Return on gross sales is among the most necessary metrics your group can monitor to gauge the well being of your online business and check the logic behind your budgeting and gross sales methods. The determine is reported as a ratio and reveals how a lot of your total income leads to revenue versus paying down working prices.

Retaining tabs in your ROS is central to understanding how your organization is performing and making sound choices for your online business — so right here, we’ll discover the idea of return on gross sales a bit additional, overview the best way to calculate it, contact on why it is necessary, go over what a very good one seems like, and see some methods you’ll be able to leverage to enhance yours.

What’s return on gross sales?

Return on gross sales (ROS) — also referred to as working margin, EBIT margin, working revenue margin, and working earnings margin — is a ratio that considers your working earnings relative to your internet gross sales. The determine is usually expressed as a proportion.

In the end, return on gross sales is a metric that reveals how a lot of your gross sales income is translating to revenue, relative to working prices — making it one of many higher metrics for gauging the effectivity and effectiveness of your budgeting and gross sales methods.

Return on gross sales is commonly conflated with related metrics — together with return on funding and return on fairness. Let’s check out the important thing components that set ROS aside from these different figures.

Return on Gross sales vs. Return on Funding

Return on funding (ROS) represents the ratio between an organization’s internet earnings and total funding — it is in the end used to gauge how successfully an organization is utilizing the funds shareholders are offering. It is calculated by dividing a enterprise’s internet earnings by the price of funding.

ROI and ROS are related in that they are each used to measure effectivity — the excellence between the metrics is in every one’s respective reference level for that measurement. ROI reveals how effectively a enterprise is performing with respect to its investments, whereas ROS represents how effectively a enterprise is performing with respect to its gross sales income.

Return on Gross sales vs. Return on Fairness

Return on fairness (ROE) is just like ROI in that it measures effectivity because it stems from investor involvement. It is calculated by dividing internet earnings by shareholders’ fairness. Like return on funding, return on fairness differs from return on gross sales in the case of the reference level it makes use of to gauge efficiency — ROE considers fairness whereas ROS considers gross sales income.

Find out how to Calculate Return on Gross sales

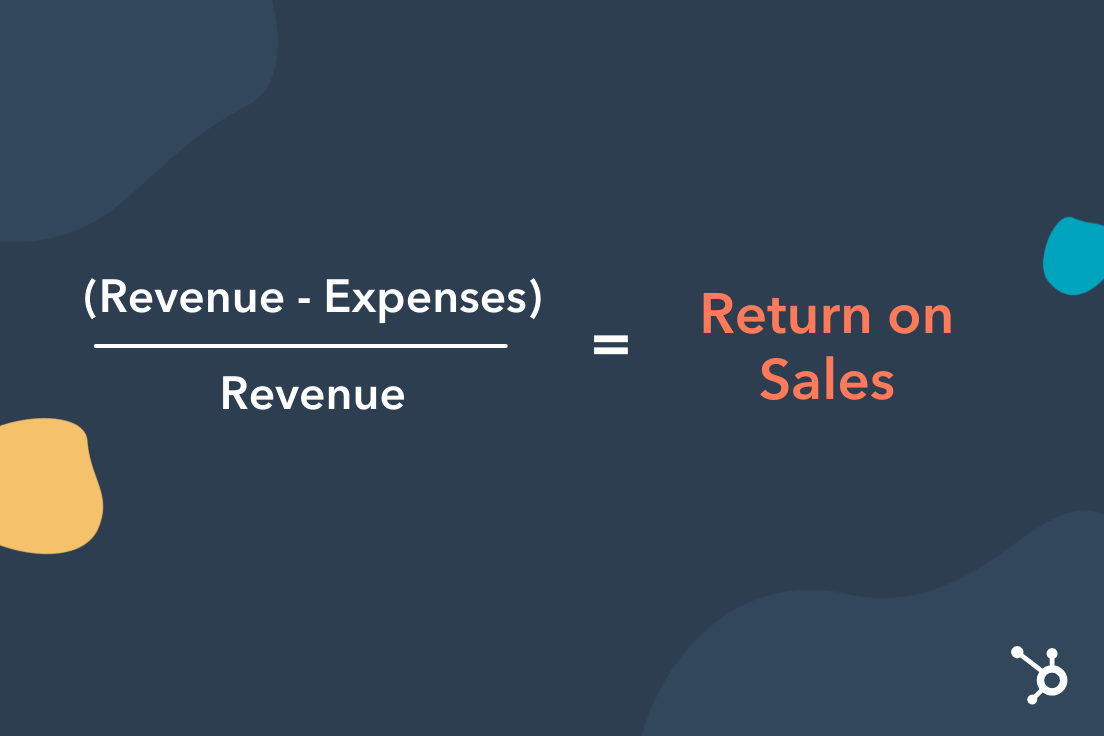

Return on gross sales is calculated by dividing your online business’s working revenue by your internet income from gross sales.

Return on Gross sales Instance

Let’s say your online business had $500,000 in gross sales and $400,000 in bills this previous quarter.

In case you needed to calculate your return on gross sales, you’d first decide your revenue by subtracting your expense determine out of your income. On this instance, you’d have $100,000 in revenue. You’d then divide that revenue determine by your whole income of $500,000 — providing you with a ROS of .20.

ROS is usually reported as a proportion, so normally, you’d be anticipated to multiply that closing quantity by 100 and use that to report your ROS — on this case, it could be 20%.

That proportion represents what number of cents you make in revenue for each greenback you earn in gross sales. Right here, your ROS could be 20 cents per greenback.

.jpeg?width=1080&name=Return%20on%20Sales%20Example%20(1).jpeg)

Return on Gross sales Formulation

To calculate return on gross sales, subtract your bills out of your income and divide that determine by your income. Return on Gross sales = (Income – Bills) / Income

Why Is Return on Gross sales Essential?

Why Is Return on Gross sales Essential?

Return on gross sales is among the most simple figures for figuring out an organization’s total efficiency — particularly in the case of the well being and effectiveness of your gross sales org.

A strong return on gross sales signifies that your organization is probably going working effectively, making sound choices, and pursuing viable gross sales alternatives. Stakeholders and collectors are sometimes within the metric as a result of it offers an correct overview of an organization’s reinvestment potential, means to pay again loans, and potential dividends.

ROS can be one of many extra dependable figures for measuring year-over-year efficiency. An organization’s income and bills might fluctuate over time, so larger income won’t be probably the most correct metric of an organization’s profitability.

In case you’re producing $1,000,000 in income with an ROS of two% after producing $250,000 in income with an ROS of 8%, it’d imply you are sacrificing effectivity as you scale — and it’s good to reevaluate your gross sales methods, broader inner operations, goal personas, or every other components that may be weighing you down.

It may also be used to check your organization’s efficiency, relative to different corporations. That being mentioned, return on gross sales can fluctuate considerably from business to business and scale to scale. So in the event you’re utilizing ROS to check your online business with one other, it solely is smart if that enterprise is your area.

What is an efficient return on gross sales?

A strong ROS means you are producing appreciable revenue out of your gross sales efforts — so clearly, the next return on gross sales ratio displays higher on each your gross sales group’s and broader enterprise’s effectiveness, effectivity, and total well being.

A great return on gross sales ratio both will increase or holds regular as your online business generates extra income. In case you initially had an ROS of 10% whereas producing $100,000 in income however a ROS of 5% whenever you improve your income to $1,000,000, it could imply your gross sales org is working much less effectively — that you simply’re possible pursuing fewer profitable or viable gross sales alternatives than you ought to be.

And as I touched on within the earlier part, the idea of a “good return on gross sales” is relative — the determine hinges on components like your organization’s scale and business. That mentioned, as a common rule of thumb, a very good return on gross sales tends to hover round 5-10%.

Find out how to Enhance Return on Gross sales

The one strategy to improve return on gross sales is to place an even bigger hole between your income and the associated fee it takes to supply your product. There are a couple of methods to perform that.

Enhance the value of your product.

This may be probably the most simple strategy to improve return on gross sales — it is not less than the one you could have probably the most management over. However “simple” does not imply “simple” on this context. It takes lots of cautious consideration and market analysis to hold out successfully.

Going this highway might simply as simply backfire on you. In case you increase your worth too radically and undermine your market place or alienate your base, you will wind up with much less income — and a worse return on gross sales determine than you began with.

Pursue reductions and value reductions in your product stock or supplies.

This technique performs on the opposite component of return on gross sales — your bills. In case you’re reluctant to lift your worth, you may need to discover this risk. Attain out to your suppliers, and see in the event you can negotiate higher charges in your product stock or supplies.

If they will not budge, strive wanting into different distributors to see in the event that they’re keen to supply decrease costs. A technique or one other, actively and aggressively pursue reductions that may have a significant affect in your manufacturing prices with out adversely impacting your income stream — once more, one thing a lot simpler mentioned than accomplished.

Strip again the way you produce or promote your product.

That is one other technique companies can use to cut back prices and, in flip, enhance return on gross sales — however it’s a very dangerous, troublesome, and typically ethically doubtful highway to take. Stripping again the way you produce or promote your product may imply adjusting compensation or letting some staff go.

You additionally should be extraordinarily cautious and be sure that shifting the way you pay your staff or altering what’s anticipated from them does not adversely affect total productiveness. You must maintain your income not less than considerably constant if this technique goes to work.

Return on Gross sales vs. Revenue Margin

The phrases “return on gross sales” and “revenue margin” are sometimes used interchangeably, however these semantics are solely partially correct. There are completely different sorts of revenue margins — solely one in every of which is identical as return on gross sales.

Internet revenue margin

Internet revenue margin (typically known as fee of return on internet gross sales) is a ratio that compares internet income and gross sales. You may calculate this determine by dividing an organization’s internet revenue after taxes and whole internet worth of gross sales. If your organization had income of $150,000 after taxes and internet gross sales of $100,000, you’d have a internet revenue margin of 1.5 or 150%.

Internet revenue margin is a metric that helps corporations evaluate how they’ve carried out over completely different time durations. Corporations usually use this determine when wanting over previous efficiency.

Gross revenue margin

You may calculate a enterprise’s gross revenue margin by subtracting the price of all items offered from the worth of the gross sales after which dividing that determine by the worth of gross sales. In case you had gross sales of $50,000 and the price of items offered was $20,000, you’d subtract $20,000 from $50,000 and divide the distinction of $30,000 by the gross sales worth of $50,000 — providing you with a gross revenue margin of .6 or 60%.

Gross revenue margin is mostly used as a benchmark for evaluating completely different corporations. It’s a great way to gauge how effectively a selected firm can generate income relative to its rivals.

Working revenue margin

Working revenue margin is one other time period for return on gross sales. Use the ROS equation to search out this determine.

Return on Gross sales Ratio Calculator

In case you’re considering a return on gross sales ratio calculator to make discovering yours a bit of simpler, here is one from Omni Calculator.

Picture Supply: Omni Calculator

Picture Supply: Omni Calculator

Return on gross sales is a crucial metric with a wide range of functions. As a enterprise proprietor, it’s essential to have an image of yours. If you wish to know the way effectively you’re turning over revenue, it’s best to perceive what ROS is and the best way to calculate it your self.

.jpg#keepProtocol)