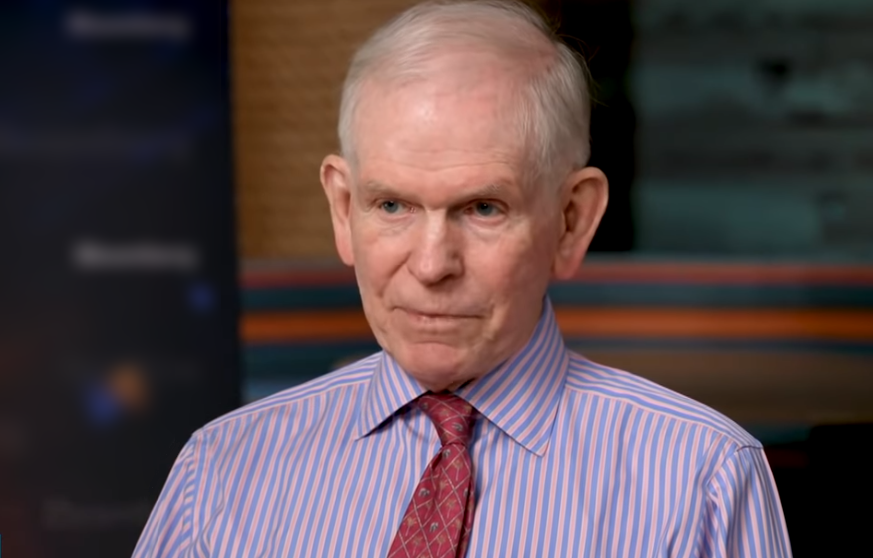

Investor sentiment has been enhancing, however the contrarians haven’t gone silent. Legendary British investor Jeremy Grantham is predicting onerous occasions forward, as he lays out his case for doom and gloom to forged a shadow on the markets.

In Grantham’s view, the pandemic inventory beneficial properties had been a bubble, and that bubble hasn’t absolutely popped but. Placing some numbers to this view, Grantham believes {that a} additional drop of 20% is feasible this 12 months – and in his worst-case situation, he says that the S&P 500 might collapse as a lot as 50% from present ranges.

Backing his view, Grantham says of that worst case, “Even the direst case of a 50% decline from right here would depart us at just below 2,000 on the S&P, or about 37% low cost. To place this in perspective, it might nonetheless be a much smaller % deviation from trendline worth than the overpricing we had on the finish of 2021 of over 70%. So that you shouldn’t be tempted to suppose it completely can not occur.”

And whereas buyers suppose that the Federal Reserve will experience to the rescue by slicing again on rates of interest, Grantham has some dangerous information. He reminds that, traditionally, the worst of recession market declines got here after the Fed’s first price minimize – a sample that began in 1929, and was repeated in 2000 and 2007.

This can be a scenario made for defensive actions. And that brings us to dividend shares. This can be a conventional defensive transfer that ensures revenue by dividend funds.

With this in thoughts, we delved into the TipRanks database and homed in on two names that match a selected profile; a market beating dividend yield of not less than 8% and a Robust Purchase score from the analyst group. Let’s take a more in-depth look.

CTO Realty Progress, Inc. (CTO)

We’ll begin with an actual property funding belief (REIT), as these corporations have lengthy been often known as dividend champions. CTO Realty Progress operates in 9 states, together with such main development areas as Florida and Texas, and manages a portfolio of income-generating properties within the shopping center and retail niches. A lot of the firm’s actual property belongings are within the Southeast and Southwest areas. CTO additionally maintains a 15% curiosity in one other REIT, Alpine Revenue Property Belief.

CTO Realty has proven some combined traits in income and revenue over the previous 12 months, which might be seen within the final quarterly report, from 3Q22. On the prime line, the whole income of $23.1 million was up 40% year-over-year, whereas the underside line internet revenue attributable to the corporate fell virtually 80%, from $23.9 million to $4.8 million over the identical interval. Throughout that point nevertheless, CTO shares have been outperforming the general inventory market; the S&P 500 is down greater than 7% over the past 12 months, whereas CTO is up 7%.

The corporate will launch its 4Q22 outcomes, and its full-year 2022 outcomes, on February 23, lower than a month from now. We’ll see then how the pattern strains are holding on revenues and earnings.

On the dividend entrance, CTO has been persistently sturdy. The corporate has been elevating the quarterly frequent share fee steadily because the first quarter of final 12 months. On an annualized foundation, the dividend pays $1.52 per frequent share – and is yielding a stable 8%. This beats inflation by 1.5 factors, guaranteeing an actual price of return. However extra importantly, the corporate pays out reliably – it’s historical past of maintaining dividend funds stretches again to the Nineteen Seventies.

BTIG analyst Michael Gorman, in his latest observe on actual property funding trusts, revised his prime choose within the area of interest – and named CTO Realty.

“We predict CTO ought to be capable to make investments accretively within the coming quarters given its capability to monetize its free-standing properties in addition to the distinctive entry to ‘different belongings’ on the stability sheet. By advantage of CTO’s $17M of subsurface pursuits and mitigation credit, the $46M structured investments portfolio, and the worth of its frequent inventory possession and administration settlement with Alpine Revenue Property Belief, we expect the corporate has extra levers for development obtainable relative to the vast majority of our REIT protection,” Gorman opined.

Trying forward from right here, Gorman charges CTO shares a Purchase, and his worth goal of $21 implies a one-year upside potential of 11%. Primarily based on the present dividend yield and the anticipated worth appreciation, the inventory has 19% potential whole return profile. (To observe Gorman’s observe report, click on right here)

What does the remainder of the Avenue take into consideration CTO’s long-term development prospects? It seems that different analysts agree with Gorman. The inventory obtained 4 Buys within the final three months in comparison with no Holds or Sells, making the consensus score a Robust Purchase. (See CTO inventory forecast)

Dynex Capital, Inc. (DX)

Sticking with REIT’s, properly flip to the mortgage-backed safety area of interest. Dynex Capital focuses on mortgage loans and securities, investing in these devices on a leveraged foundation. The corporate’s method to portfolio improvement is predicated on a number of easy guidelines, together with capital preservation, disciplined capital allocation, and secure returns on the long run.

From an investor perspective, these returns embody a high-yield dividend, paid out month-to-month. The latest fee was declared earlier this month for a February 1 fee at 13 cents per frequent share. This fee annualizes to $1.56, and provides a yield of 10.8%. The corporate’s historical past of dependable funds goes again to 2008, a transparent constructive for buyers to think about. And with inflation nonetheless operating at 6.5% annualized, the points of interest of Dynex Capital’s regular, high-yield fee are clear.

Dynex’s operations introduced in a complete curiosity revenue of $20.4 million, as of 3Q22. This compares favorably to the earlier quarter’s whole of $18.3 million – though it’s down considerably from the $56.1 million reported for 3Q21. Over that very same time interval, Dynex noticed its internet revenue to frequent shareholders change from $91.4 million to a lack of $42.5 million. The web loss displays a pointy decline within the firm’s e-book worth, which administration attributed to growing home rates of interest mixed with a tough geopolitical scenario.

Supporting the dividend, the corporate reported a non-GAAP earnings obtainable for distribution (EAD) of 24 cents per frequent share, and had money holdings of $260.3 million.

Regardless that DX is dealing with headwinds, Credit score Suisse 5-star analyst Douglas Harter not too long ago upgraded his score on the inventory from Impartial to Outperform (i.e. Purchase). Backing his bullish stance, Harter writes: “We view the inventory as essentially the most enticing among the many Company-focused mREITs to seize potential tightening of MBS spreads. That is primarily based on the next stage of confidence within the sustainability of the dividend (lowest required yield amongst Company-focused), enticing P/B valuation (87% of e-book in comparison with 97% for different Company-focused friends), and a stronger relative observe report of defending e-book worth in unstable interval.” (To observe Harter’s observe report, click on right here.)

General, this REIT has picked up 3 analyst critiques not too long ago, and they’re all constructive and provides the inventory its unanimous Robust Purchase consensus score. (See DX inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather essential to do your individual evaluation earlier than making any funding.