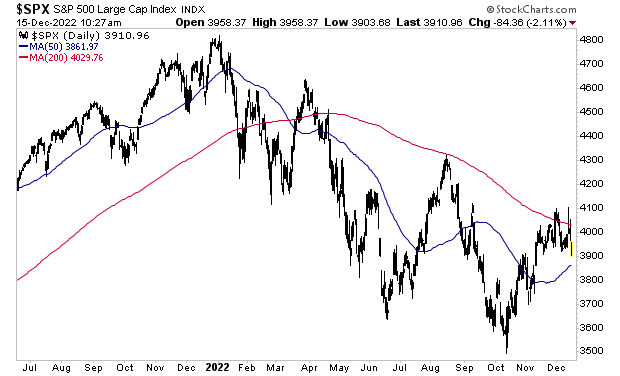

The massive information this week is that shares misplaced their 200-Day Shifting Common (DMA) once more.

Traditionally, November and December are two of essentially the most bullish months for shares. Solely April is best from a single month perspective. So, the very fact the market was unable to reclaim its 200-DMA and stay there may be EXTREMELY bearish.

The worth motion was feeble to say the least.

The bulls have all the pieces going for them: the Fed has diminished the tempo of its rate of interest hikes, the economic system will not be but in recession, and we’re in among the best months for inventory market returns: the famed Santa Rally of December.

So the truth that the bulls had been unable to get shares above their 200-DMA signifies that this current market rally was nothing greater than a Bear Market Rally, NOT the beginning of a brand new Bull Market.

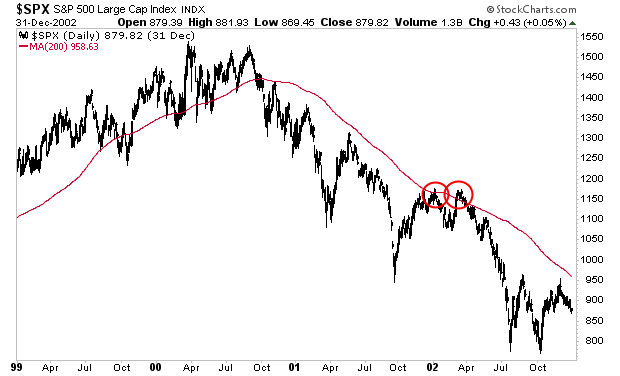

Under is a chart of what occurred to shares once they failed to keep up their 200-DMA in the course of the Bear Market of 2000-2003. I’ve highlighted this in pink circles. Shares dropped one other 30%.

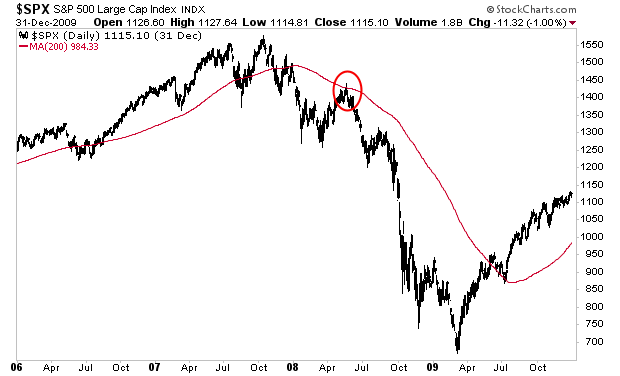

Right here’s the identical merchandise in the course of the bear market of 2007-2009. This time round shares misplaced 50%.

Sadly for anybody who’s shopping for into this narrative that shares are in a brand new bull market, the bear market is NOT over. With a recession simply across the nook, shares will quickly collapse to new lows.