The monetary system is at present experiencing a “aid rally.”

For the eight weeks ending October twenty eighth, the first issues going through the monetary system had been:

1) The collapse of the British Pound/ UK Authorities Bonds

2) The collapse of the Japanese Yen.

3) The collapse of U.S. Treasuries.

All of these have been resolved briefly, courtesy of the Truss Authorities resigning within the U.Okay., the Financial institution of Japan making its largest intervention ever within the foreign money markets, and U.S. Treasuries catching a bid, courtesy of Treasury Secretary Janet Yellen verbally intervening to assist the Biden Administration with the mid-term elections.

All of those options are non permanent nevertheless.

The actual fact is that the U.S. is in an inflationary recession. I do know it. You already know it. Policymakers understand it, although they should mislead prop up the bogus narrative that all the pieces is below management.

It’s not.

The monetary system has already erased extra wealth in 2022, than it did in 2020 or 2008. Throughout these prior crises, bonds rallied offering a hedge in opposition to the collapse in shares.

Not this time.

Bonds AND shares are each collapsing, erasing over $18 trillion in wealth. And keep in mind, that’s NOT counting the lack of capital in housing or different asset courses.

And sadly for the bulls, we’re nowhere close to the underside for both shares or bonds.

Stanley Druckenmiller is arguably the best investor alive at this time. He averaged 30% a yr for 30 years straight. And he notes that traditionally, every time inflation will get over 5%, inflation by no means comes down till the Fed raises charges ABOVE CPI.

At present, charges are 3.0-3.25%.

CPI is over 8%.

We now have a looooong methods to go right here. And there’s loads of historic information to again that up.

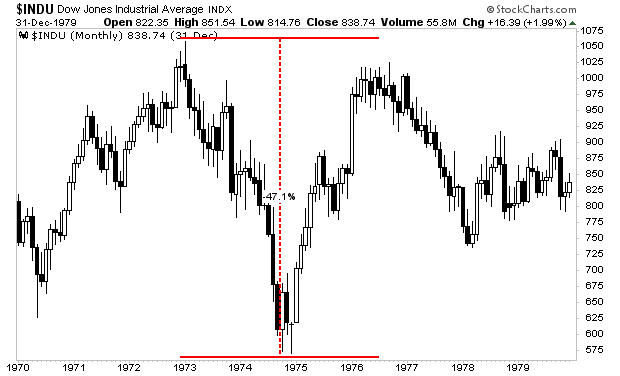

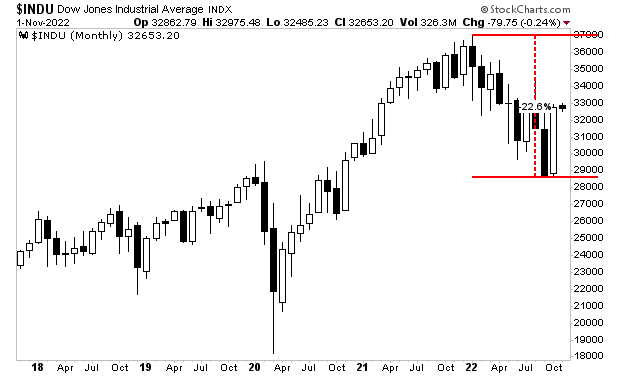

Over the last stagflationary disaster within the Nineteen Seventies, shares misplaced 50% of their worth earlier than bottoming.

To date, in 2022, shares have solely misplaced 22%. If we’re LUCKY, we’re half means by way of this bear market.

Who would you quite wager on being right… an funding legend like Druckenmiller, who has one of many best monitor information in historical past… or the Fed or another institution shill whose job it’s to assert all the pieces is nice?

A crash is coming. And it’s going to make 2008 appear like a joke. I coined the time period the “The whole lot Bubble” in 2014. I warned about it for the higher a part of 10 years.

And it has formally burst.