Fed doing nothing to charges subsequent week.

Financial information has been blended to the purpose the place the Fed can possible justify not rising charges (straight). In fact, they will accomplish a few of their targets by jawboning (e.g. speaking down the market).

In July, futures are displaying a roughly 65% probability of a charge enhance. That tracks with the mainstream narrative.

It has grow to be obvious that the Fed is not performed elevating charges. Nevertheless, at this stage, they are not in as a lot of a rush to hike.

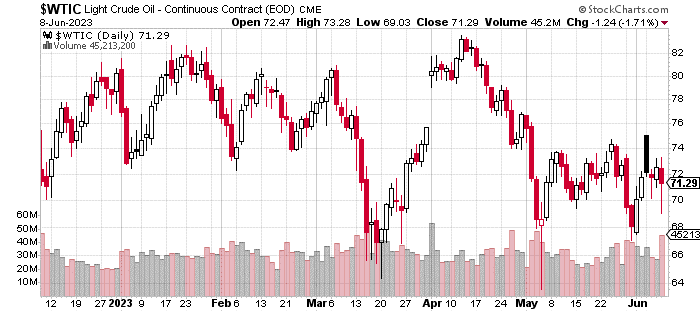

Shifting on to grease, West Texas crude has been a bit unstable these days. Saudi Arabia introduced manufacturing cuts, and the value of crude briefly spiked. Nevertheless, it is come again all the way down to round $70 per barrel.

Regulate oil because it could possibly be a number one indicator for the financial system (and thus, shares). A value too excessive or too low is mostly not good for shares (for various causes). Nevertheless, the place we are actually when it comes to value is just about a non-factor.

As talked about earlier, volatility, as seen within the VIX chart beneath, has come crashing down in current days. The worth is now firmly beneath 15, which is usually thought-about a low-volatility regime.

Whereas we might see a short-term spike primarily based on the information cycle or the Fed, I count on volatility to stay comparatively low.

The summer season months are typically slower when it comes to realized volatility (the precise motion of shares). Thus, implied volatility (ahead wanting) tends to return down as nicely. That is at the least a part of why the VIX is so low proper now.

Let’s check out the portfolio.

What To Do Subsequent?

The above commentary will assist you to admire the place the market goes. However if you wish to know one of the best shares to purchase now, then please try my new particular report:

3 Shares to DOUBLE This 12 months

What provides these shares the fitting stuff to grow to be huge winners, even on this difficult inventory market?

First, as a result of they’re all low priced corporations with probably the most upside potential in right now’s unstable markets.

However much more necessary, is that they’re all prime Purchase rated shares in line with our coveted POWR Scores system and so they excel in key areas of development, sentiment and momentum.

Click on beneath now to see these 3 thrilling shares which might double or extra within the yr forward.

3 Shares to DOUBLE This 12 months

All of the Greatest!

Jay Soloff

Chief Progress Strategist, StockNews

Editor, POWR Shares Below $10 Publication

SPY shares rose $0.19 (+0.04%) in after-hours buying and selling Friday. 12 months-to-date, SPY has gained 12.84%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Jay Soloff

Jay is the lead Choices Portfolio Supervisor at Traders Alley. He’s the editor of Choices Flooring Dealer PRO, an funding advisory bringing you skilled choices buying and selling methods. Jay was previously an expert choices market maker on the ground of the CBOE and has been buying and selling choices for over 20 years.

The publish How Decrease Volatility and Oil Manufacturing Cuts Might Impression the Market… appeared first on StockNews.com