Discover out what’s in retailer for lithium in 2023!

The Investing Information Community (INN) spoke with analysts, market watchers and insiders about which developments will affect lithium within the 12 months forward.

✓ Developments ✓ Forecasts ✓ High Shares

Desk of Contents:

|

|

A Sneak Peek At What The Insiders Are Saying about Lithium

“Batteries have gotten higher, cheaper and extra considerable — these are the three issues which can be driving ahead what I feel is the mega development of our instances.”

— Simon Moores, Benchmark Mineral Intelligence

“Lithium shares have run, so one must be selective. However I do see the market worth holding for a while, which implies that something coming into manufacturing within the subsequent whereas goes to get pleasure from excessive costs.

— Rodney Hooper, RK Fairness

“If there may be not sufficient provide accessible of uncooked supplies, (demand) will simply carry over into the subsequent 12 months. It should simply preserve ballooning much more than anyone would assume.”

— Ashish Patki, Livent

Who We Are

The Investing Information Community is a rising community of authoritative publications delivering unbiased,

unbiased information and schooling for traders. We ship educated, rigorously curated protection of a spread

of markets together with gold, hashish, biotech and plenty of others. This implies you learn nothing however the perfect from

all the world of investing recommendation, and by no means should waste your useful time doing hours, days or perhaps weeks

of analysis your self.

On the identical time, not a single phrase of the content material we select for you is paid for by any firm or

funding advisor: We select our content material based mostly solely on its informational and academic worth to you,

the investor.

So if you’re on the lookout for a solution to diversify your portfolio amidst political and monetary instability, this

is the place to start out. Proper now.

Lithium Forecast and Shares to Purchase in 2023

Lithium Market 2022 12 months-Finish Evaluation

What occurred to lithium in 2022? Our lithium market replace outlines key developments quarter by quarter.

Pull quotes have been supplied by Investing Information Community purchasers Argentina Lithium & Vitality and Alpha Lithium. This text just isn’t paid-for content material.

Lithium costs remained at all-time highs in 2022 as electrical car (EV) demand jumped and provide tightness elevated.

The important thing uncooked materials utilized in batteries took middle stage this previous 12 months, and from bearish oversupply calls from banks to lithium shares seeing positive aspects, it was an eventful 12 month interval for the sector.

Learn on for an summary of the elements that impacted the lithium market in 2022, from the primary provide and demand dynamics to how analysts thought the metallic carried out in every quarter of the 12 months.

Lithium market in Q1: Value rally continues

EV demand has been driving lithium costs larger, and as talked about, analysts are optimistic in regards to the market going ahead. Throughout Q1 of this 12 months, costs elevated greater than 126 % year-on-year, in accordance with Benchmark Mineral Intelligence information.

“Following the worth rally within the Chinese language home market in This fall 2021, there was an expectation that lithium costs would proceed to climb in early Q1 on the again of experiences that the market remained exceptionally tight,” Benchmark Mineral Intelligence Senior Analyst Daisy Jennings-Grey advised the Investing Information Community (INN).

“Nevertheless, as per each vital worth milestone lithium has hit within the final 12 months, every month introduced recent highs that many did not assume can be achieved so rapidly,” she mentioned on the finish of Q1.

Motivated by excessive lithium costs and the will to satisfy the surging demand, firms shared information about ramp-ups, restarts and enlargement plans through the first three months of the 12 months. “However the quarter positively painted a transparent image of the disconnect between lithium provide and downstream demand from the EV trade,” Jennings-Grey added.

With that in thoughts, all eyes turned to the 12 months’s anticipated ramp-up and enlargement tasks.

“A handful of Australian and Chilean ramp-ups stay the largest danger to our forecast,” CRU Group’s Martin Jackson advised INN in Q1. “There’s sufficient incentive for these to exceed expectations and maximize returns.”

Equally, Benchmark Mineral Intelligence’s Jennings-Grey mentioned the success of those enlargement and restart tasks would play an element within the actuality of how tight the market was by the center of 2022.

“Moreover, the impact on the spodumene feedstock bottleneck and the worth for which any accessible spodumene materials goes for on the spot market will probably be a defining consider showcasing market sentiment,” she mentioned.

Lithium market in Q2: Bearish provide calls put strain on shares

Throughout Q2, COVID-19 lockdowns in China, significantly Shanghai, gave rise to an sudden hit on demand from the EV sector, with various car manufacturing vegetation shutting down over April.

“Given rising issues over rising COVID-19 circumstances in China, mixed with experiences that Chinese language regulators have been seeking to stop costs from climbing so quickly, there have been some expectations firstly of Q2 that lithium costs may not see the identical upward climb skilled in Q1, with this expectation coming to actuality,” Jennings-Grey mentioned.

Talking with INN at this 12 months’s Fastmarkets Lithium Provide and Uncooked Supplies convention, William Adams of Fastmarkets mentioned the demand pullback can be short-term. “What we’re seeing is only a pause on the demand facet due to the lockdowns in China,” he mentioned. “And I feel it is extra that client demand has been constrained moderately than falling again.”

As lockdown measures eased, Adams was anticipating lithium costs to maneuver larger.

“I don’t assume we’ve seen the height in costs but,” he advised INN on the occasion, which was held in Phoenix, Arizona. “We anticipate to see that in direction of the top of this 12 months, or perhaps the primary quarter subsequent 12 months.”

On the provision facet, availability of fabric from home Chinese language brinesources ramped up as anticipated over late Q2 as hotter climate improved seasonal evaporation charges, analyst Daisy Jennings-Grey advised INN.

Throughout Q2, funding financial institution Goldman Sachs (NYSE:GS) launched a report that elevated traders’ worries over potential extra lithium provide; the financial institution additionally predicted a pointy correction in costs by the top of subsequent 12 months.

Nevertheless, for Benchmark Mineral Intelligence, the lithium market will stay in structural scarcity till 2025. “The lithium market will stability over the subsequent few years, nevertheless it’s unlikely that an unprecedented ramp-up of marginal, unconventional feedstock will fill the deficit. Additionally it is unlikely that demand will weaken considerably,” analysts on the agency mentioned in June.

Equally, iLi Markets’ Daniel Jimenez doesn’t assume provide will have the ability to meet up with demand at the very least till 2026 to 2027, primarily due to the issue of bringing greenfield tasks into manufacturing at full capability. “Over this time period, lithium must be the limiting consider EV gross sales,” he mentioned. “Even with demand rising very strongly, the investments the trade is making at present would possibly yield further capability in six to 10 years from now that we aren’t in a position to see at present.”

Lithium market in Q3: Value momentum continues

In Q3, lithium costs within the Chinese language home market noticed sturdy upward momentum, Jennings-Grey mentioned.

“(This was) signaled in direction of the top of Q2, when COVID-19 restrictions have been lifted in Shanghai at the beginning of June,” she defined to INN. “With demand selecting up in direction of the top of the quarter, and forward of Golden Week vacation, home costs sustained upward momentum all through the quarter, hitting recent highs in September.”

Regardless of the macroeconomic headwinds, the Chinese language home market seemed to be unaffected by the financial downturn, with the EV trade performing properly though different sectors have been experiencing weak spot.

“Outdoors of China, there have been murmurs of weakening demand from conventional sectors, significantly in Europe and North America, though this had little downward bearing on pricing as provide remained very tight,” Jennings-Grey mentioned on the finish of Q3.

Wanting over to produce, manufacturing from the brine tasks in China’s Qinghai province was anticipated to wane getting into the winter months amid cooling temperatures cool and slower evaporation charges.

“On the identical time, there may be restricted further provide anticipated to return on-line or ramp up through the quarter, and with demand anticipated to proceed to develop, it appears as if provide is about to tighten even additional,” Jennings-Grey mentioned.

Wanting ahead to costs, Benchmark Mineral Intelligence was anticipating little draw back to pricing in This fall as demand was able to ramp up; with none additional provide coming to market, availability of fabric regarded set to be even tighter.

Lithium market in This fall: Demand stays vibrant

Lithium continued to carry on to excessive ranges all through This fall, though costs began to slide by the top of the 12 months.

“We anticipated costs to proceed to climb in 2022, however not as a lot as they ended up doing,” Adams advised INN. “That mentioned, having reached a excessive at 512,500 yuan per tonne in March, we didn’t assume we had seen the excessive. We anticipated costs to rise additional earlier than dipping in direction of the top of the 12 months.”

Commenting on lithium demand throughout a panel at this 12 months’s Benchmark Week, Ashish Patki of Livent (NYSE:LTHM), which operates its lithium enterprise within the Salar del Hombre Muerto in Argentina, mentioned probably the greatest methods to deliver again what’s occurring within the provide chain and put it by way of lithium demand is to take a look at cathode output.

“China is the middle of cathode output … this 12 months’s lithium-iron–phosphate output in China is well on observe to cross 1 million tonnes in comparison with about 400,000 tonnes final 12 months,” he mentioned. “Nickel–cobalt–manganese 811 by way of output in China is within the quantity two place, and what we’re seeing is 100% development year-over-year as properly.”

Patki’s demand estimate for 2023 is that the trade will want one million tonnes of lithium carbonate equal.

“Once more, whether or not there’s provide that can have the ability to meet that, that is the large query,” he mentioned. “(Moreover) many people within the trade, we are inclined to understate, underestimate the model of purposes of lithium-ion batteries.”

For the enterprise improvement director at Livent, if provide can not catch up, demand will probably be deferred, not destroyed.

“If there may be not not sufficient provide accessible of uncooked supplies, it should simply carry over into the subsequent 12 months,” he mentioned. “It should simply preserve ballooning much more than anyone would assume.”

For lithium miners making an attempt to develop tasks and convey provide on stream, financing continues to be an enormous hurdle.

“Funding has occurred, nevertheless it’s not occurring nonetheless at a fee that anybody wants. Institutional cash continues to be not as aggressive accurately,” mentioned Simon Moores of Benchmark Mineral Intelligence. “After which, in the event that they get the cash to take it to the allowing stage, then allowing is a large hurdle — it will probably add 50 % of the time onto constructing your mine.”

The US and Canada are each mentioned to be reviewing the allowing course of for brand spanking new mines as they proceed to push for extra home and regional provide of key uncooked supplies, together with lithium.

As of December 12, 2022, Benchmark Mineral Intelligence’s lithium index was up 152.4 % year-to-date, with that quantity growing to 182.6 % on a year-on-year foundation.

Don’t overlook to comply with us @INN_Resource for real-time information updates!

Securities Disclosure: I, Priscila Barrera, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the data reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

Lithium Market Forecast: High Developments That Will Have an effect on Lithium in 2023

Learn on to be taught what analysts anticipate for the lithium market in 2023.

Pull quotes have been supplied by Investing Information Community purchasers Lake Assets and Worldwide Lithium. This text just isn’t paid-for content material.

Lithium costs soared in 2021 on the again of rising international electrical car (EV) gross sales, and in 2022 the battery metallic stayed at historic highs as traders paid increasingly more consideration to developments within the sector.

Right here the Investing Information Community (INN) appears at lithium’s 2022 efficiency, in addition to what analysts see coming for the market in 2023. Learn on to be taught their ideas on provide, demand and costs.

How did lithium carry out in 2022?

On the finish of 2021, analysts have been anticipating lithium demand to proceed outpacing provide within the 12 months forward.

Talking in regards to the lithium market in 2022, Daisy Jennings-Grey, senior analyst at Benchmark Mineral Intelligence, mentioned she anticipated an enormous hike in costs by means of 2022, however the scale at which this occurred was unprecedented.

“What was significantly stunning in comparison with 2021 was the steep climb in feedstock costs, which actually indicated the extent of provide tightness available in the market,” she defined to INN. “(It additionally) highlighted that top lithium costs aren’t simply reactionary to sentiment, however a mirrored image of the uncooked materials disconnect.”

In 2022, Williams Adams, head of base and battery metals analysis at worth reporting company Fastmarkets, was additionally anticipating costs to proceed to rise, however not as a lot as they ended up doing.

“That mentioned, having reached a excessive at 512,500 yuan per tonne in March, we didn’t assume we had seen the excessive — we anticipated costs to rise additional earlier than dipping in direction of the top of the 12 months,” he mentioned. “In the long run, costs climbed to 597,500 yuan in mid-November and have been final at 567,500 yuan, so they’re certainly slipping as 2022 attracts to a detailed.”

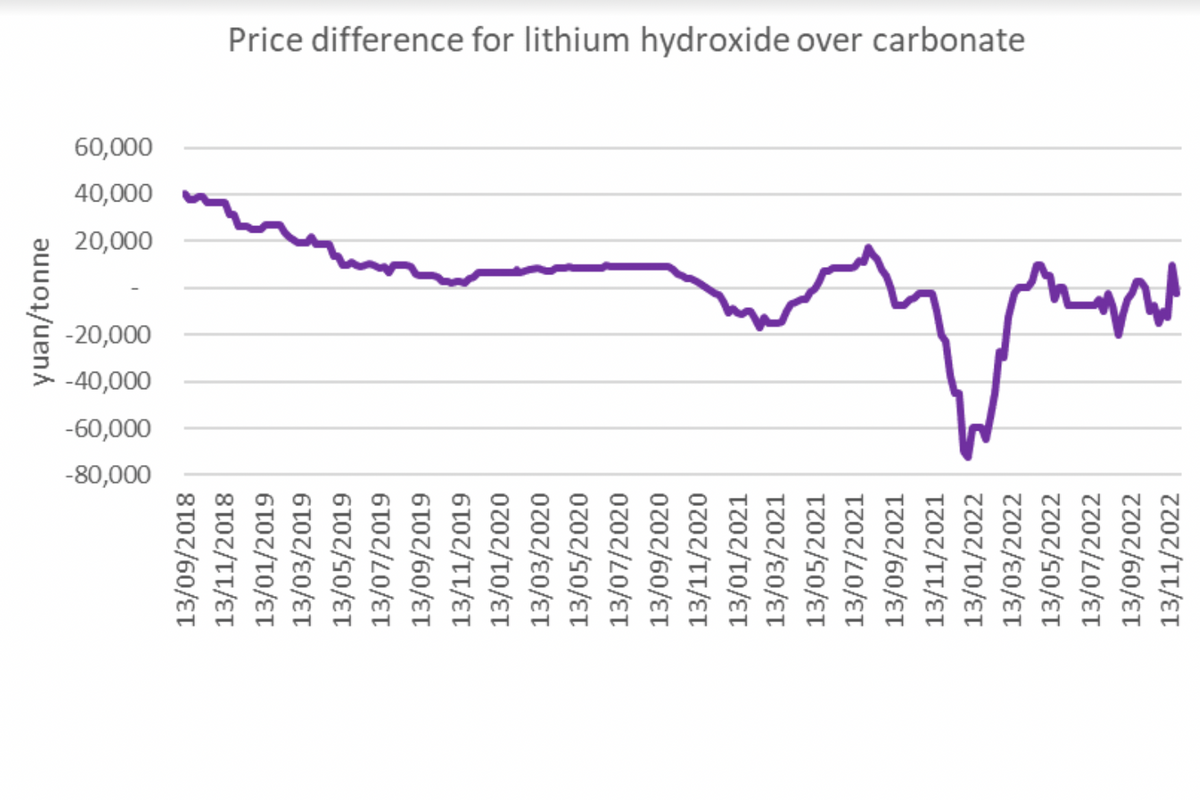

When how totally different lithium merchandise carried out, lithium carbonate costs began 2022 at a major premium to hydroxide, at 70,000 yuan, in accordance with Fastmarkets information. This distinction was pushed by sturdy demand from lithium-iron–phosphate (LFP) batteries, which use lithium carbonate.

LFP batteries have been on the rise in China and are used for shorter-range, sturdy, lower-cost EVs. LFP batteries at the moment coexist with higher-nickel cathode sorts, comparable to nickel-cobalt–manganese (NCM), which may present longer-range journey and better vitality density for customers with vary nervousness. These cathodes require lithium hydroxide as an alternative of carbonate.

“Demand for NCM was affected by a mix of stronger demand for LFP in China and as elements shortages constrained EV manufacturing in Europe and the US, which affected demand,” Adams mentioned.

In China, carbonate continues to be at a premium to hydroxide, albeit solely round 5,000 yuan.

Graph displaying worth distinction for lithium hydroxide over carbonate.

Graph by way of Fastmarkets.

Outdoors of China, nonetheless, hydroxide costs have been notably larger than carbonate costs on the spot market, in accordance with Benchmark Mineral Intelligence information.

“(This is because of) a mix of various elements, together with sturdy demand for high-nickel cathodes within the Japanese and Korean markets, in addition to battery-grade hydroxide provide tightness pushed by sanctions on Russia, the place a few of Europe’s lithium refineries are based mostly,” Jennings-Grey mentioned.

Learn extra about what occurred within the lithium market in 2022 quarter by quarter right here.

What’s the lithium provide and demand forecast for 2023?

Most lithium demand comes from the EV area, which has seen upward momentum lately. International EV gross sales surpassed the 6 million mark in 2021, and in 2023, Daniel Jimenez of iLi Markets is anticipating demand for EVs to develop at comparable ranges to 2022.

“The query is, will the lithium provide be there? And while you look roughly on the enhance of provide available in the market subsequent 12 months, the place will that be coming from? Nicely, it will likely be coming principally from incumbents,” he mentioned.

Hearken to the interview under to be taught extra about Jimenez’s ideas on lithium in 2023.

Benchmark Mineral Intelligence expects lithium demand development of round 40 % in 2023 versus 2022 — a “notable step up.”

Demand from China continues to be seen rising the quickest, however development is about to choose up significantly in the remainder of Asia. “Europe and North America may even discover a step up in demand as their downstream battery provide chains start to develop,” Jennings-Grey mentioned.

As the brand new 12 months begins, LFP batteries are anticipated to proceed taking market share from NCM, however each battery chemistries are anticipated to see sturdy development, which interprets into excellent news for each lithium carbonate and lithium hydroxide.

“We don’t anticipate such a blow out within the premium in 2023 — we anticipate each salts to roughly commerce on the identical worth degree in 2023,” Fastmarkets’ Adams mentioned.

Benchmark Mineral Intelligence can also be anticipating the LFP market to stay sturdy. “However high-nickel cathode producers have additionally carried out properly, so it appears doubtless the 2 chemical substances’ relationship will proceed to interchange,” Jennings-Grey mentioned. “Moreover, with direct hydroxide conversion from spodumene permitting for simpler manufacturing of the chemical, it does not all the time should be produced from changing carbonate, eradicating among the baked-in premium hydroxide has all the time held over carbonate.”

Wanting over to produce, Benchmark Mineral Intelligence forecasts some development, however not sufficient to see the market stability.

“As all the time, lithium tasks are prone to face delays — sometimes these are technical, however more and more it has been about discovering a educated labor pressure for the job,” Jennings-Grey mentioned.

“Different provide dangers come within the type of geopolitics and local weather change, comparable to the problems we noticed in Sichuan province in 2021 through the heatwave, or in Yichun in December when experiences of thallium within the water shut down operations for a few days.”

All in all, Benchmark Mineral Intelligence is forecasting that the market will probably be in deficit, though some further provide would possibly ease this deficit a little bit. In distinction, Fastmarkets expects a small provide surplus to develop in 2023.

“We anticipate a comparatively stronger pick-up within the US, demand to recuperate in Europe as elements shortages ease and as there are lengthy ready lists for EVs,” Adams mentioned. “However a tough financial recession in Europe or the US might turn into a headwind — we don’t anticipate it to, because of the lengthy ready lists, however that would change.”

One other issue that would dampen demand is subsidy modifications in China, Adams added. “Whereas we anticipate a small surplus subsequent 12 months, we expect the excess will probably be absorbed by restocking and can solely assist cut back the general feeling of tightness,” Adams mentioned.

Fastmarkets’ analysis group sees 2022 lithium carbonate equal (LCE) demand coming in at 698,900 tonnes, with an increase to 884,400 tonnes in 2023. In the meantime, the agency sees LCE provide rising from 679,400 tonnes in 2022 to 895,900 tonnes in 2023, making a nominal surplus of 11,500 tonnes.

What is the outlook for lithium costs in 2023?

Following one other sturdy 12 months, traders and market watchers are questioning what’s forward for lithium costs.

When requested about lithium in 2023, Fastmarkets’ Adams mentioned he expects costs to start out drifting decrease within the subsequent 12 months.

“A provide response is already underway, with further manufacturing coming from new capability, restarts and expansions,” he mentioned. “As this provide reaches the market, permitting for ramp-up points and time for materials to be certified, we anticipate the provision tightness to ease, which ought to imply customers really feel much less have to chase costs larger.”

Costs began to melt in the previous couple of weeks of December forward of Chinese language New 12 months, which comes significantly early in 2023; uncertainty associated to COVID-19 is feeding into this sentiment as properly.

“Nevertheless, it is very typical for lithium costs to right barely heading into Q1, which is when downstream demand from the EV sector is weakest,” Jennings-Grey mentioned.

As talked about, her agency is anticipating demand in 2023 to be notably larger than in 2022. “Mixed with the truth that feedstock provide is about to stay tight and spodumene offtake costs nonetheless have room to rise, based mostly on actions within the chemical substances market over early This fall, there’s nonetheless loads of upside potential for lithium carbonate and hydroxide costs in 2023,” the analyst mentioned. “Some legacy contracts take longer to meet up with the spot market as properly, so you want to issue that in too.”

It is necessary to notice that lithium traded at spot costs solely displays a portion of the market — in reality, most lithium is locked up in contracts, which in some circumstances embody mounted pricing.

“Contracts by and huge are usually not essentially based mostly on that spot worth,” Chris Berry of Home Mountain Companions mentioned. “What we’re seeing is a state of affairs the place contracts are listed, and moderately than targeted on spot costs or mounted costs, you are going to see pricing contracts embedded with floating pricing going ahead.”

For Berry, these contracts would have flooring and ceilings embedded in them to guard each purchaser and vendor.

“As a result of on the finish of the day, what we’re making an attempt to do is develop this market from a quantity perspective sustainably. And placing flooring and ceilings in contracts is a method to do this,” he mentioned.

Hearken to the interview under to be taught extra about Berry’s ideas on battery metals in 2023.

What elements will transfer the lithium market in 2023?

Talking in regards to the challenges for junior miners as 2023 begins, Jennings-Grey mentioned that funding stays a problem.

“Nevertheless, with the downstream changing into more and more switched on to the uncooked materials disconnect, this additionally presents a possibility for venture builders to see new funding coming in immediately from cathode, cell and EV producers,” she mentioned.

For his half, Adams does not envision costs falling again under incentive ranges for a few years, that means there may be lots of alternative.

“The challenges are getting by means of the allowing phases, getting labor and expert labor with the related know-how,” he commented to INN. “There are lots of downstream customers very eager to safe provide, so they need to have little problem getting financed so long as they’ve high quality tasks.”

He added that in 2023 among the warmth will come out of costs, and that would dampen sentiment.

“However this could make for a greater surroundings for mutually helpful offers and partnerships to be made, which will probably be all-important for matching customers with suppliers,” he mentioned.

When it comes to developments to look at, Jennings-Grey will probably be keeping track of various sources of lithium.

“The extent of success with reference to improvement of hard-rock belongings in Jiangxi and Africa will probably be an attention-grabbing improvement,” she mentioned. “Moreover, any breakthroughs in direct lithium extraction or various extraction strategies, though most of those tasks nonetheless appear to be targeted on the midterm moderately than close to time period.”

One other catalyst to concentrate to subsequent 12 months will probably be how immediately concerned OEMs get with the miners. “(This) might actually see venture tempo choose up if enormous investments are supplied by the purchasers who want lithium essentially the most,” Jennings-Grey mentioned.

Talking with INN at this 12 months’s Benchmark Week, a whole week of conferences centered across the lithium-ion battery provide chain, CEO Simon Moores mentioned OEMs should take management of their provide chains.

“A number of offers have been achieved with kind of development-stage junior mining, however lots of them are very weak offers,” Moores mentioned. “Actuality is these firms, these builders want onerous money to get issues up and operating.”

Hearken to the interview above to seek out out extra about Moores’ ideas on battery uncooked supplies.

Don’t overlook to comply with us @INN_Resource for real-time information updates!

Securities Disclosure: I, Priscila Barrera, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the data reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

Caspar Rawles: Cathodes, Anodes and What to Count on in 2023

INN caught up with Caspar Rawles of Benchmark Mineral Intelligence to speak in regards to the battery manufacturing area.

Talking with the Investing Information Community after this 12 months’s Benchmark Week occasion, held in Los Angeles in mid-November, Caspar Rawles, chief information officer at Benchmark Mineral Intelligence, mentioned the primary development in battery manufacturing this previous 12 months has been an enormous enhance within the quantity of manufacturing.

“A lot of new battery vegetation, plenty of new capability now producing and delivering largely into the electrical car (EV) market, however kind of rising into the vitality storage spectrum as properly,” he mentioned. “One of many key developments inside that as properly has been the continued development of lithium-iron–phosphate batteries throughout the Chinese language market particularly.”

One other key development seen in 2022 has been a extra aggressive push from governments to cut back their dependence on Asia and construct home provide chains for lithium-ion batteries. “Basically, one of many challenges that doubtlessly performs into all of this, is which you could construct the battery vegetation, you possibly can construct the EV vegetation, you possibly can construct the cathode vegetation, but when you do not have the uncooked supplies to feed them, they’re simply costly weights in your stability sheet,” Rawles mentioned.

Commenting on the cathode area, he highlighted that over 90 % of cathode manufacturing capability plans at the moment sit inside China. “Within the US and in Europe, plans have been very a lot targeted round battery manufacturing, and naturally EV manufacturing, as a result of you will have massive automakers in these areas, however that midstream hasn’t actually been properly attended to” Rawles mentioned.

“We’re beginning to see these investments occur, however constructing a brand new cathode plant is a two to a few 12 months time horizon — best-case situation. So there’s nonetheless going to be a while earlier than we see these vegetation come on-line.”

On the anode facet, the professional identified that graphite may be at a turning level.

“Simply the quantity, the speed at which the market has been rising, has significantly accelerated over the past couple of years,” he mentioned. “After we take into consideration uncooked supplies, graphite is definitely the biggest part by weight in comparison with some other battery uncooked materials, so every gigawatt hour or megawatt hour of capability that is deployed has a big effect on graphite.”

Rawles additionally shared his perception available on the market share for anodes and cathodes going ahead. Hearken to the interview above to be taught extra of his ideas, or click on right here for the total Benchmark Week playlist.

Remember to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Priscila Barrera, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the data reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

Rodney Hooper: Lithium Structural Deficit Nonetheless Forward, Mass Funding Wanted

INN caught up with Rodney Hooper of RK Fairness at this 12 months’s Benchmark Week to speak about what’s been occurring within the lithium area.

Lithium costs stay at historic highs after rallying in 2021 on sturdy demand from the electrical car sector.

RK Fairness’s Rodney Hooper thinks a structural deficit is within the playing cards, even amid bearish oversupply calls from funding banks.

“I preserve mentioning it — the one solution to get this market in stability, or in oversupply, is to have an extra of upstream funding, and we simply have not seen that,” he advised the Investing Information Community.

“We’ve not seen sufficient tasks permitted. We do not see sufficient tasks below development. And if something, we’re seeing new tasks that have been assumed to be coming on-line already be barely delayed.”

Talking on the sidelines of this 12 months’s Benchmark Week, held in Los Angeles, Hooper mentioned he expects 2023 to have a provider shortfall at the very least as massive as this 12 months, if not greater. “I’ve readjusted my worth forecasts, and I see round US$65,000, US$70,000 a tonne actually as a worth holding,” he mentioned. “So I do not see any kind of dip till 2025.”

Despite the fact that lithium shares have suffered in current weeks, most have seen year-on-year share worth will increase because of larger lithium costs, sturdy demand and optimism in regards to the electrical car sector. However is it nonetheless time to purchase lithium shares?

“Lithium shares have run, so one must be selective,” Hooper mentioned. “However I do see the market worth holding for a while, which implies that something coming into manufacturing within the subsequent whereas goes to get pleasure from excessive costs.”

Hooper believes there’s nonetheless worth to be present in some early stage firms.

“I nonetheless assume that early stage firms that may drill up have lots of alternative if we’re going to see elevated costs for many of this decade, which lots of us consider that you’ll, and never essentially at these ranges, however excessive sufficient to be very worthwhile and properly above what’s priced into the market,” he mentioned.

Hooper additionally shared his insights on what to anticipate within the battery metals area in 2023, and which different battery metallic other than lithium he’s keeping track of. Hearken to the interview above for extra, or click on right here for the total Benchmark Week playlist.

Remember to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Priscila Barrera, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the data reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

High 9 Lithium Shares (Up to date December 2022)

Because the 12 months nears its finish, the highest lithium shares by share worth efficiency on US, Canadian and Australian exchanges are up considerably year-to-date.

Editor’s word — This text was initially targeted on the highest Canadian lithium shares, however has been expanded to cowl the highest lithium shares globally. Click on right here to learn in regards to the high Canadian lithium shares.

Lithium broke its 2021 highs in 2022, rising to new ranges. Though costs cooled barely in the midst of the 12 months, they climbed considerably on the finish of Q3 and into This fall, slowing down barely to finish the 12 months.

The Investing Information Community not too long ago spoke with specialists in regards to the developments that affected lithium in 2022, and one key concern that’s steadily driving costs is the shortage of provide in comparison with looming demand potential.

Corporations around the globe are working to reply that concern. In Australia, the 12 months noticed many firms on the ASX pivot to lithium, both tapping lithium potential of their pre-existing properties or buying new ones. As for the US, the Biden administration not too long ago introduced US$2.8 billion in grants for battery metals firms within the US.

Right here the Investing Information Community takes a have a look at the highest lithium shares with year-to-date positive aspects.

The listing under was generated utilizing TradingView’s inventory screener on December 14, 2022, for Canadian and US firms, and December 22, 2022, for Australian firms. It contains firms listed on the NYSE, NASDAQ, TSX, TSXV and ASX; all high lithium shares had market caps above $10 million when information was gathered.

High US lithium shares

1. Sigma Lithium (NASDAQ:SGML)

12 months-to-date achieve: 198.77 %; market cap: US$3.28 billion; present share worth: US$31.70

In Minas Gerais, Brazil, Sigma Lithium has its Grota do Cirilo hard-rock lithium venture, the place it’s at the moment setting up Section 1 operations with anticipated commissioning by the top of the 2022 12 months. Sigma anticipates Section 1 manufacturing of 270,000 metric tons (MT) yearly and Section 2 manufacturing of 531,000 MT. Along with that, the corporate is constructing a greentech dense media separation manufacturing plant, which it says will make its operations vertically built-in.

On Might 26, Sigma filed a consolidated technical report that appears at two preliminary manufacturing phases for Grota do Cirilo. The built-in operation would supply feedstock spodumene ore from the corporate’s Section 1 and Section 2 lithium deposits to provide battery-grade, high-purity lithium focus. This enlargement situation “will doubtlessly place (Sigma) because the world’s fourth largest lithium producer.” In mid-August, Sigma shared an replace on its “transformative” Q2, mentioning the beforehand introduced information that it had elevated the useful resource at Grota do Cirilo by 50 %; a Section 3 technical report has now been filed. Its share worth continued to develop all year long, reaching a year-to-date excessive of US$37.46 on October 27 after beginning the 12 months at US$10.57.

Halfway by means of November, Sigma launched a Q3 replace, offering additional data on its many development actions and the graduation of spodumene ore mining that month. Most not too long ago, December 8 noticed the announcement of enlargement and financing milestones — in accordance with Sigma, it has acquired optimistic financial outcomes from a research targeted on the potential to spice up output at Grota do Cirilo from 270,000 MT in 2023 to 768,000 MT within the operation’s second 12 months.

2. SQM (NYSE:SQM)

12 months-to-date achieve: 75.83 %; market cap: US$25.53 billion; present share worth: US$89.97

SQM is among the world’s largest lithium firms. It produces lithium out of Chile’s Salar de Atacama and brings it to the market within the type of lithium carbonate and lithium hydroxide. SQM is creating the hard-rock Mount Holland lithium venture in Australia by means of a three way partnership with Wesfarmers (ASX:WES,OTC Pink:WFAFF). The corporate locations a heavy emphasis on the sustainability of its operations, with a manufacturing course of that entails 97.4 % photo voltaic vitality.

On March 2, SQM launched its 2021 earnings report, together with web earnings of US$585.5 million in comparison with US$164.5 million for 2020. SQM’s share worth spiked in Might and continued to rise by means of late Might, reaching what was then a year-to-date excessive of US$113.33. On August 17, SQM shared its Q2 and H1 earnings for this 12 months. In H1, the corporate noticed US$1.66 billion in web earnings, which was a rise of 940 % over its web earnings of US$157.8 million in H1 2021.

In September, SQM celebrated 25 years of lithium manufacturing in Chile, and mirrored on its path to that time; it additionally shared its imaginative and prescient for the Salar Futuro venture, which is concentrated on growing the sustainability of extraction from the Salar de Atacama. Choices being checked out embody superior evaporation applied sciences and direct lithium extraction. On September 14, the corporate’s share worth hit a recent excessive of US$133.52. In its Q3 outcomes, launched in mid-November, SQM reported US$1.1 billion in web earnings for the quarter, and US$1.63 billion in gross revenue. Most not too long ago, SQM introduced an interim dividend of US$3.08 per share.

3. Albemarle (NYSE:ALB)

12 months-to-date achieve: 4.7 %; market cap: US$29.04 billion; present share worth: US$247.86

Albemarle is a lithium large that produces lithium, bromine and catalyst options at operations around the globe. It has a 49 % curiosity within the firm whose subsidiary, Talison Lithium, owns and runs the Greenbushes mine, in addition to a 60 % curiosity in Mineral Assets’ (ASX:MIN,OTC Pink:MALRF) Wodgina mine. Each of those are hard-rock lithium mines in Western Australia. The corporate runs the Silver Peak lithium mine in Nevada, which it calls the one producing lithium mine in North America; it additionally creates high-quality lithium merchandise. Its most important lithium operations are at Chile’s Salar de Atacama.

On June 13, Albemarle inaugurated its third chemical conversion plant in Chile, which it mentioned ought to double its lithium manufacturing, in addition to decrease water consumption by 30 % per MT. On the finish of August, Albemarle shared plans to create two international enterprise items, considered one of which is able to deal with lithium. The corporate expects the items to be energetic as of January 1, 2023.

Albemarle acquired US$150 million on October 19 to assist fund a commercial-scale lithium concentrator facility in North Carolina; the cash got here as a part of the brand new US battery provide chain grant program. Per week later, the corporate acquired Guangxi Tianyuan New Vitality Supplies, which owns a lithium conversion facility that may convert 25,000 MT of lithium carbonate equal per 12 months.

Information continued for the corporate, which shared its third quarter outcomes, together with a achieve of 318 % in web lithium gross sales over 2021. On November 9, the corporate introduced it was investing as much as US$540 million into its bromine operations in Arkansas, US. The information drove its share worth considerably, bringing it to a year-to-date excessive of US$325.38 on November 11. Days later, the corporate introduced it had employed Sean O’Hollaren as chief exterior affairs officer.

Albemarle introduced on December 13 that it’ll set up the Albemarle Expertise Park in Charlotte, North Carolina, and has acquired a spot at which to take action. The corporate is investing US$180 million within the facility, which will probably be “a world-class facility designed for novel supplies analysis, superior course of improvement, and acceleration of next-generation lithium merchandise to market.”

High Canadian lithium shares

1. Tearlach Assets (TSXV:TEA)

12 months-to-date achieve: 655.93 %; market cap: C$140.39 million; present share worth: C$2.23

Tearlach Assets has spent the 12 months increase a portfolio of lithium tasks in Ontario’s Thunder Bay space.

After buying and selling comparatively flatly by means of the top of August, the corporate noticed enormous positive aspects within the final 4 months of the 12 months. The agency launched a company replace on September 19 that discusses the NI 43-101 technical report for its Savant venture, in addition to its choice settlement to accumulate 100% of the Ferland venture. Later that month, Tearlach signed choice agreements to accumulate 100% of each the Wesley and the Harth lithium tasks.

Tearlach’s share worth actually started to climb after the October 4 appointments of Paul Chow and John Bean to the corporate’s board of administrators; each have expertise in a variety of industries. On October 27, the corporate shared it was commencing a C$5 million personal placement, which later closed in mid-November at C$7.59 million. After beginning the month at C$0.58, Tearlach ended at C$1.48.

December additionally introduced vital information for the lithium firm. On December 5, Tearlach introduced additional acquisitions, this time the choice to accumulate a 100% curiosity in Pakwan and Margot Lake within the Electrical Avenue area.

“Including to an already thrilling portfolio, the Pakwan and the Margot are situated in essentially the most prolific lithium mining developments within the Americas,” CEO Ray Strafehl commented in a launch. “The Initiatives are in a area with a number of discoveries, beneficial geology, confirmed metallurgy, and most significantly, on-trend and subsequent to one of many highest-grade lithium tasks within the Americas.”

Tearlach’s most up-to-date information got here on December 8 with the appointment of Morgan Legstrom as CEO and director of the corporate. Its share worth hit a year-to-date excessive of C$2.25 on December 15.

2. Sigma Lithium (TSXV:SGML)

12 months-to-date achieve: 228.46 %; market cap: C$4.24 billion; present share worth: C$42.70

For details about Sigma Lithium and what has pushed its share worth, see its entry within the high US lithium firms part above.

3. Nevada Dawn Metals (TSXV:NEV)

12 months-to-date achieve: 171.43 %; market capitalization: C$17.62 million; present share worth: C$0.19

Nevada Dawn Metals, which underwent a identify change from Nevada Dawn Gold in September, wholly owns two lithium tasks, the Gemini and Jackson Wash belongings, that are situated within the Lida Valley basin in Nevada. Based on Nevada Dawn, the Lida Valley basin shares comparable geography to the close by Clayton Valley basin, the place Albemarle’s (NYSE:ALB) Silver Peak lithium mine is situated. Along with its lithium properties, the corporate owns 100% of the Coronado VMS venture, 20 % of the Kinsley Mountain gold venture and 15 % of each the Treasure Field copper venture and the Lovelock Mine cobalt venture.

In Q1, Nevada Dawn Metals noticed little motion, even because it commenced exploration at Gemini. It wasn’t till the corporate shared its first drill outcomes on April 18 that its share worth broke above C$0.10, leaping from C$0.08 to C$0.14 in a single day. Additional exploration outcomes on the venture, together with 1,101 elements per million lithium over 730 toes, continued to drive its share worth larger.

After rising by means of Might and early June, the corporate’s share worth hit an H1 excessive of C$0.36 on June 10 off the again of June 6 exploration outcomes displaying 327.7 milligrams of lithium per liter of water over 220 toes, in addition to personal placement information. In late July, Nevada Dawn acquired an exploration allow for Gemini that elevated the variety of boreholes on the venture to 12, six of which have been deliberate for a Section 2 drilling program on the venture. The corporate’s share worth spiked considerably, from C$0.22 on August 23 to C$0.38 on August 30, a brand new year-to-date excessive for the corporate, though it didn’t launch information throughout that point interval.

Section 2 drilling commenced in mid-October and has two aims: to check lithium-bearing brine and sediments at better depths in comparison with earlier exploration, and to check the width of a beforehand recognized lithium-bearing zone. In November, Nevada Dawn introduced on Willem Duyvesteyn as a metallurgical advisor. Most not too long ago, on December 6, the corporate acquired preliminary geochemical analyses for one of many boreholes at Gemini; outcomes present that it has intersected lithium-bearing sediment.

High Australian lithium shares

1. Tyranna Assets (ASX:TYX)

12 months-to-date achieve: 283.33 %; market cap: AU$57.73 million; present share worth: AU$0.023

Tyranna Assets (ASX:TYX) was beforehand targeted on gold and nickel, however pivoted this 12 months to lithium. After buying 80 % of Angolan Minerals in Might, Tyranna now owns the Namibe lithium venture within the Giraul pegmatite subject in Angola.

Though Tyranna’s share worth carried out comparatively flatly early in 2022 — staying round AU$0.006 — the corporate’s acquisition of the Namibe venture started driving it upwards, and shares of Tyranna have steadily moved larger over the course of the 12 months. The corporate launched an replace on exploration in early August, sharing that Angolan Minerals had accomplished a Section 1 exploration program that included 50 samples. In late August, outcomes from the exploration revealed a mean grade of three.21 % lithium oxide between the samples, with a excessive level of 9.74 %.

Tyranna’s share worth hit a year-to-date excessive of AU$0.056 on September 11, the day earlier than it revealed its plan for a maiden drilling program at Namibe’s Muvero prospect. The corporate anticipated that it might be full by the top of November. Nevertheless, on November 7, the corporate launched early findings from the primary three drill cores on the web site — though one core did present seen spodumene, among the drilling was not intersecting what the corporate had anticipated based mostly on its preliminary exploration. Tyranna modified its drill program in response to those outcomes, with its share worth dropping from AU$0.042 to AU$0.032 in a single day.

Tyranna accomplished the revised drill program on December 6, sharing that assays must be accessible in February 2023. Thus far, drilling has confirmed the presence of lithium under floor, and Tyranna has mentioned the data gained from this system will probably be used to plan its optimized follow-up drilling in 2023. This information triggered its share worth to drop once more, falling from AU$0.032 to AU$0.025 by December 7. Though This fall has been much less optimistic for Tyranna, it’s nonetheless up considerably year-to-date.

2. Latin Assets (ASX:LRS)

12 months-to-date achieve: 244.83 %; market cap: AU$207.51 million; present share worth: AU$0.10

Latin Assets (ASX:LRS) is an exploration firm on the lookout for metals that can assist transfer the world in direction of net-zero emissions. The corporate is concentrated on lithium and copper tasks in South America, and in Australia it has the Cloud 9 kaolin-halloysite venture. Its lithium tasks are the Salinas pegmatite venture in Brazil and the Catamarca pegmatite venture in Argentina.

In late March, Latin Assets found excessive lithium grades throughout exploration at Salinas, inflicting its share worth to soar over the subsequent two weeks. The corporate launched assays from the venture with a peak grade of three.22 % lithium hydroxide; shares moved from AU$0.06 the day of the discharge to AU$0.22 by April 6, a year-to-date excessive. As Q2 progressed, Latin Assets moved decrease.

August noticed extra optimistic motion for Latin Assets, when drilling confirmed a brand new discovery west of Salinas’ Colina prospect. Outcomes from metallurgical take a look at work acquired in late August have been described as optimistic, with 78.72 % of the lithium oxide recovered right into a focus grading a “very excessive” 6.57 % lithium oxide.

In early October, the corporate introduced a new discovery on the Colina prospect after drill outcomes confirmed a number of high-grade lithium-bearing pegmatites. November introduced information that Latin Assets was again on the bottom in Argentina to recommence subject work on the Catamarca venture, and the corporate shared particulars on what its subsequent steps on the venture will seem like.

Its two most up-to-date items of reports have been each associated to the Salinas venture. The corporate acquired additional metallurgical take a look at work outcomes, reporting restoration enhancements because the final batch, with a mean of 80.5 % lithium oxide grading 6.6 %. On December 6, Latin Assets launched the maiden useful resource for the Corina deposit, with indicated and inferred sources totalling 13.3 million MT at 1.2 % lithium oxide.

3. Cygnus Gold (CY5:AU)

Firm Profile

12 months-to-date achieve: 111.11 %; market cap: AU$69.87 million; present share worth: AU$0.38

Cygnus Gold (ASX:CY5) is one other ASX firm that not too long ago pivoted to lithium. The corporate has an choice to earn as much as 70 % within the Pontax lithium venture in Quebec, which it has targeted on exploring within the latter half of 2022. Cygnus additionally has the Mitsumis lithium venture in Quebec, in addition to the Bencubbin polymetallic and Stanley gold tasks in Australia.

In late September, Cygnus acquired 30 kilometers of strike size at which samples have graded as much as 2.8 % lithium oxide. The brand new land is adjoining to Pontax. October 4 noticed the appointment of David Southam to the corporate’s board of administrators; he was not too long ago acknowledged as Mining CEO of the 12 months for ASX-listed firms. As of November 1, he grew to become a non-executive director, and in February 2023 he’ll turn into a managing director. The corporate’s share worth rose considerably the day of this information, leaping from AU$0.25 to AU$0.37, and continued to climb by means of October.

On October 13, Cygnus introduced it might be elevating AU$6.3 million to advance Pontax by means of the usage of absolutely paid peculiar shares priced at AU$0.73 every. As of November 8, diamond drilling at Pontax had commenced, with 10,000 meters deliberate for the maiden drill program. The corporate’s share worth reached a year-to-date excessive of AU$0.60 on November 14.

The primary outcomes from the diamond drilling got here on November 29. Based on the corporate, the “first two holes drilled at Pontax verify a 75m-thick pegmatitebearing zone, with a number of stacked spodumene-bearing pegmatite dykes.” Because of the optimistic outcomes seen from the drilling, the corporate has accomplished an AU$8 million personal placement with the aim of speedy exploration, with extra drill rigs being mobilized in January and February.

FAQs for investing in lithium

How a lot lithium is on Earth?

Whereas we do not know the way a lot whole lithium is on Earth, the US Geological Survey estimates that international reserves stand at 22 billion MT. Of that, 9.2 billion MT are situated in Chile, and 5.7 billion MT are in Australia.

The place is lithium mined?

Lithium is mined all through the world, however the two nations that produce essentially the most are Australia and Chile. Australia’s lithium comes from primarily hard-rock deposits, whereas Chile’s comes from lithium brines. Chile is a part of the Lithium Triangle alongside Argentina and Bolivia, though these two nations have a decrease annual output.

Rounding out the highest 5 lithium-producing nations behind Australia and Chile are China, Argentina and Brazil.

What’s lithium used for?

Lithium has all kinds of purposes. Whereas the lithium-ion batteries that energy electrical automobiles, smartphones and different tech have been making waves, it is usually utilized in prescribed drugs, ceramics, grease, lubricants and heat-resistant glass. Nonetheless, it’s largely the electrical car trade that’s boosting demand.

Is lithium funding?

The lithium worth has seen enormous success over the previous 12 months, and plenty of shares are up alongside that. It is as much as traders to determine if it is time to get in available on the market, or in the event that they’ll attempt to anticipate a dip.

All kinds of analysts are bullish available on the market as electrical automobiles proceed to prosper, and lithium demand from that section alone is predicted to proceed to rise. These specialists consider the lithium story’s power will proceed over the subsequent a long time as producers battle to satisfy quickly rising demand.

put money into lithium?

Not like many commodities, traders can not bodily maintain lithium because of its harmful properties. Nevertheless, these seeking to get into the lithium market have many choices with regards to put money into lithium.

Lithium shares like these talked about above might be choice for traders within the area. For those who’re seeking to diversify as an alternative of specializing in one inventory, there may be the International X Lithium & Battery Tech ETF (NYSE:LIT), an exchange-traded fund (ETF) targeted on the metallic. Skilled traders can even have a look at lithium futures.

purchase lithium shares?

Lithium shares may be discovered globally on numerous exchanges. By the usage of a dealer or an investing service comparable to an app, traders can buy particular person shares and ETFs that match their investing outlook.

Earlier than shopping for a lithium inventory, potential traders ought to take time to analysis the businesses they’re contemplating; they need to additionally determine what number of shares will probably be bought, and what worth they’re keen to pay. With many choices available on the market, it is vital to finish due diligence earlier than making any funding choices.

It is also necessary for traders to maintain their targets in thoughts when selecting their investing methodology. There are various elements to think about when selecting a dealer, in addition to when investing apps — just a few of those embody the dealer or app’s repute, their payment construction and funding model.

Don’t overlook to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Lauren Kelly, at the moment maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: Nevada Dawn Metals and Latin Assets are purchasers of the Investing Information Community. This text just isn’t paid-for content material.