That is the second publication of the Market’s Compass Rising Markets Nation ETF Examine to be printed in our Substack Weblog that can spotlight the technical adjustments of the 22 EM ETFs that we monitor on a weekly foundation that additionally contains notes on the technical adjustments from our final printed Market’s Compass EM International locations ETF Examine three weeks in the past on February twenty third. Previous publications may be accessed by way of The Market’s Compass Substack Weblog, The Market’s Compass web site or by contacting us instantly.

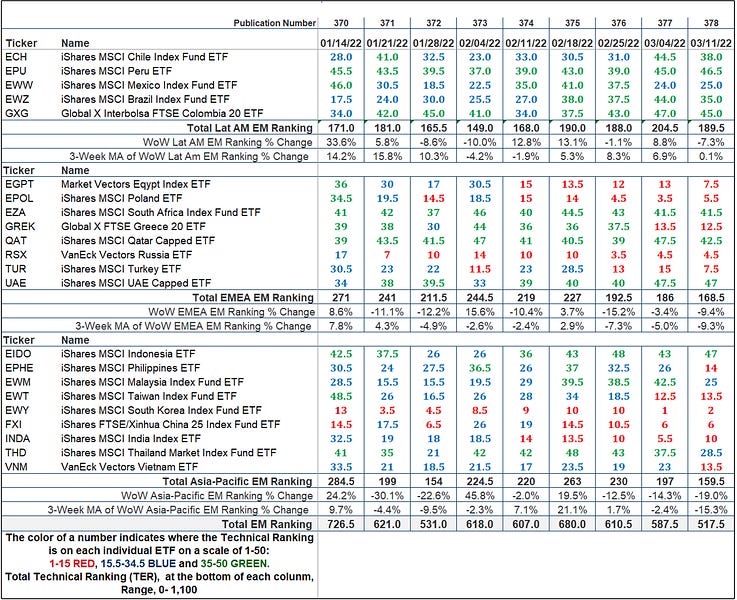

Final Week’s and eight Week Trailing Technical Rankings of Particular person ETFs

The Excel spreadsheet under signifies the weekly change within the Technical Rating (“TR”) of every particular person ETF. The technical rating or scoring system is a wholly quantitative method that makes use of a number of technical concerns that embrace however aren’t restricted to development, momentum, measurements of accumulation/distribution and relative energy. If a person ETFs technical situation improves the Technical Rating TR rises and conversely if the technical situation continues to deteriorate the TR falls. The TR of every particular person ETF ranges from 0 to 50. The first take away from this unfold sheet must be the development of the person TRs both the continued enchancment or deterioration, in addition to a change in course. Secondarily, a really low rating can sign an oversold situation and conversely a continued very excessive quantity may be considered as an overbought situation, however with due warning, over bought situations can proceed at apace and overbought securities which have exhibited extraordinary momentum can simply change into extra overbought. A sustained development change must unfold within the TR for it to be actionable. The TR of every particular person ETF in every of the three geographic areas may also reveal comparative relative energy or weak point of the technical situation of the choose ETF in the identical area.

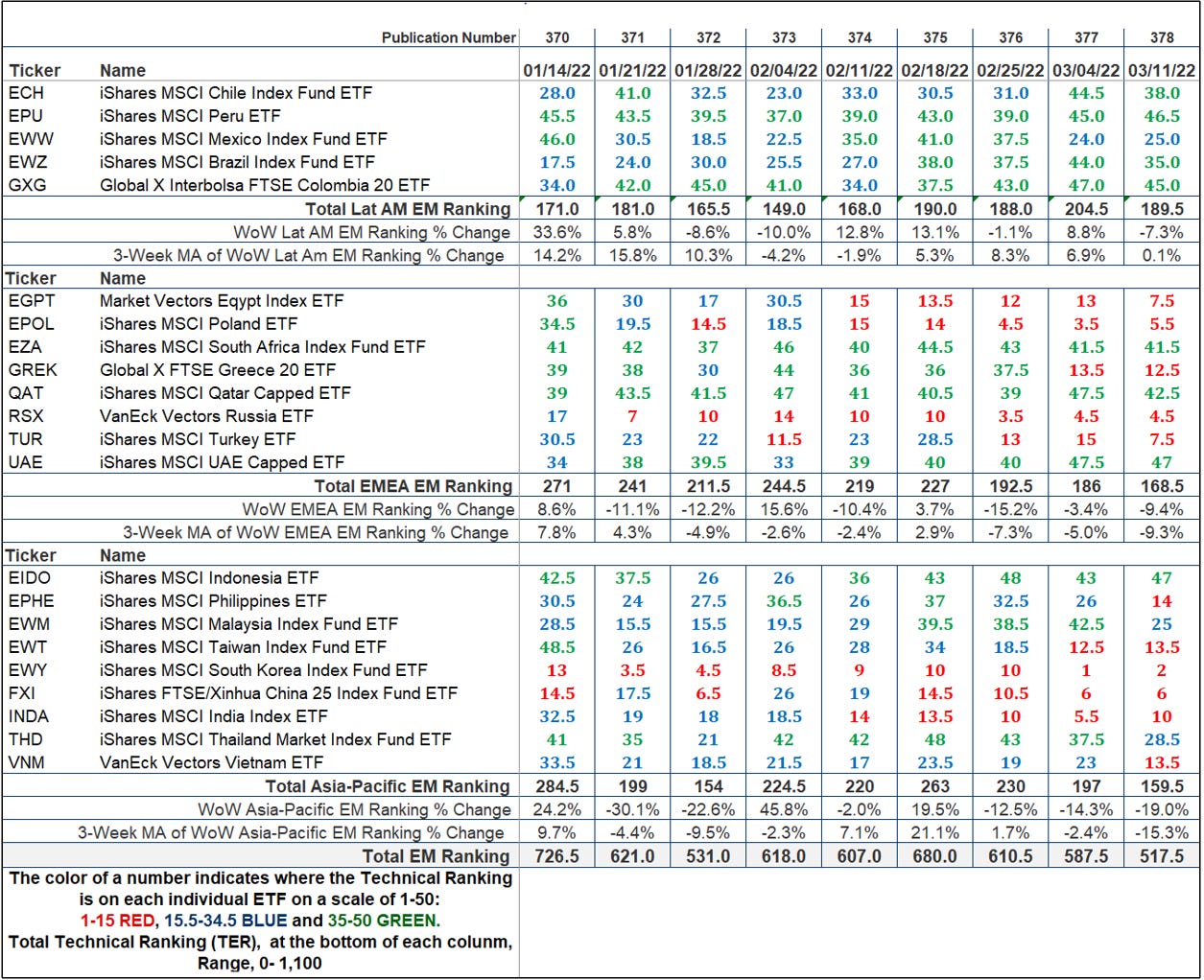

As may be seen above, of the three Rising Market Nation areas we monitor, solely the 5 Latin America Nation ETFs have sported Technical Rankings (“TRs”) which were above the “pink zone” (above 15) for the previous 9 weeks leaving the Whole Lat AM EM Rating down just about unchanged over the previous three weeks from 190 to 189.5 (we highlighted the continued relative outperformance of the 5 Lat Am Nation ETFs in our final EM Weblog . The Whole EMEA EM Rating that features 8 separate nation ETF TRs has carried out far worse over the identical interval (over the previous), dropping 25.8% to 168.5 from 227. The poorest geographic area Whole Rating change since we printed three weeks in the past has been the Asia-Pacific EM Rating that features 9 separate nation ETF TRs. The Asia-Pacific Whole Rating has fallen to 159.5 from 263, by 103.5 “handles” or 39.3% for the reason that February 18th studying. The SPDR S&P Rising Asia Pacific ETF (GMF) has accelerated decrease over the previous three weeks (chart offered under) and has been declining for the reason that February sixteenth excessive of 146.78 to final week’s closing low of 104.96, a -28.5% drop. Notice within the decrease panel of the chart that MACD has been monitoring sharply decrease reflecting the latest pace of draw back worth momentum. Admittedly, the GMF isn’t a vastly liquid ETF (with a 90-day Combination Quantity of 28,700 shares) however the chart of the ETF serves to characterize the liquidation of the underlying equities within the Asia-Pac area. The panel following the chart of the GMF are the highest 15 holdings within the ETF and are closely weighted to Taiwanese, Chinese language, and Indian equities facilitated by investments in Depositary Receipts.

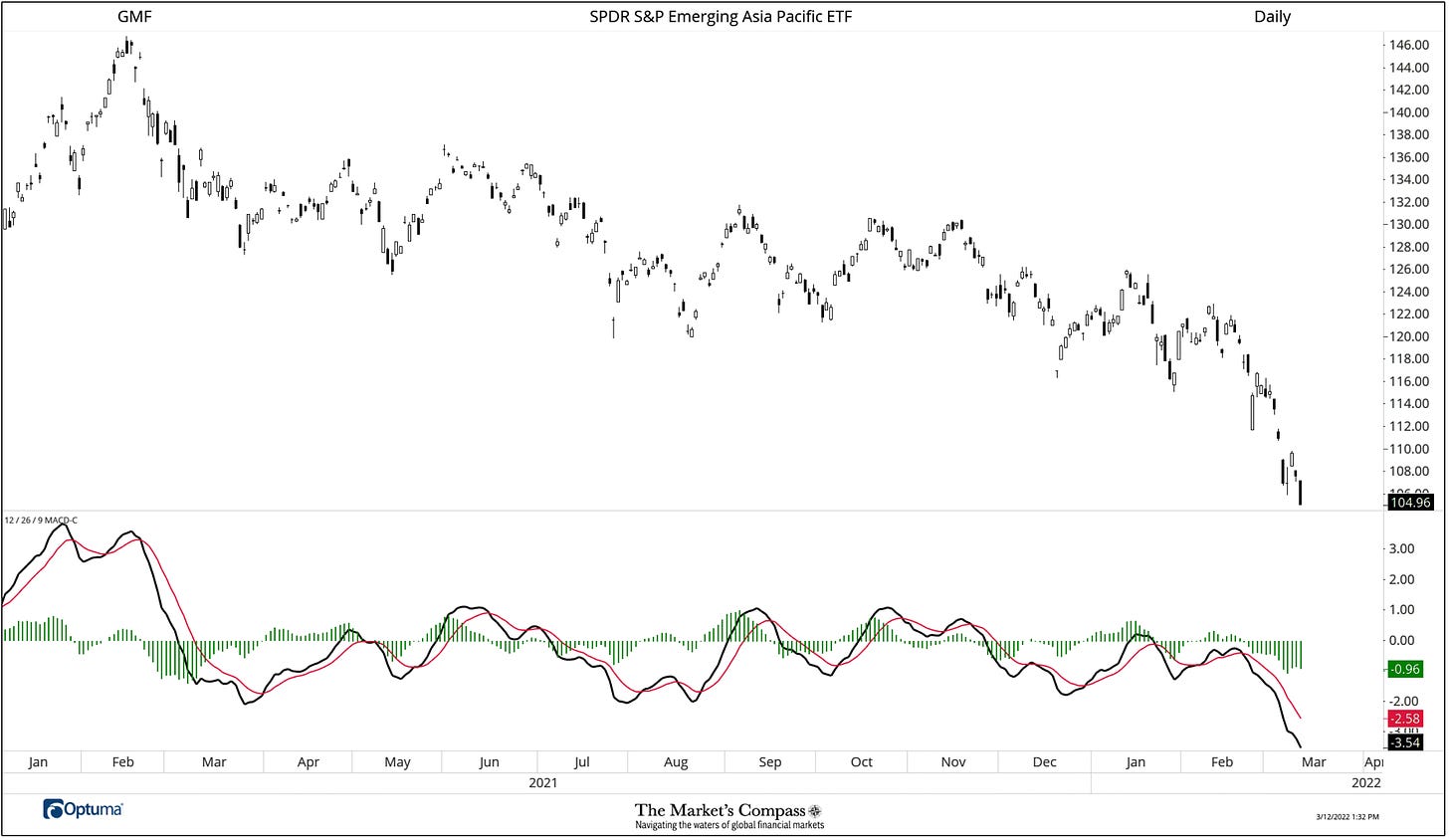

The EEM with This Week’s Whole ETF Rating “TER” Overlayed

The Whole ETF Rating (“TER”) Indicator is a complete of all 22 ETF rankings and may be checked out as a affirmation/divergence indicator in addition to an overbought oversold indicator. As a affirmation/divergence software: If the broader market as measured by the iShares MSCI Rising Markets Index ETF (EEM) continues to rally and not using a commensurate transfer or increased transfer within the TE” the continued rally within the EEM Index turns into more and more in jeopardy. Conversely, if the EEM continues to print decrease lows and there’s little change or a constructing enchancment within the TER a constructive divergence is registered. That is, in a style, is sort of a conventional A/D Line. As an overbought/oversold indicator: The nearer the TER will get to the 1100 stage (all 22 ETFs having a TR of fifty) “issues can’t get significantly better technically” and a rising quantity particular person ETFs have change into “stretched” the extra of an opportunity of a pullback within the EEM. On the flip facet the nearer to an excessive low “issues can’t get a lot worse technically” and a rising variety of ETFs are “washed out technically” an oversold rally or measurable low is near be in place. The 13-week exponential transferring common in Crimson smooths the unstable TER readings and analytically is a greater indicator of development.

The EEM Whole Technical Rating (“TER”) of the 22 Rising Market Nation ETFs fell to 517.5 from 587.5, leading to a +12.03% lower week over week. Over the 3-week interval since we final publish the Whole EM Rating fell -23.8% to 517.5 from 680. Though it was a pointy drop it was not commensurate with the EEM which fell 12.62% over the identical interval. We remind readers that as a result of a good quantity EM ETFs are thinly traded and are topic to large swings which in flip creates unstable particular person Technical Rating adjustments, that the calculation of the TER additionally fluctuates in the same manor. Analytically, specializing in the 13-week transferring common of the TER is a much better indicator. Though that transferring common has not made a brand new low it’s nonetheless trending decrease, and as may be seen on the chart above, the sequence of upper lows within the TER for the reason that July of final 12 months was ameliorated with final weeks studying because the EEM has traded down sharply over the previous three weeks. TER divergences take time to develop, and provided that we start to see worth escape of the down development or the TER decisively escape of the contracting triangle to increased highs would we be ready to counsel that the EEM could also be out of the woods.

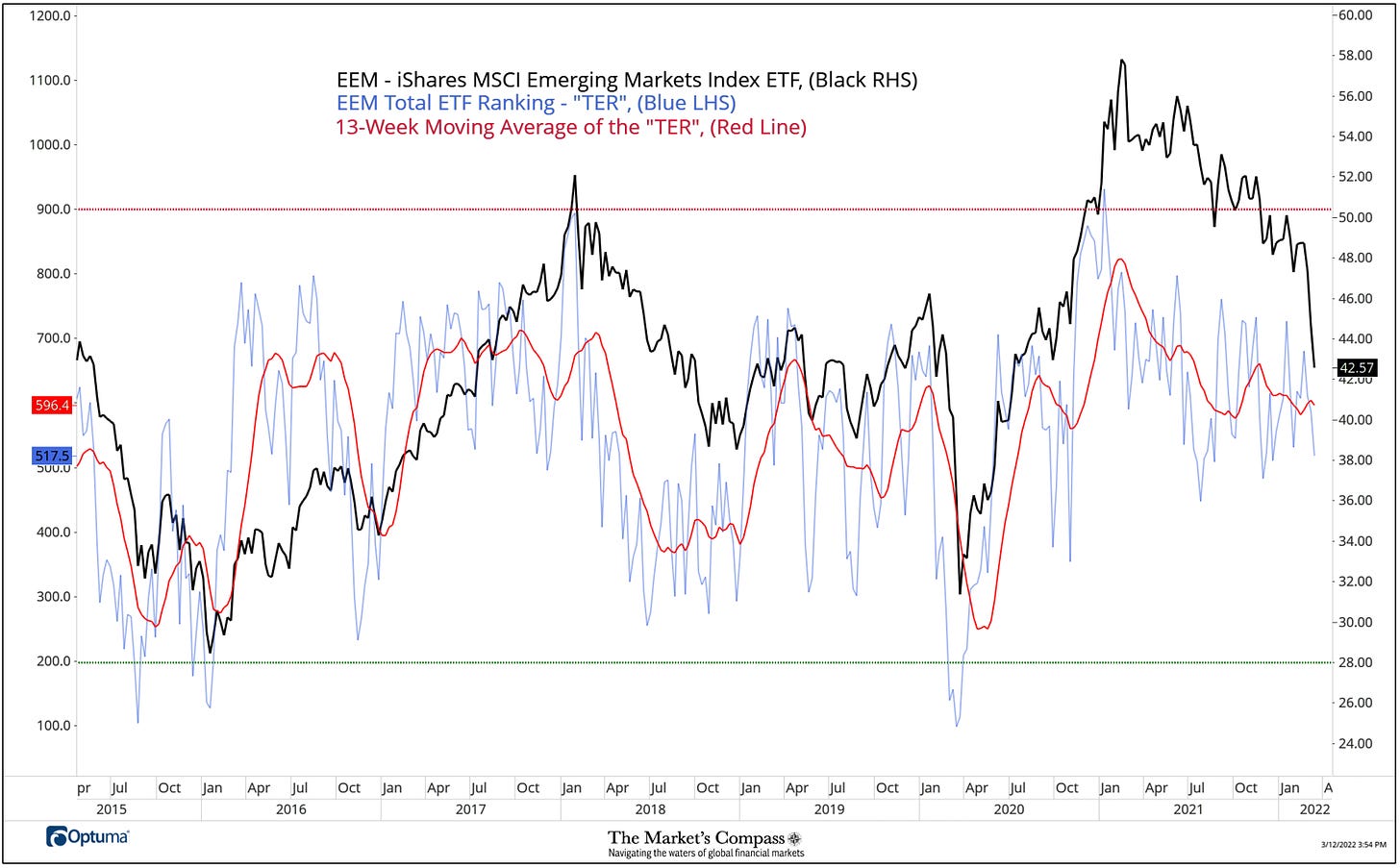

The Common “TR” Rating of the 22 Rising Markets Nation ETFs

The Common Weekly Technical Rating (“ATR”) is the typical Technical Rating (“TR”) of the 22 Rising Markets Nation ETFs we monitor weekly and is plotted within the decrease panel on the Weekly Candle Chart of the iShares MSCI Rising Markets Index ETF (EEM) offered under. Just like the “TER”, it’s a affirmation/divergence or overbought/oversold indicator.

The Common Technical Rating (“ATR”) of the 22 Rising Markets Nation ETFs fell final week however the development, as may be seen by the longer-term transferring common (blue line) stays flat in a sideways churn though the shorter-term transferring common (pink line) is starting to trace at a flip decrease. The EEM has been in a grinding downtrend since February that accelerated over the previous three weeks. Over that interval the EEM is down -12.6%. That mentioned the ATR has prevented printing a decrease low. This can be a results of the Lat-Am TRs being elevated, with these eliminated this week’s ATR studying of the remaining 17 ETFs can be 19.29.

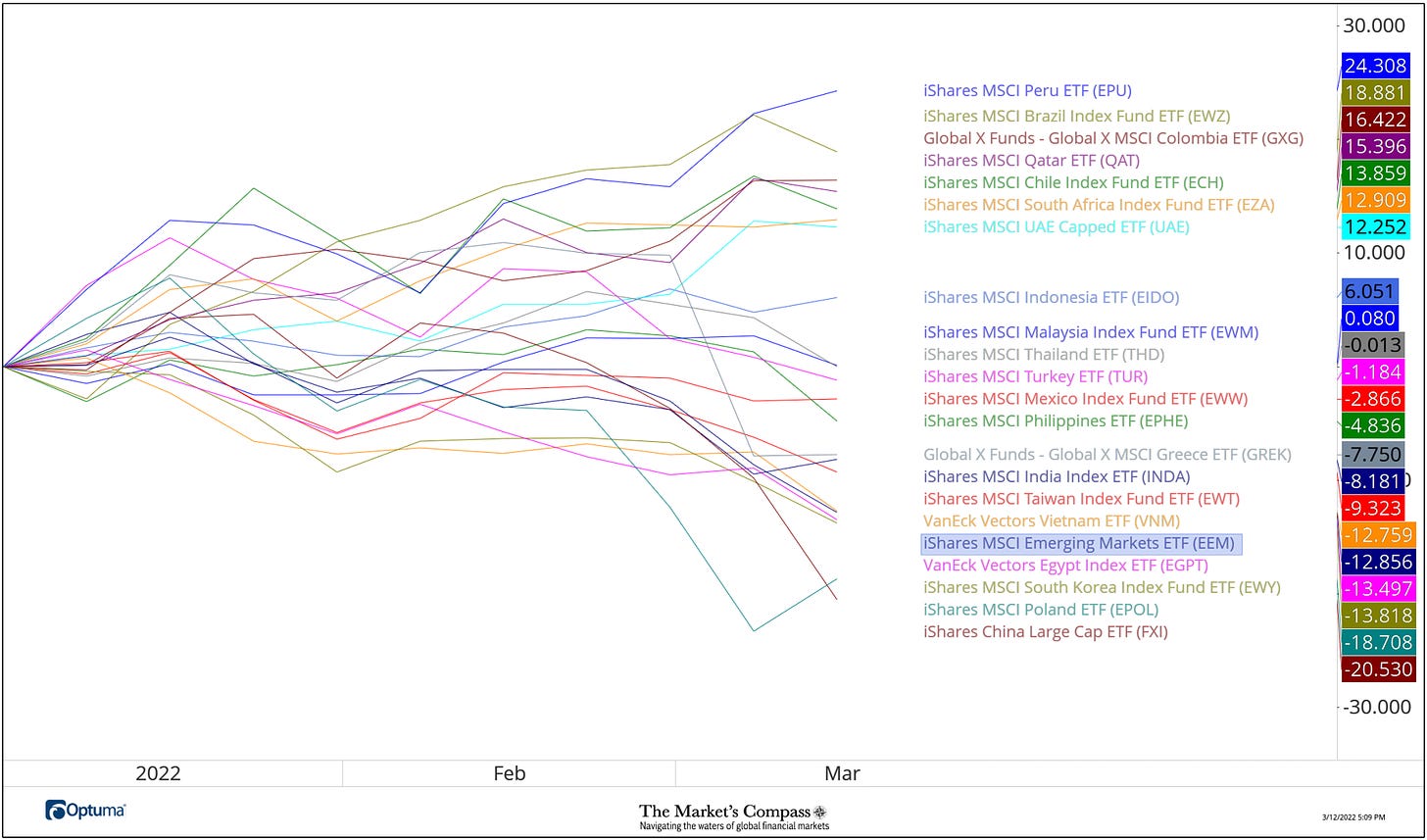

Absolute Efficiency of the 22 Rising Market International locations ETFs Yr to Date*

*Doesn’t embrace dividends and the RSX which was down -78.80% earlier than buying and selling was halted.

Extra affirmation of the outperformance on the Lat AM Nation ETFs for the reason that begin of the 12 months are revealed on the chart above.

The Common “TR” Rating of the 22 ETFs

The Common Weekly Technical Rating (“ATR”) is the typical Technical Rating (“TR”) of the 22 Rising Markets Nation ETFs we monitor weekly and is plotted within the decrease panel on the Weekly Candle Chart of the iShares MSCI Rising Markets Index ETF (EEM) offered under. Just like the “TER”, it’s a affirmation/divergence or overbought/oversold indicator.

The Common Technical Rating (“ATR”) of the 22 Rising Markets Nation ETFs fell final week however the development, as may be seen by the longer-term transferring common (blue line) stays flat in a sideways churn though the shorter-term transferring common (pink line) is starting to trace at a flip decrease. The EEM has been in a grinding downtrend since February that accelerated over the previous three weeks. Over that interval the EEM is down -12.6%. That mentioned the ATR has prevented printing a decrease low. This can be a results of the Lat-Am TRs being elevated, with these eliminated this week’s ATR studying of the remaining 17 ETFs can be 19.29.

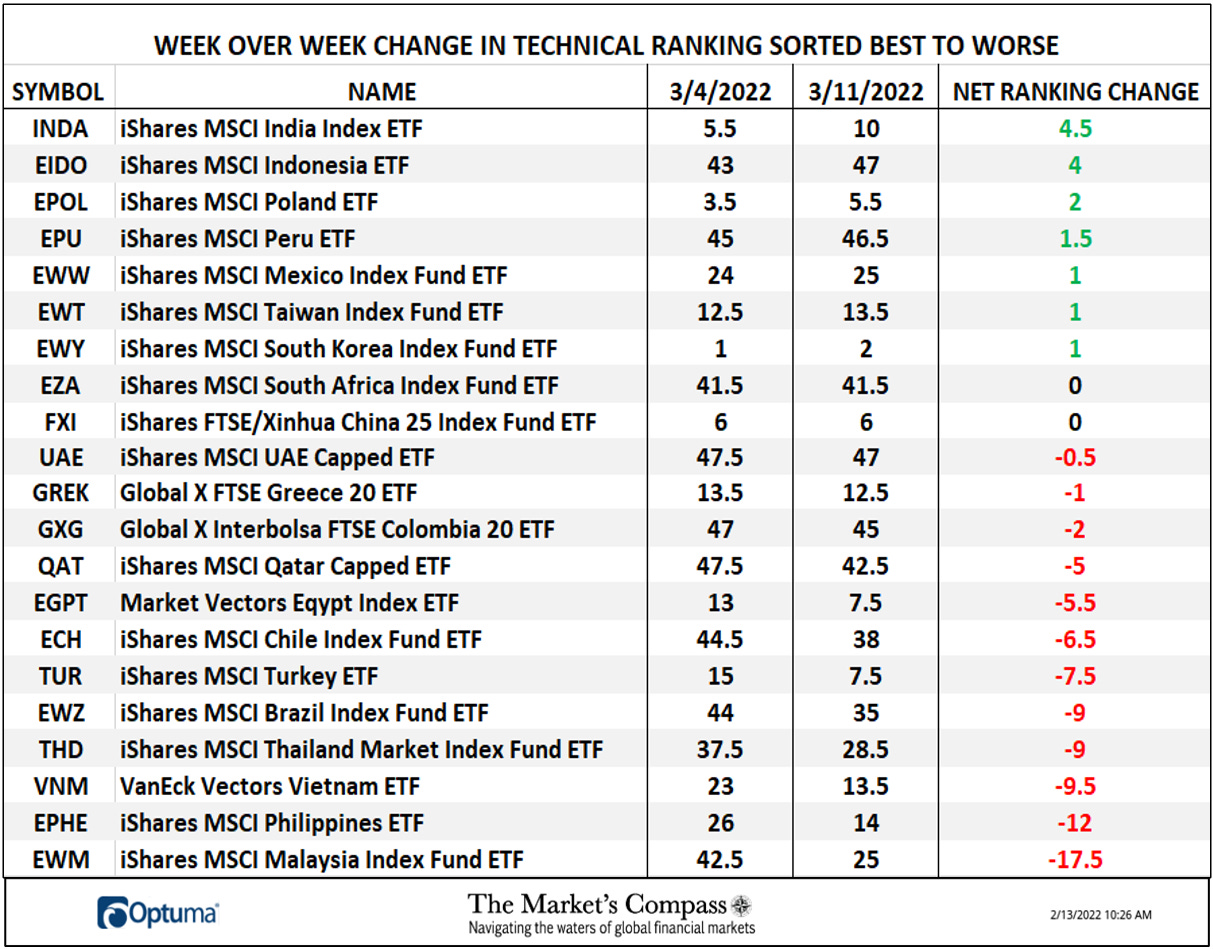

The Week Over Week Change in Technical Rankings*

*The RSX has been deleted from his week’s Week over Week adjustments within the TRs.

The three largest Technical Rating drops had been Asia-Pacific ETFs, the iShares MSCI Malaysia Index Fund ETF (EWM) falling -17.5 to 25 from 42.5 adopted by the iShares MSCI Philippines ETF (EPHE) which dropped -12 to 14 from 26 and the VanEck Vectors Vietnam ETF (VNM) which fell -9.5 to 13.5 from 23. Information is courtesy of Optuma.

The Rising Markets Nation ETFs Weekly Absolute and Relative Worth % Change*

*Doesn’t together with dividends, the VanEck Vectors Russia ETF (RSX) is once more, omitted.

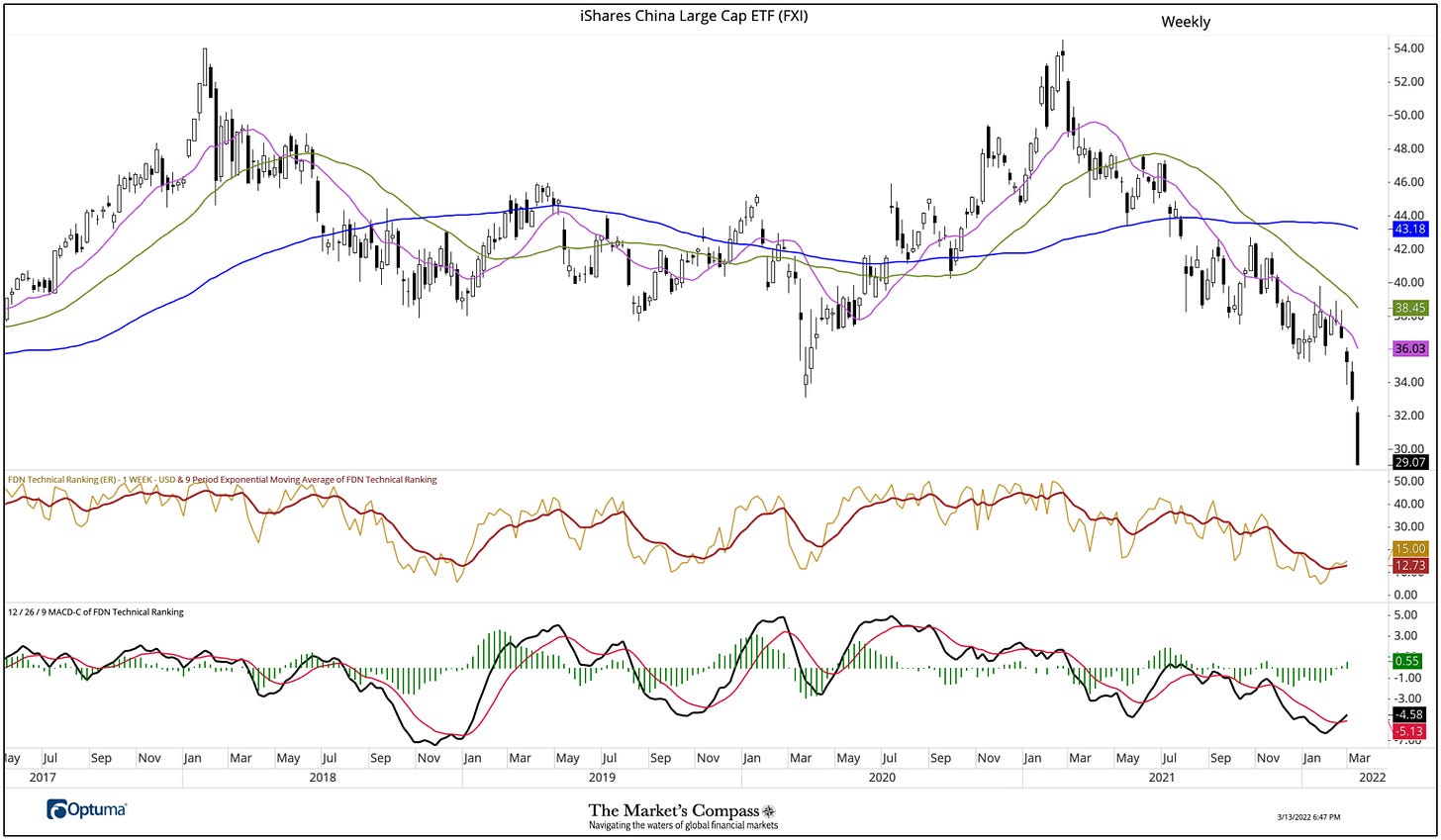

Eight of the 22 Rising Markets Nation ETFs we monitor improved on an absolute foundation final week, led by the iShares MSCI Poland ETF (EPOL) up +6.01%. Seventeen EM ETFs outperformed the iShares MSCI Rising Markets ETF (EEM) on a relative foundation which was down -4.59% on the week On a relative foundation 4 EM ETFs underperformed. The worst performing ETF on an absolute foundation was the iShares China Massive Cap ETF (FXI), down -11.83% on the week (the highest 15 holdings within the ETF observe the weekly chart under). Information is courtesy of Bloomberg.

FXI Holdings

I invite our readers to contact me with any questions or feedback at…tbrackett@themarketscompass.com