Pull quotes have been offered by Investing Information Community purchasers CanAlaska Uranium and Skyharbour Sources. This text isn’t paid-for content material.

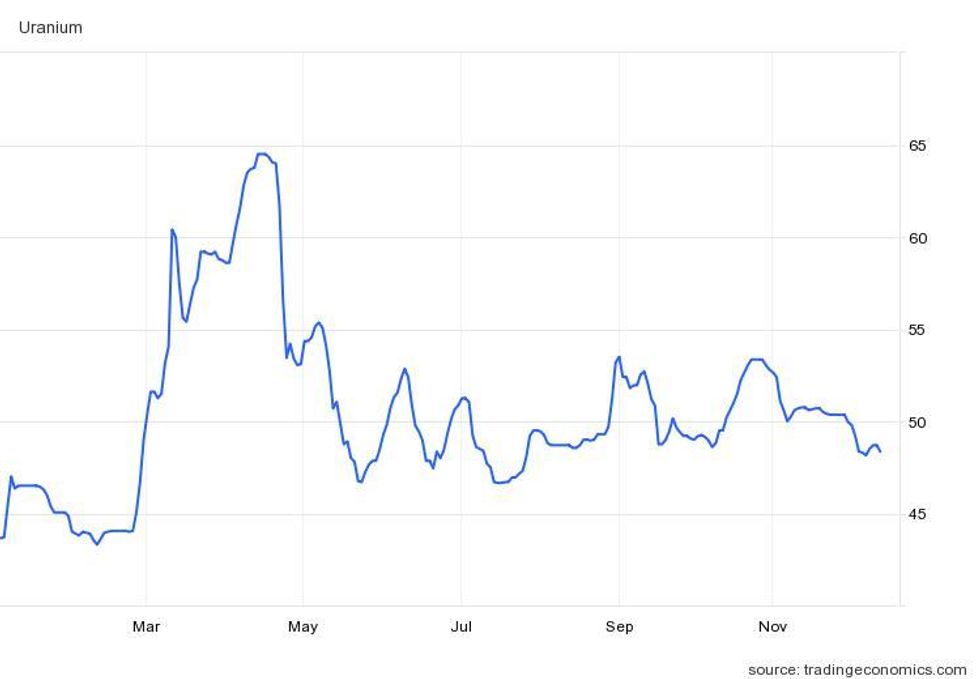

After climbing 41 % in 2021, uranium’s rise was extra muted this 12 months. The vitality gasoline is about to finish the 12 months simply 9.94 % larger than its January begin, however has nonetheless achieved effectively amid international financial turmoil and geopolitical strife.

Potential provide challenges associated to conversion and enrichment added tailwinds to the market early within the 12 months, propeling uranium costs to an 11 12 months excessive of US$64.47 per pound in April. Efforts to tame inflation eroded a few of uranium’s worth as the primary half of the 12 months neared its finish, and costs had slipped to US$46.92 on the finish of Might.

Constructive fundamentals across the want for nuclear vitality prevented uranium from falling beneath US$48 June by December. Learn on for extra particulars on the commodity’s quarter-by-quarter efficiency in 2022.

Uranium value in Q1: Geopolitical instability a key driver

The 12 months began with U3O8 buying and selling for US$43.66 as main uranium producer Kazakhstan confronted civil unrest — protesters within the nation took to the streets to voice their displeasure about points similar to vitality prices.

By February 9, costs had fallen to US$43.15, their lowest level in 2022. Nevertheless, Russia’s late February invasion of Ukraine served as a development catalyst, sending uranium values above US$50 by the start of March.

As tensions continued to accentuate between Russia and Ukraine, considerations over the way forward for Russia’s function within the conversion and enrichment section of the nuclear gasoline cycle elevated.

In keeping with UxC, costs for conversion jumped from US$15 per kilogram of uranium to US$40, the place they proceed to carry.

“Conversion provide has grow to be extraordinarily tight and is anticipated to stay weak to provide shocks over the following decade as manufacturing capability has been decreased whereas demand is rising as a consequence of shifts in enricher tails assays,” UxC explains in a observe.

The overview additionally factors to a number of components that might drive the market to unprecedented ranges.

“A number of points have affected the provision facet of the equation in recent times, together with Honeywell’s choice in 2017 to shutter its Metropolis conversion plant till 2023, Orano’s delayed transition to its new COMURHEX II amenities, in addition to impacts from Russia’s invasion of Ukraine,” it reads. “In consequence, costs for conversion companies have risen to historic highs as of 2022.”

Earlier than Q1 ended, U3O8 broke previous the US$60 mark for the primary time since 2011.

Uranium value in Q2: Vitality safety comes into focus

The second quarter of the 12 months noticed uranium make its most pronounced value bounce, including 49 % from its February low to the 11 12 months excessive of US$64.50 in April. The market continued to search out help from the battle in Ukraine, together with international efforts to fight rising greenhouse fuel emissions.

U3O8’s value efficiency year-to-date.

Chart through TradingEconomics.

Russia is chargeable for 43 % of world uranium enrichment capability, and enrichment is a vital step in producing the fabric wanted to feed nuclear reactors and generate electrical energy.

“Basically, because the world is making an attempt to pivot away and punish Russia for its invasion of Ukraine, western utilities are attempting to determine how you can safe various provide, and that is inflicting an actual pinch level,” John Ciampaglia, CEO of Sprott Asset Administration, mentioned throughout his keynote deal with at a summer time uranium convention held by Pink Cloud Monetary Companies.

The transition away from Russian enrichment could also be simpler mentioned than achieved as Russia additionally possesses the most important share — roughly 40 % — of the world’s conversion infrastructure.

The US, the world’s largest purchaser of uranium for nuclear reactors, depends on Russia for 20 % of its transformed uranium. Eradicating Russian provide from America has an estimated price of over US$1 billion and would take time to return to fruition.

Domestically, the nation has one conversion facility, Honeywell’s Metropolis plant in Illinois, which was shuttered in 2017. In early 2021, Honeywell introduced plans to restart its conversion plant amid rising conversion costs.

Metropolis is scheduled to begin conversion in 2023.

Uranium rices ended the primary half of 2022 within the US$50 vary, a 13 % uptick from January.

Uranium value in Q3: Sprott belief continues shopping for

Q3 noticed the Sprott Bodily Uranium Belief (SPUT) (TSX:U.UN,TSX:U.U) proceed to amass kilos of U3O8.

“SPUT bought greater than 24 million kilos U3O8 in 2021, or about 25 % of all spot purchases,” a UxC report states. “Via August 2022, the Belief has bought an extra 16 million kilos U3O8 out there.”

At the moment, SPUT holds 59,269,000 kilos of U3O8 valued at US$2.84 billion.

By early September, the uranium costs have been as excessive as US$53.63, their highest H2 degree. Strain from the US Federal Reserve’s response to skyrocketing inflation saved most markets from making any significant positive aspects within the fall.

A powerful US greenback additionally impeded development throughout all markets.

“For uranium, the U3O8 spot value fell 8.66 % in September, bodily uranium’s largest month-to-month decline since March 2019,” wrote Jacob White, senior analyst at Sprott Asset Administration. “Uranium miners adopted swimsuit, shedding 16.17 %, posting their worst month-to-month efficiency because the inception of the North Shore International Uranium Mining Index in June 2017.”

Regardless of the poor September efficiency, the worth of U3O8 remained above US$48 by October earlier than rallying again to the US$53 threshold on the finish of the month. The vitality gasoline’s resilience amid broad headwinds “belies the robust fundamentals of uranium markets,” in response to White.

“12 months-to-date as of September 30, U3O8 conversion and enriched uranium costs have all considerably appreciated for each short- and long-term buy contracts,” White wrote. In his opinion, the market is at a flux level.

“We consider that the present demand for uranium conversion and enrichment, coupled with a shift away from Russian suppliers, helps larger U3O8 uranium spot costs, in the end benefiting uranium miners,” he mentioned.

Though the present macroeconomic surroundings is opposed, Sprott Asset Administration believes the “uranium bull market stays intact” and on monitor for continued development. Future catalysts embrace the swap to inexperienced vitality, the necessity for vitality safety and the proliferation of recent nuclear reactor builds.

“Over the long run, elevated demand within the face of an unsure uranium provide will seemingly help a sustained bull market,” added White. “For buyers, uranium miners have traditionally exhibited low/reasonable correlation to many main asset lessons, probably offering portfolio diversification.”

Uranium value in This autumn: Attitudes towards nuclear enhance

The final quarter of 2022 started with U3O8 sustaining the US$48 value level. This degree additionally appears to indicate the brand new backside for the market as values have remained at or above the brink since July.

The spot value endured some volatility because of the Fed’s rate of interest climbing regime, in addition to power within the US greenback, which hit a 20 12 months excessive and held in that territory by the penultimate month of the 12 months.

On the flip facet, costs benefited from optimistic attitudes towards nuclear vitality on the United Nations’ COP27 convention. Whereas nuclear vitality was previously excluded from discourse round clear and inexperienced vitality, this 12 months’s convention included the significance of nuclear for attaining international emissions-reduction targets.

The occasion culminated within the international nuclear business releasing a joint assertion urging “choice makers to acknowledge and help the necessity for elevated nuclear vitality era.” The group additionally known as for extra funding throughout the sector for brand new nuclear builds and the development of nuclear innovation.

“Nuclear vitality has the very best capability issue versus conventional and various vitality sources and may complement renewable vitality sources’ intermittency with dependable baseload energy,” Sprott Asset Administration’s White wrote in a December observe.

As of December 19, U3O8 was priced at US$48.10.

Don’t neglect to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the data reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

From Your Website Articles

Associated Articles Across the Internet