Comparatively low shares of value promotions had been the norm till early this 12 months, however that won’t be a profitable technique for Black Friday 2022 or This autumn usually. With sharp falls in demand, and no let-up within the strain on shoppers’ wallets, extra substantial promotions might push shoppers to spend greater than deliberate on and round Black Friday – however it’s not the one issue I’d contemplate, having delved into present client drivers.

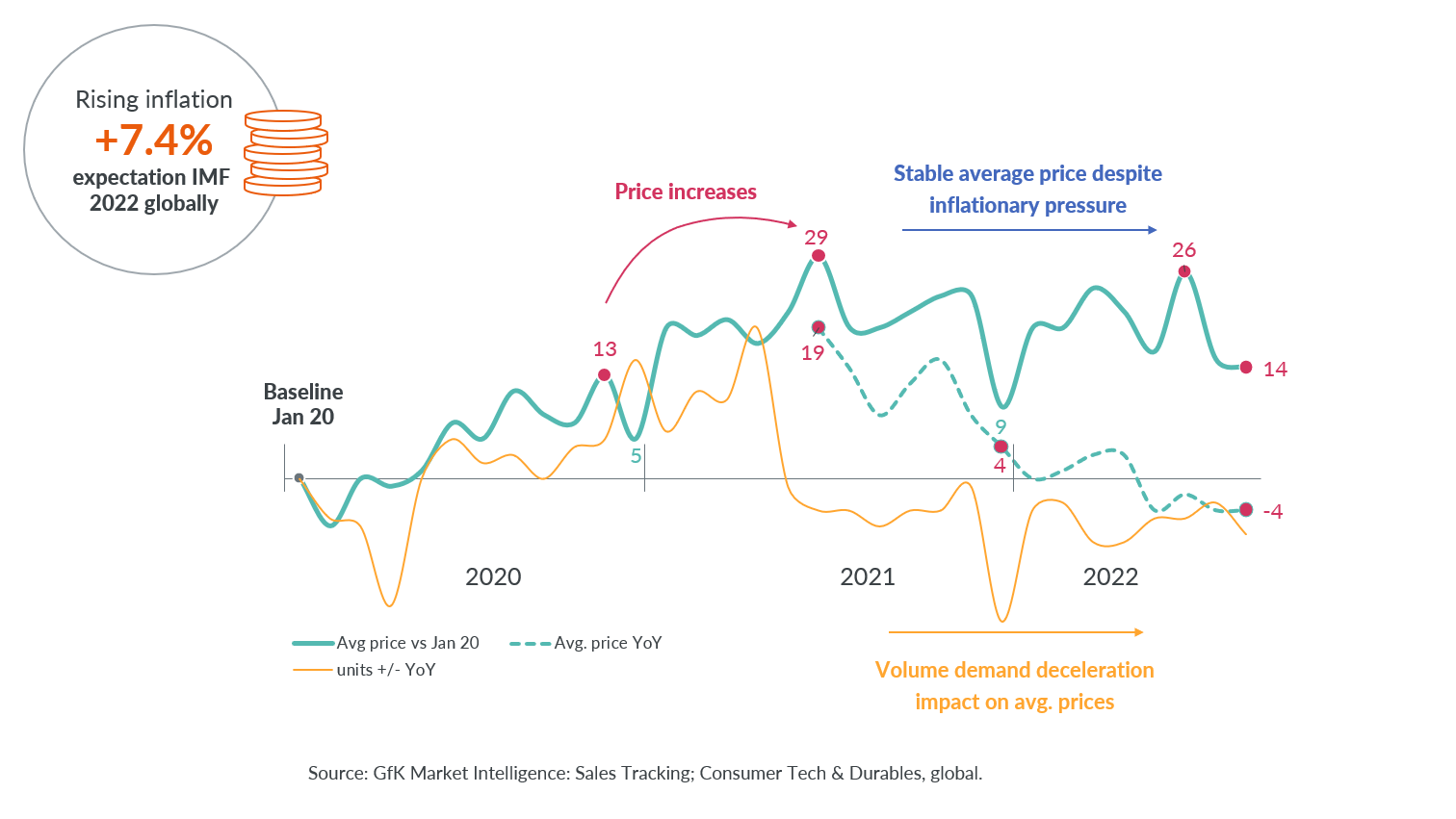

After a gentle rise in costs all through the final two years, 2022 has seen common costs (thought of in US {dollars}) maintain stage within the broad view – regardless of the impacts of inflation. This is because of a major drop within the quantity of demand seen since mid-2021.

Tech Shopper Items common value progress (USD) and unit progress 12 months on 12 months (versus January 2020)

As quickly as this grew to become seen, common value will increase halted, and like for like costs even declined. For instance, throughout main home home equipment, the typical value in USD on phase stage decreased by 3% in August 2022 versus the earlier 12 months, whereas common TV costs throughout the primary half of the 12 months fell by 5% total, and 14% for 75+inch screens.

With elevated client value sensitivity fuelled by rising inflation and vitality price, retail has little room for value will increase. Consequently, producers are dealing with robust headwinds when aiming to offset rising prices of manufacture and supply.

Compounding this example, excessive inventory ranges in classes with notably low quantity demand have pressured retailers into rising value promotions.

Outlook for Black Friday 2022 and This autumn

Non-must-have (luxurious Small Home Home equipment (SDA), luxurious Main Home Home equipment (MDA), wearables, picture) merchandise on this space are more likely to see the strongest declines in total quantity gross sales, nonetheless, premium segments will proceed to promote in key markets.

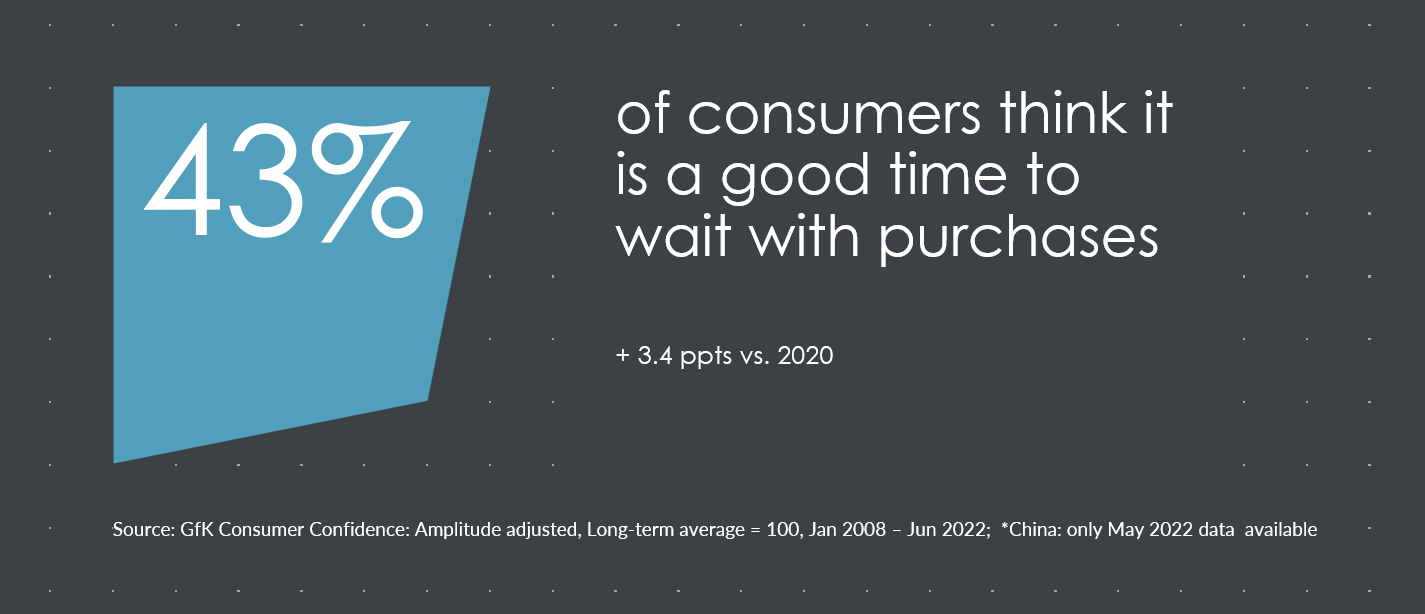

Quantity gross sales might be underneath better strain than common, because the mass market delay or cancel non-essential spending. Already 43% of individuals globally suppose that now could be a greater to delay purchases that to make them (up 3.4 share factors in comparison with 2020). Nevertheless, premium merchandise in these classes will stay in demand. It’s because the standard premium consumers (excessive earnings) will stay comparatively unaffected by the rising price of residing and proceed their typical shopping for habits. In the event that they do scale back spend, they may flip to “reasonably priced premium” – and that is more likely to turn out to be an rising matter as value sensitivity grows in 2023.

Necessities (Good Cellular Telephones, TVs, normal Main Home Home equipment, fundamental Small Home Home equipment) merchandise’ quantity gross sales are more likely to be extra secure. Nevertheless, common costs might be underneath strain because the product combine suffers

Entry-price segments will turn out to be extra related as lower-income purchasers scale back their spend, even on important gadgets, to remain inside a given and reducing budgets.

Some extent to notice is the particular scenario for IT and, to some extent, SDA. These had been the quickest rising segments for the reason that pandemic and so market saturation is now fairly excessive. Particularly for IT, which means that we don’t count on an uptick within the entry-price market in This autumn, although IT is a “should have”, as the same old alternative demand is low attributable to latest market saturation.

What are the expectations for heavy reductions throughout peak gross sales season resembling Black Friday 2022?

It’s apparent that product teams which have skilled notably weak demand over the previous months are most certainly to be discounted extra strongly – to filter out inventories.

TVs are essentially the most outstanding class for this, with heavy strain to dump quantity by way of promotion provides. This development is already strongly seen within the Jan-Aug knowledge, which exhibits the share of value promotions (value lower 15%) greater than doubled in comparison with the identical interval final 12 months.

An additional instance is cordless vacuum cleaner handsticks. After robust gross sales in 2021, there was clear deceleration in demand this 12 months. Therefore value promotion gross sales (15%+ value lower) for this product group have grown by nearly 30% in comparison with final 12 months. I additionally count on to see robust discounting for these merchandise throughout the coming This autumn peak season 2022.

A third instance is decrease priced IT merchandise; the IT product group has suffered demand drops this 12 months, after saturation in recent times. Promotion exercise has due to this fact greater than doubled throughout Jan-Aug this 12 months in comparison with final, however largely for gadgets promoting beneath USD1000.

The place can we count on reasonable or no reductions throughout Black Friday 2022?

Merchandise which can be nonetheless having fun with secure or robust demand will naturally see far much less drive for discounting. A chief instance is robotic vacuum cleaners with filth extraction (docking station). Gross sales of those have greater than doubled this 12 months in comparison with final – leading to a drop within the share of value lower promotions.

Curiously, premium IT merchandise – these above USD1000 – haven’t seen the rise in value promotions that I discussed above for lower-priced IT. Discounting exercise has been restricted to the decrease priced merchandise.

Easy methods to drive premium gross sales in 2022 peak season

The break up scenario for lower-price versus premium IT merchandise proven above is probably going all the way down to the polarization of shoppers that has been accentuated by the mounting cost-of-living disaster.

Decrease-income customers who would normally purchase within the entry or normal value bands are closely decreasing or suspending their spend. However higher-income customers who habitually purchase premium merchandise are extra ‘disaster resistant’ and proceed to purchase within the top-end of the markets, and at a comparatively secure stage of spend. Whereas there are some early indications of a transfer to ‘reasonably priced premium’, we however count on this client phase to proceed to buy within the premium finish throughout the peak season.

The query is, how can retailers and producers make it even simpler for customers to make the psychological sum that triggers them to determine on a extra premium product, somewhat than a fundamental one, this Black Friday?

Our #1 advice: present shoppers find out how to reduce the “complete lifecycle price” by investing extra upfront.

Focus your promoting on how your higher-end merchandise ship far better sturdiness, or eco-credentials, or upgradeability and repair-ability and vitality effectivity than the cheaper fashions. Present customers that, by spending a bit extra now, they get a far better financial return over the total lifecycle of the product.

Take TVs and laptops (in addition to most non-essential SDAs) as examples. Vitality effectivity performs a really low half in shoppers’ decision-making when selecting which mannequin to purchase on this space – whether it is even thought of in any respect. However a transparent winner is when you’ll be able to present that the elevated sturdiness, repair-ability and upgradability / updateability of 1 mannequin over one other delivers long-term cash financial savings for the proprietor. Which means robust {hardware} and upgradable software program, in addition to highly effective efficiency options, will set off extra premium purchases, even amongst shoppers battling with inflation.

For MDA, nonetheless, the vitality effectivity of a mannequin performs an particularly vital function for shoppers when deciding which merchandise to purchase. Greatest-in class vitality labels, in addition to low absolute vitality consumption, might be leveraged simply within the face of hovering family vitality payments. That is particularly so for fridges and freezers, that are working continually evening and day, in addition to Tumble Dryers, which use the best common quantity of vitality. In washing machines, shopping for an A-rated mannequin somewhat than a C-rated one may save 100kwh/12 months over 12 years (the typical alternative cycle for MDA). Retailers ought to urge shoppers that the long-term saving in vitality payments greater than offsets the elevated preliminary buy price of shopping for a higher-end mannequin – particularly if the worth of vitality retains rising into 2023 and past.