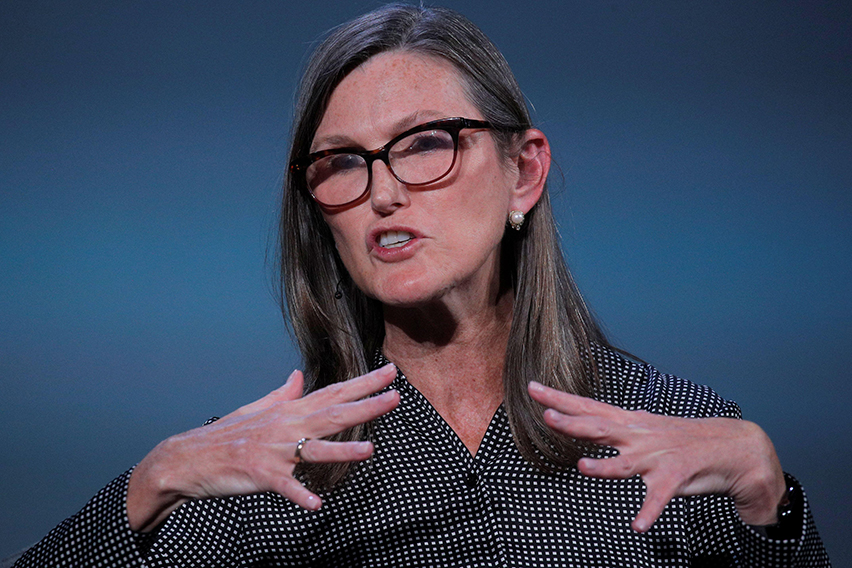

Not way back thought-about a trailblazing investing guru, sentiment has fully shifted round Cathie Wooden over the previous 12 months and a half. Her ARK Make investments fund’s ARK Innovation ETF is loaded with growth-oriented pandemic-era winners however as anybody following the inventory market’s trajectory will know, the tables have turned on shares of that ilk. And the result’s that the ARKK ETF is now down by an enormous 65% in 2022.

Does that imply Wooden is able to desert her technique of backing progressive but dangerous and infrequently unprofitable names searching for safer havens? No, is the quick reply.

Wooden not solely factors out that ARKK shares have been rising at a sooner tempo than these of the Nasdaq 100 – ~31% income progress year-over-year vs. ~16% progress within the trailing 4 quarters as of the tip of Q2 – and so have the “added wherewithal to accommodate investments sooner or later.”

“Nonetheless,” says Wooden, “the market is paying little for what we consider is superior progress potential.”

And towards a backdrop of rising rates of interest which have diminished the present worth of future money flows, the worth of “pure-play innovation methods” has declined by 50-90% over the previous 18 months, a flip of occasions through which the “fairness markets appear to have bowed to GAAP EBITDA and shifted towards defensive low-growth methods.”

However Wooden thinks that’s the fallacious solution to go about investing and that the tides will flip once more.

“We consider GAAP EBITDA falls quick when measuring the longer-term progress and profitability profile of early stage, quickly rising, progressive firms,” she mentioned. “In our view, the long-term profitability and fairness efficiency of so-called ‘profitless tech’ firms will dwarf these of firms which have catered to short-term oriented shareholders with share repurchases and dividends, on the expense of investing sooner or later.”

Is Wooden proper? Solely time will inform. Within the meantime, we’ve determined to try the fund’s prime two holdings to see why she’s so assured they’re long-term winners. We’ve additionally opened up the TipRanks database to search out out whether or not the Avenue’s specialists are in settlement. Let’s examine the outcomes.

Zoom Video Communications (ZM)

Taking the primary spot and accounting for 9.36% of the ARKK ETF with a worth of greater than $605 million is that almost all pandemic-era of shares, Zoom Video Communications.

You don’t should be an avid follower of the inventory market to know the Zoom story. A distinct segment video conferencing product on the onset of the Covid-19 pandemic, with the arrival of world lockdowns, it shortly became a ubiquitous software utilized by tens of millions worldwide – from companies to households to training our bodies. Consequently, the inventory soared to unimaginable heights throughout 2020, however as has occurred to so many, the comedown has been vicious. Shares sit 90% under the highs of October 2020 and have shed 64% this 12 months.

That mentioned, the corporate’s most up-to-date report for the third fiscal quarter (October quarter) was an honest one. Income got here in at $1.1 billion, representing a 4.8% year-over-year enhance and assembly Avenue expectations. On the bottom-line, adj. EPS of $1.07 beat the analysts’ forecast of $0.83.

The variety of prospects contributing over $100,000 within the trailing 12 months income – an vital metric signifying the product’s reputation with massive companies – elevated by 31% from the identical interval a 12 months in the past. Nonetheless, the outlook fell wanting expectations and the shares drifted south following the print as has been the case all through most of 2022.

However, whereas MKM analyst Catharine Trebnick believes the corporate might want to show its credentials within the present local weather, she stays upbeat round its long-term potential.

“Within the troublesome near-term macro surroundings, administration might want to present robust execution on new options and go-to-market initiatives to compete successfully and stabilize the On-line enterprise. Long run, we proceed to consider that the corporate’s positioning in a big and underpenetrated market alternative can drive sustainable progress in a normalized surroundings,” Trebnick opined.

Trebnick’s confidence is conveyed by a Purchase score and a $100 value goal. As such, the analyst sees shares climbing 53% increased over the approaching 12 months. (To observe Trebnick’s monitor document, click on right here)

Most on the Avenue, nevertheless, will not be fairly as assured as Trebnick or Wooden. The inventory boasts a Maintain consensus score, primarily based on 15 Holds (i.e. Neutrals) vs. 7 Buys and a pair of Sells. Nonetheless, most consider the shares at the moment are undervalued; the $86.75 common goal makes room for 12-month features of 32.5%. (See Zoom inventory forecast on TipRanks)

Precise Sciences Company (EXAS)

ARKK’s second greatest holding is a totally totally different type of innovator. Taking over 8.68% of area within the ETF and a holding price greater than $561 million, Precise Sciences is a molecular diagnostics specialist targeted on detecting early-stage cancers. The corporate boasts a portfolio of assorted testing merchandise led by its flagship providing, Cologuard, which as one of the vital dependable non-invasive CRC (colorectal most cancers) screening assessments, boasts a powerful market place.

In its most up-to-date monetary assertion, for Q3, Precise Sciences put in a powerful displaying. Income climbed by 15% from the identical interval final 12 months to $523.1 million, beating Wall Avenue’s forecast by $19.95 million. Whereas the corporate posted a lack of $0.84 per share, the determine nonetheless managed to come back in forward of the -$1.07 anticipated by the analysts. Moreover, the corporate raised its full-year income outlook to between $2.025 billion and $2.042 billion, $33 million increased on the midpoint than the prior forecast.

The market favored the outcomes, sending shares increased within the subsequent session and the inventory received one other increase extra lately. Final week, most cancers screening rival Guardant introduced top-line information for a blood-based most cancers screening check which was a little bit of a letdown. As a competitor, that’s excellent news for Precise Sciences.

Among the many bulls is Canaccord analyst Kyle Mikson who sees a string of catalysts forward to spice up the inventory. He writes, “We consider 2023 might be one other vital 12 months for information readouts that ought to remind buyers (doubtlessly a ‘wake-up name’) of Precise’s near-, medium- and long-term pipeline progress drivers… Whereas friends are impacted by unsure reimbursement and different points, we consider these catalysts and the corporate’s relative stability ought to assist drive EXAS valuation ranges increased in 2023.”

“Moreover,” Mikson additional defined, “we consider Guardant Well being’s latest readout of the ECLIPSE screening research for the corporate’s liquid biopsy check lifted an overhang from EXAS shares that ought to enable the inventory to carry out effectively primarily based on the corporate’s stable fundamentals in 2023.”

All of this prompted Mikson to charge EXAS inventory a Purchase, whereas his $70 value goal makes room for 12-month features of ~37%. (To observe Mikson’s monitor document, click on right here)

Most of Mikson’s colleagues are considering alongside the identical traces; primarily based on 9 Purchase rankings vs. 3 Holds, the inventory garners a Robust Purchase consensus score. (See EXAS inventory forecast on TipRanks)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is extremely vital to do your personal evaluation earlier than making any funding.