One of many instruments that the Federal Reserve has to handle the cash provide is the reserve requirement. Importantly, the reserve requirement can also be a potent device to handle systemic threat of the banking system. The Federal Reserve has lately abolished the reserve requirement. This text examines a number of attainable impacts of this motion.

The reserve requirement is basically the proportion of deposits {that a} financial institution should maintain. As outlined by Investopedia:

Reserve necessities are the amount of money that banks should have, of their vaults or on the closest Federal Reserve financial institution, in step with deposits made by their clients. Set by the Fed’s board of governors, reserve necessities are one of many three important instruments of financial coverage—the opposite two instruments are open market operations and the low cost price.

The reserve necessities are traditionally essential within the U.S. and carried out in response to a banking disaster:

The fractional banking system got here into place as an answer to issues encountered throughout the Nice Melancholy when depositors made many withdrawals, resulting in financial institution runs.

corporatefinanceinstitute.com/assets/information/finance/fractional-banking/

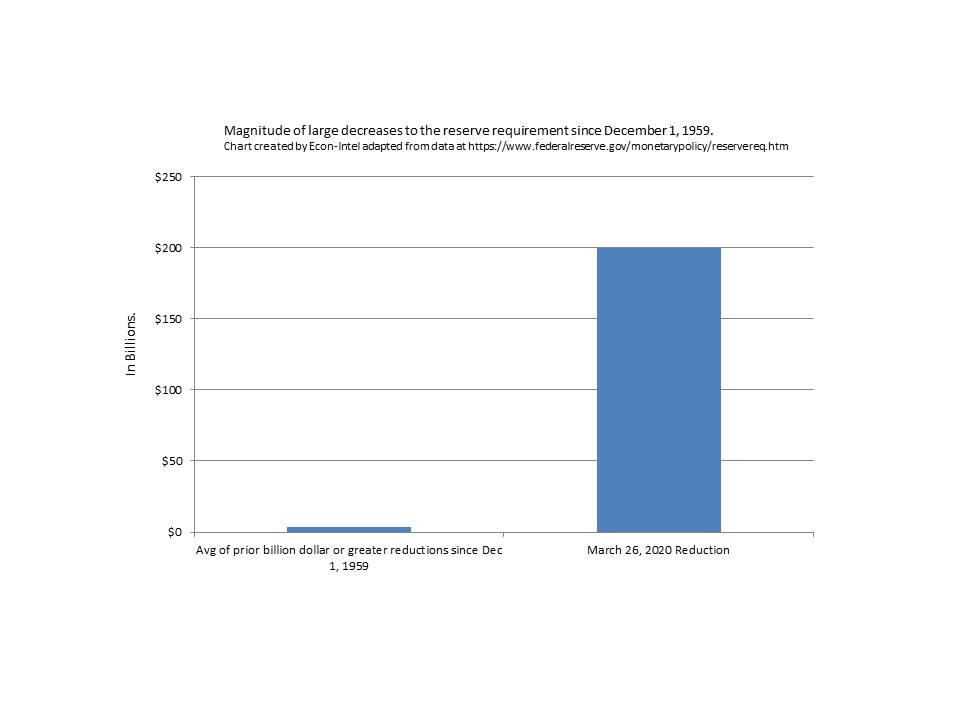

Since December 1, 1959, the Federal Reserve has adjusted the reserve necessities 105 instances previous to the latest time. At which level, the reserve requirement was abolished. The overwhelming majority (80.9%) of these changes, the reserve necessities affected the banking system by lower than $1.0 Billion. Of these instances that the Federal Reserve did change the reserve requirement, such that it affected the banking reserves by greater than $1.0 Billion, 6 elevated the reserve requirement and 14 decreased the reserve requirement. The chart under compares the size of these prior giant decreases within the required banking reserves to the present change within the banking reserves.

As you’ll be able to see, this alteration is unprecedented in scale. No different reductions in reserve necessities have come wherever shut. The reserve requirement had by no means been abolished prior! The prior file for decreasing the reserve requirement was roughly $8.9 billion on April 2, 1992. This time it was roughly $200 billion. This essentially adjustments all the U.S. banking system. It’s not a fractional reserve system. Now, there isn’t any authorized requirement for banks to take care of reserve balances.

The Fed’s Reasoning For Abolishing the Reserve Requirement:

On March 15, 2020, the Federal Reserve issued three press releases taking a sequence of actions. One motion abolished the reserve requirement. Chosen textual content from every is cited under, then examined:

Federal Reserve points FOMC assertion:

The coronavirus outbreak has harmed communities and disrupted financial exercise in lots of international locations, together with the US. World monetary circumstances have additionally been considerably affected….On a 12‑month foundation, total inflation and inflation for objects apart from meals and power are operating under 2 p.c. Market-based measures of inflation compensation have declined; survey-based measures of longer-term inflation expectations are little modified.

The consequences of the coronavirus will weigh on financial exercise within the close to time period and pose dangers to the financial outlook. In mild of those developments, the Committee determined to decrease the goal vary for the federal funds price to 0 to 1/4 p.c. The Committee expects to take care of this goal vary till it’s assured that the economic system has weathered latest occasions and is on monitor to attain its most employment and worth stability targets. This motion will assist help financial exercise, robust labor market circumstances, and inflation returning to the Committee’s symmetric 2 p.c goal.To help the sleek functioning of markets for Treasury securities and company mortgage-backed securities which can be central to the movement of credit score to households and companies, over coming months the Committee will enhance its holdings of Treasury securities by not less than $500 billion and its holdings of company mortgage-backed securities by not less than $200 billion. The Committee may also reinvest all principal funds from the Federal Reserve’s holdings of company debt and company mortgage-backed securities in company mortgage-backed securities. As well as, the Open Market Desk has lately expanded its in a single day and time period repurchase settlement operations.

www.federalreserve.gov/newsevents/pressreleases/monetary20200315a.htm

Federal Reserve Actions to Help the Circulate of Credit score to Households and Companies

The Federal Reserve encourages depository establishments to show to the low cost window to assist meet calls for for credit score from households and companies presently. In help of this objective, the Board right now introduced that it’ll decrease the first credit score price by 150 foundation factors to 0.25 p.c, efficient March 16, 2020.

The Federal Reserve is encouraging banks to make use of their capital and liquidity buffers as they lend to households and companies who’re affected by the coronavirus.

For a few years, reserve necessities performed a central position within the implementation of financial coverage by making a steady demand for reserves. In January 2019, the FOMC introduced its intention to implement financial coverage in an ample reserves regime. Reserve necessities don’t play a big position on this working framework.

In mild of the shift to an ample reserves regime, the Board has lowered reserve requirement ratios to zero p.c efficient on March 26, the start of the subsequent reserve upkeep interval. This motion eliminates reserve necessities for hundreds of depository establishments and can assist to help lending to households and companies.

www.federalreserve.gov/newsevents/pressreleases/monetary20200315b.htm

Coordinated Central Financial institution Motion to Improve the Provision of U.S. Greenback Liquidity

The Financial institution of Canada, the Financial institution of England, the Financial institution of Japan, the European Central Financial institution, the Federal Reserve, and the Swiss Nationwide Financial institution are right now saying a coordinated motion to reinforce the availability of liquidity through the standing U.S. greenback liquidity swap line preparations.The swap traces can be found standing amenities and function an essential liquidity backstop to ease strains in world funding markets, thereby serving to to mitigate the results of such strains on the availability of credit score to households and companies, each domestically and overseas.

www.federalreserve.gov/newsevents/pressreleases/monetary20200315c.htm

Summarized, the Federal Reserve acknowledged that as a result of coronavirus there was financial hurt. As a result of inflation was low, they have been going to supply financial stimulus through decrease rates of interest. In addition to treasury and company mortgage-backed securities purchases. Moreover, they introduced that they have been going to lend liberally by their repo facility. They additional went on to encourage banks to proceed to lend and abolished the reserve necessities. In addition to, coordinated with a number of different reserve banks to take care of liquidity within the greenback swap markets.

In the course of the panic and financial stresses surrounding the early portion of the coronavirus pandemic, these actions are defendable. Now, circumstances have modified and it’s obvious that the huge financial stimulus has led to an inflationary atmosphere. Apparently, the Federal Reserve both misjudged the optimum amount of financial easing or waited too lengthy earlier than decreasing financial stimulus.

Abolishing Reserve Necessities in an Period of Tightening Makes no Sense:

Now, the Federal Reserve has reversed course on rates of interest and is now aggressively elevating charges. In addition to promoting off treasuries and mortgage-backed securities quite than buying them. The logic of eradicating the reserve requirement briefly to stimulate the economic system was defensible throughout the pandemic response. Nevertheless, leaving the reserve requirement at 0% and experimenting with operating with none reserves is a weird and dangerous experiment. Moreover, it’s going to restrict the Fed’s means to tighten when that’s their objective.

Reserves are important to the steadiness of the banking system. For depositors to have the ability to withdraw cash from their financial institution, reserves should be out there. Each logically and traditionally, when some depositors are unable to get their cash out of their financial institution, a panic is probably going. As an elevated variety of individuals worry the identical occurring to them and go to withdraw cash from their financial institution. This may create a financial institution run. When banks that had adequate reserves for day-to-day actions are unable to redeem deposits for his or her shoppers throughout the panic. The panic and financial chaos surrounding the following money crunch can unfold and create economically troublesome instances.

Of the instruments that the Federal Reserve has, the reserve requirement is the one that almost all immediately impacts financial institution liquidity. It additionally applies most on to these banks with marginal liquidity with out instantly immediately affecting the extra liquid banks. In different phrases, the reserve requirement generally is a extra focused device than the blunter rate of interest device.

Instance Threat State of affairs of Abolished Reserve Requirement:

Present reserve necessities are 0%, as they’re now. The least liquid financial institution, as decided by its reserves, is 1.2%. As an example, it holds $12,000,000 of reserves in money or on the nearest Federal Reserve department on $1,000,0000,000 of deposits. All different banks are holding 3.0% or extra in reserves on this instance.

If the Federal Reserve have been involved about future financial circumstances, it might select to extend the reserve requirement from 0% to 1%. This modification would make sure that the least liquid financial institution didn’t mortgage out all the remaining $12,000,000 of reserves.

This is able to lower the chance of the least liquid financial institution failing attributable to liquidity points. In addition to enhance certainty that the financial institution has the reserves out there when depositors want to withdraw cash. If the Federal Reserve is unsure that the rise from 0% to 1% is adequate to buffer towards these dangers sooner or later, the Fed may also provide ahead steering on the reserve requirement. It will encourage banks to retain extra money in preparation for subsequent extra will increase within the reserve requirement. This feature would enable banks to organize prematurely for added will increase within the reserve requirement. This motion will assist guarantee ample liquidity for the banking system to proceed working easily.

The Fed is responding to excessive inflation by elevating rates of interest and decreasing its stability sheet by promoting bonds. Each of those actions tighten the cash provide to dampen demand for items and providers. This lowered demand will hopefully dampen inflation and convey it again all the way down to a extra cheap stage. Why then has the Federal Reserve left in place an unprecedented coverage of maximum loosening by permitting the banks to maintain actually no reserves by any means? When the Federal Reserve is tightening the cash provide anyway, there isn’t any value to tightening by rising the reserve requirement. This is able to obtain the objective of tightening to combat inflation and would enhance the liquidity of the least liquid banks. Subsequently, reducing threat to the banking system as an entire.

Three key causes to extend the reserve requirement immediately:

- First, when the Federal Reserve is tightening anyway, there isn’t any unfavourable impact of slowing the economic system from having a portion of this tightening come from the rise in reserve necessities. However elevating the reserve requirement at a time when the Fed is loosening financial coverage would counteract their different actions to stimulate the economic system.

- Second, all through the banking system as an entire, there are important reserves. As of the tip of twond quarter 2022, the banking system as an entire, has money to cowl roughly 17.9% of all buyer deposits (See: banking business information for extra particulars). As a result of comparatively excessive money balances within the banking system presently, it must be comparatively simple for the much less liquid banks to restructure their stability sheets to attain larger reserve balances. Ready longer till total systemic liquidity decreases would jeopardize the power of the much less liquid banks to extend their very own reserves and liquidity.

- Third, starting the method of accelerating reserve necessities now permits extra time for banks to adapt. A fast change in reserve necessities can be harder for banks to reply to and would enhance the probabilities of unfavourable penalties throughout the transition.

Conclusion:

The Federal Reserve has a device that each will increase systemic banking security and tightens financial coverage. However, they’ve deserted it. Additional delays in re-establishing an affordable reserve requirement jeopardizes the long run stability of the US banking system. The present coverage of tightening gives a uncommon alternative. The Fed might re-implement reserve necessities to tighten the cash provide and enhance the steadiness of the banking system. The Federal Reserve Abolishing the reserve requirement elevates many potential dangers. Delaying a return to using reserve necessities presently, when the Federal Reserve is tightening coverage, is downright unexplainable.